Mortgage Rates & Refinancing in 2025: Is Now the Time Despite the Debt Clock?

Mortgage rates have always been at the centre of financial planning, but 2025 presents a unique challenge. With the U.S. national debt clock racing past $35 trillion and the Federal Reserve juggling inflation and growth concerns, borrowers face a critical question: Is now the right time to buy, refinance, or hold steady on your mortgage?

This year’s housing and lending environment is unlike any in recent history. Rising federal debt, volatile bond yields, and shifting central bank policies have created both risks and opportunities for homeowners and buyers.

In this article, we’ll explore the mortgage rate trends in 2025, the impact of national debt on borrowing costs, and practical strategies to make smart mortgage decisions in this uncertain climate.

Mortgage Rates in 2025: A High-Stakes Balancing Act

After years of turbulence sparked by the pandemic, inflation spikes, and aggressive rate hikes, mortgage markets in 2025 remain unpredictable. The 30-year fixed mortgage rate hovers between 6.5% and 7%, depending on lender and credit profile.

Why are rates stuck high

- Short-term stability, long-term uncertainty: Rates have cooled slightly from 2023–24 peaks but remain historically high compared to the ultra-low rates of the 2010s.

- Fed policy in focus: The Federal Reserve has signaled it will prioritize debt sustainability and inflation moderation, making rate cuts less aggressive than markets once hoped.

- Global debt pressure: With the U.S. government borrowing heavily to finance stimulus and entitlement programs, Treasury yields remain elevated—directly influencing mortgage rates.

Economists caution that even small rate shifts matter. A difference of just 0.5% on a $400,000 mortgage can mean nearly $120 more per month in payments. That translates to almost $1,500 annually—a heavy burden for middle-class households.

Mortgage Rate Trends: 2020–2025 Snapshot

To understand the current landscape, it helps to look back at how rates have evolved in recent years.

| Year | Average 30-Year Fixed Mortgage Rate | Key Economic Driver |

|---|---|---|

| 2020 | 3.1% | Pandemic stimulus, ultra-low Fed rates |

| 2021 | 3.2% | Continued low rates, housing demand surge |

| 2022 | 5.3% | Fed hikes to fight inflation |

| 2023 | 6.8% | Inflation peaks, Treasury yields rise |

| 2024 | 7.1% | National debt concerns weigh on markets |

| 2025 | 6.5% – 7.0%* | Fed cautious on cuts, high debt clock impact |

*2025 range reflects early-year averages and may shift with Fed policy decisions.

This table illustrates why homeowners feel squeezed—just five years ago, mortgages were almost half the cost they are today. The jump in rates is directly tied to national debt pressures and monetary tightening.

The Debt Clock’s Shadow on Housing

The national debt clock, long seen as an abstract warning, has now become a tangible factor in mortgage decisions.

How debt drives mortgage rates

- Higher Government Borrowing = Higher Yields

As the Treasury issues more debt, bond yields climb, and mortgage rates follow. - Inflation Risk

Heavy borrowing risks fuel inflation, forcing the Fed to keep monetary policy restrictive. - Investor Sentiment

Global investors watch the U.S. debt trajectory closely. Concerns about fiscal stability push risk premiums higher, indirectly raising mortgage costs. - Reduced Affordability

Rising debt costs squeeze consumer purchasing power, making it harder for new buyers to enter the housing market.

Example:

If the Treasury issues an extra $1 trillion in bonds, yields may rise by 0.3–0.5%. That seemingly small shift can add thousands to a borrower’s lifetime mortgage cost.

For households, this debt-driven interest rate pressure means that timing matters more than ever when considering mortgage commitments.

Should You Buy a Home in 2025?

For aspiring homeowners, the decision to buy in 2025 isn’t just about personal finances—it’s about macroeconomic timing.

Advantages of buying now

- Home prices in many regions have cooled slightly after years of rapid appreciation.

- Renting costs remain high, making ownership more attractive in the long term.

- Locking in a mortgage now protects against potential rate spikes if debt concerns worsen.

Risks of buying now

- If rates fall in 2026–27, today’s buyers may feel “locked in” at a high rate.

- Debt-driven economic slowdown could put downward pressure on housing prices, leading to potential equity risk.

Scenario Example

- A buyer in 2020 with a 3% mortgage on a $350,000 home pays about $1,475 monthly.

- The same buyer in 2025 at 6.8% pays nearly $2,300 monthly—a $9,900 difference annually.

Key takeaway: If your finances are stable, and you find a reasonably priced home, buying in 2025 may still make sense—especially if you plan to stay long-term.

Refinancing in 2025: Worth It or Not?

Refinancing was once a golden strategy when rates dipped below 4%. In 2025, the calculus is more complex.

When refinancing makes sense

- You currently hold a mortgage above 8%.

- You want to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

- You’re consolidating high-interest debt into a lower-rate mortgage.

When refinancing doesn’t make sense

- Your current mortgage is already near today’s average rate.

- Closing costs and fees outweigh the potential savings.

- You plan to move within 3–5 years, making refinancing uneconomical.

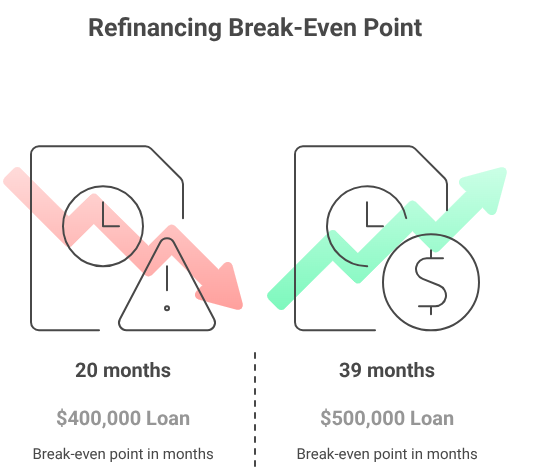

Refinancing Break-Even Example

| Current Loan | Rate | New Loan Rate | Monthly Savings | Closing Costs | Break-Even Point |

|---|---|---|---|---|---|

| $350,000 | 8.2% | 6.9% | $285 | $5,500 | ~19 months |

| $400,000 | 7.6% | 6.5% | $245 | $4,800 | ~20 months |

| $500,000 | 7.0% | 6.5% | $155 | $6,000 | ~39 months |

Interpretation:

- If you plan to stay in your home beyond the break-even point, refinancing could save you money.

- If you plan to sell or move sooner, refinancing may cost more than it saves.

Strategies to Manage Mortgage Debt in a High-Rate Era

Whether you’re buying, refinancing, or staying put, 2025 demands a proactive approach:

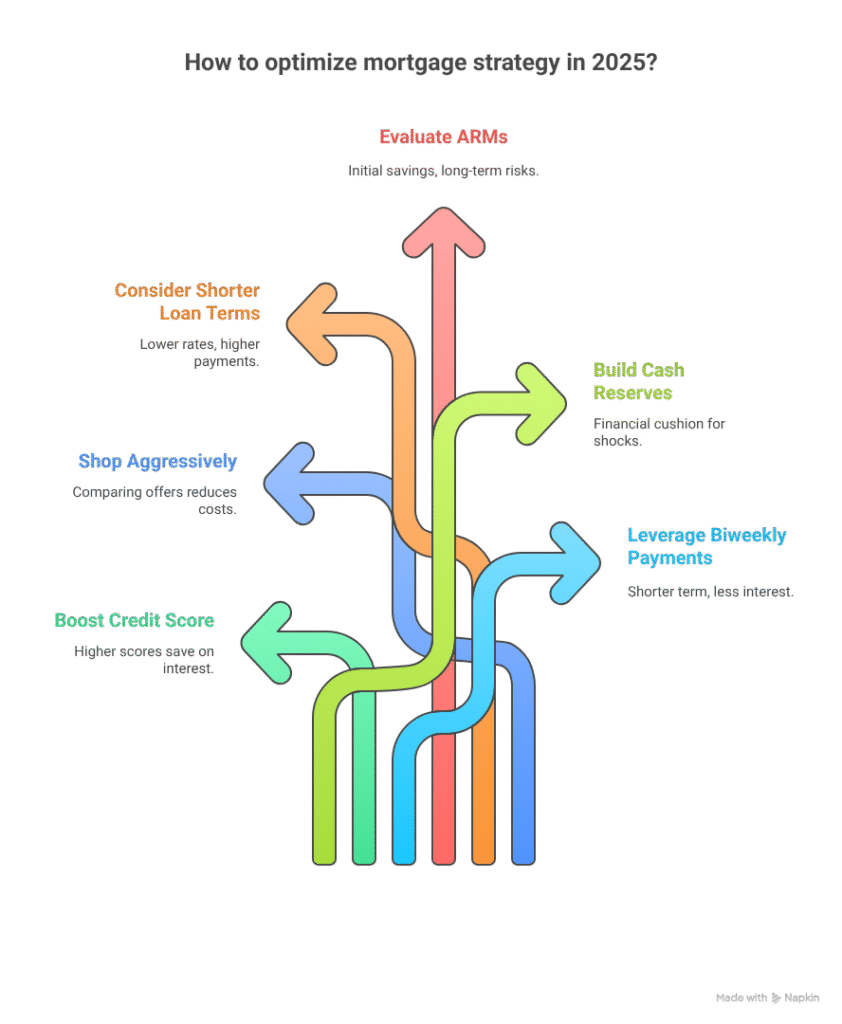

- Boost Credit Score

A higher score can save thousands in interest. Pay down revolving debt and avoid new credit inquiries before applying. - Shop Aggressively

Mortgage rates vary widely among lenders. Comparing offers can reduce costs by 0.25% to 0.5%. - Consider Shorter Loan Terms

A 15-year mortgage often carries lower rates than a 30-year loan, though monthly payments are higher. - Evaluate ARMs Carefully

Adjustable-rate mortgages may offer initial savings but carry long-term risks if rates climb. - Build Cash Reserves

In a high-debt, high-rate economy, financial cushions are vital to withstand shocks like job loss or economic slowdown. - Leverage Biweekly Payments

Splitting payments biweekly instead of monthly can shave years off your loan term and reduce interest costs.

Real Estate Market Outlook in 2025

The housing market’s trajectory depends heavily on how debt, inflation, and Fed policy evolve.

- Stable but expensive: Prices are unlikely to crash, but affordability will remain stretched.

- Regional divergence: Markets in the Midwest and South may remain resilient, while overheated West Coast cities could see corrections.

- Investor caution: Institutional investors are slowing purchases, wary of both rates and economic uncertainty.

- First-time buyers squeezed: Young households face the steepest affordability challenges in decades.

This creates a market where motivated buyers still find opportunities, but speculation-driven booms are unlikely.

Long-Term Debt and Mortgage Affordability

The bigger question is not just about 2025—it’s about the decade ahead. If the national debt keeps rising without fiscal reform:

- Mortgage rates may remain structurally higher.

- Buyers could face permanently reduced affordability.

- Refinancing “booms” may be rarer than in the past.

- Homeownership could fall, particularly among younger generations.

Some economists warn of a “new normal” where mortgage rates never return to the 3–4% range seen in the 2010s. If true, financial planning will require a permanent adjustment in household expectations.

Conclusion: Making Smart Mortgage Moves in 2025

In 2025, navigating mortgages isn’t simple. The debt clock looms large, the Fed is cautious, and affordability challenges persist. Still, opportunities exist for strategic buyers and disciplined homeowners.

- Buyers should weigh the stability of ownership against potential rate declines.

- Refinancers must calculate carefully, ensuring savings outweigh costs.

- Current homeowners should focus on debt management, credit health, and long-term planning.

The national debt and Fed policy will continue shaping mortgage markets, but personal financial discipline remains the most powerful tool. By making informed, calculated decisions, households can weather the uncertainty and secure their financial future—even under the shadow of the debt clock.