New Canadian Bankruptcy Rules: Easier to Qualify in 2025?

In 2025, Canada introduced major reforms to its bankruptcy laws—changes that could significantly alter how individuals and businesses approach insolvency. With rising consumer debt and economic uncertainty affecting Canadians across income brackets, these regulatory updates are both timely and impactful.

The following overview highlights the key changes in the Canadian bankruptcy system, who stands to benefit the most, and what the broader implications may be. Whether you’re facing personal financial stress or navigating business challenges, understanding these updates is crucial to making informed decisions in today’s economy.

A Quick Overview of Bankruptcy in Canada

Bankruptcy in Canada is governed by the Bankruptcy and Insolvency Act (BIA). It provides a legal process that allows individuals or businesses who are unable to pay their debts to either eliminate or restructure what they owe under the supervision of a Licensed Insolvency Trustee (LIT).

Historically, the system has been criticized for being too complex and rigid, particularly for middle-income Canadians and small business owners who struggle to meet eligibility thresholds. Until recently, the formal process often favoured either the very poor or large corporate entities, leaving many stuck in a financial grey zone.

What Prompted the Changes in 2025?

Several economic and social factors drove the Canadian government to revisit its bankruptcy framework:

- Record household debt: According to Statistics Canada, household debt rose to $2.94 trillion in late 2024, with the debt-to-income ratio hovering around 181.6%, one of the highest among G7 nations.

- Post-pandemic credit strain: Many Canadians deferred loan payments during COVID-19 and are now facing ballooning repayments.

- Rising insolvency filings: In 2024, consumer insolvency filings jumped by 16.5% compared to the previous year.

- Pressure from advocacy groups: Consumer rights organizations pushed for a more accessible and compassionate system for debt relief.

Another critical factor driving the reforms was the growing inequality in financial outcomes across different Canadian provinces. For instance, in 2024, Ontario and British Columbia reported the highest consumer debt levels, averaging over $75,000 per household, while provinces like Nova Scotia and Manitoba lagged slightly behind. This discrepancy created systemic barriers in how bankruptcy was accessed across regions, prompting calls for a unified and fairer approach.

Additionally, younger Canadians faced increasingly unstable financial futures. A 2024 survey by Equifax showed that 61% of Canadians aged 25–34 expressed concern about never being able to pay off their debt. Student loans, coupled with rising rents in major urban centres, pushed many into cycles of minimum payments and compounding interest—traps that the new reforms aim to break.

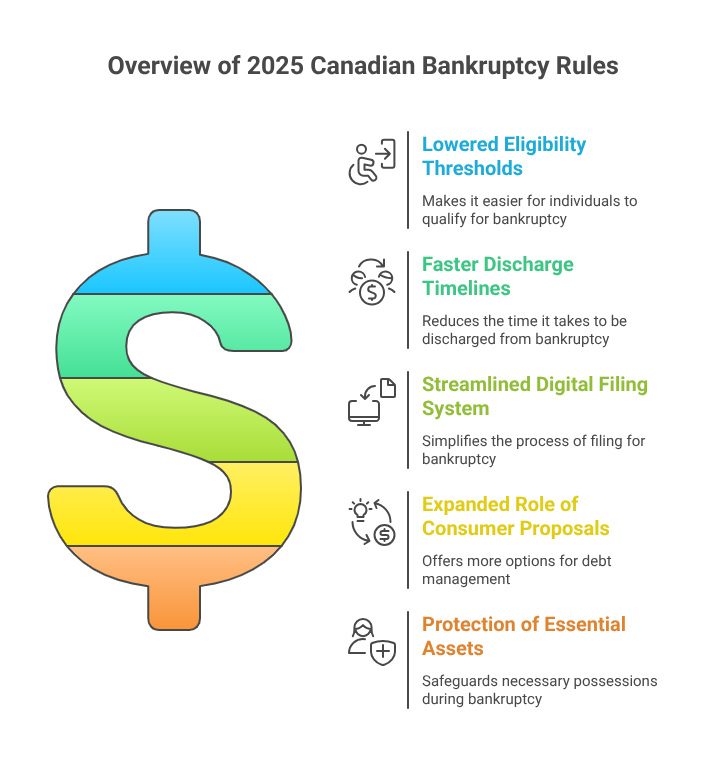

Key Changes in the 2025 Canadian Bankruptcy Rules

1. Lowered Eligibility Thresholds

Previously, to qualify for bankruptcy, individuals needed to owe at least $1,000 in unsecured debt and prove they were insolvent. While the dollar threshold remains unchanged, the criteria for demonstrating insolvency have become more flexible.

What’s changed?

- No need to be fully unable to meet all financial obligations.

- Evidence such as consistent missed payments or partial payments over 3 months can now be accepted.

- Gig workers and freelancers are now explicitly included.

Impact: Thousands of middle-income Canadians and self-employed individuals now qualify for relief they were once denied.

2. Faster Discharge Timelines

Previously, discharge timelines could stretch from 9 months to over 3 years, depending on income and previous filings. The 2025 rules offer a more forgiving path:

- First-time bankrupts: Discharge in 6 months

- Second-time bankrupts: Discharge in 12 months

- Mandatory financial counselling: Still required but now available online and streamlined

Impact: Canadians can return to financial health faster, with less long-term damage to their creditworthiness.

3. Streamlined Digital Filing System

Canada launched a fully digital bankruptcy platform in 2025 through the Office of the Superintendent of Bankruptcy. Canadians can now:

- File for bankruptcy from anywhere in the country

- Access real-time progress tracking

- Upload documents digitally

- Integrate with CRA for immediate tax verification

Impact: Filing becomes more accessible, especially for rural populations and tech-savvy younger Canadians.

4. Expanded Role of Consumer Proposals

Consumer proposals are legal agreements negotiated between debtors and creditors to repay part of the debt over time. They’ve gained increased relevance in 2025:

- Debt ceiling raised to $300,000 (excluding mortgages)

- Extended repayment terms up to 7 years

- Flexibility to restructure terms mid-way due to life events

Impact: Many may now choose this alternative to bankruptcy, avoiding asset seizure and long-term credit damage.

5. Protection of Essential Assets

Canada’s new rules reflect a more compassionate stance by allowing individuals to keep basic necessities for work and life:

- Vehicles up to $10,000 in value are now protected

- Tools of the trade up to $15,000

- One primary digital device (regardless of value) is exempt

One notable development in the 2025 rules is the recognition of digital livelihoods. The legislation now includes protections for “income-generating digital tools,” which is particularly relevant for content creators, remote workers, and online freelancers. Devices such as tablets, microphones, and even digital editing software licenses may now be exempt in certain cases, provided they are essential for professional use.

Impact: Debtors maintain the tools necessary to generate income and rebuild their finances.

The Real Impact in Numbers

- Projected Increase in Filings: Experts forecast a 20% rise in consumer bankruptcies and proposals in 2025 due to the relaxed eligibility.

- An estimated 1 in 6 Canadians are now within range of qualifying for legal insolvency relief.

- Over 50% of applicants in Q1 2025 cited medical expenses, job loss, or inflation as key drivers for insolvency.

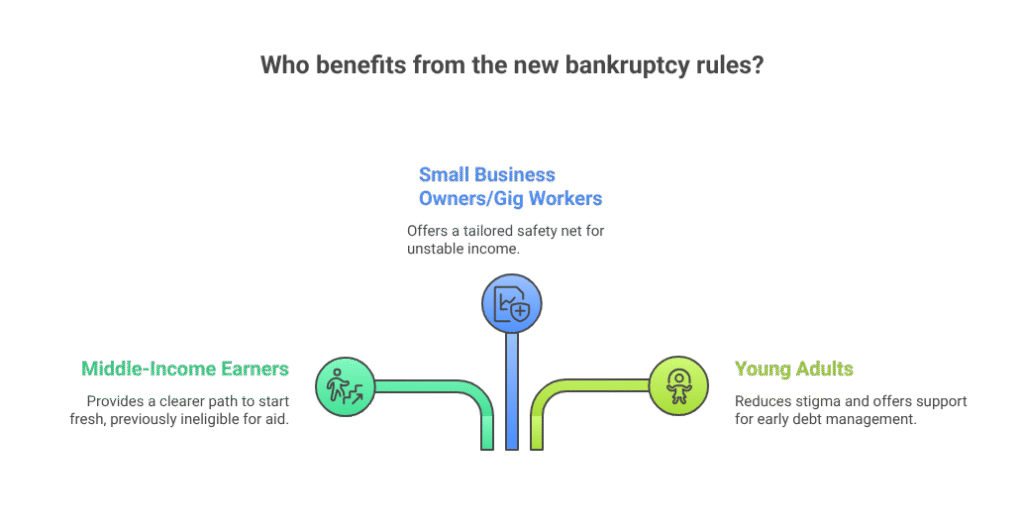

Who Benefits from the New Rules?

Middle-Income Earners

Once caught between ineligibility for aid and inability to repay, these individuals now have a clearer path to start fresh.

Small Business Owners and Gig Workers

With unstable income and few protections in past years, these groups finally have a safety net tailored to their unique circumstances.

Young Adults

Those under 35 now face less stigma and greater support in tackling debt early before it becomes lifelong.

Challenges and Criticism

Some challenges remain despite the progress:

- Credit Risk Concerns: Banks worry that easier access may increase defaults or reduce the incentive to repay.

- Fraud Monitoring: With digital filing, regulators must guard against fraudulent activity or misuse of the system.

- Rehabilitation Oversight: Faster discharge must be paired with stronger post-bankruptcy education and support.

The government has allocated an additional $50 million over 3 years to support fraud prevention, trustee training, and financial literacy programs.

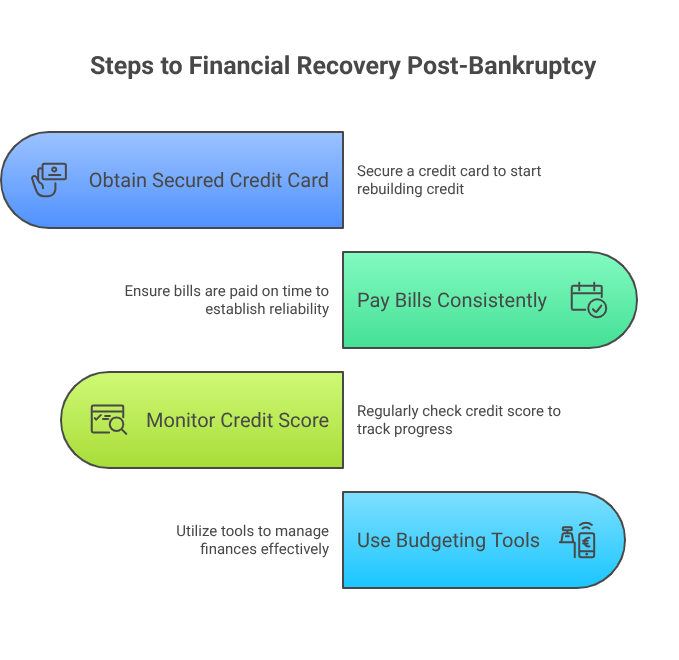

Rebuilding After Bankruptcy

The new rules make it easier to recover financially post-bankruptcy. Key steps include:

- Obtaining a secured credit card

- Paying bills consistently and on time

- Monitoring your credit score monthly

- Using budgeting tools or financial counselling apps

The updated bankruptcy framework is also expected to have a positive ripple effect on mental health. According to a recent survey by Credit Canada, nearly 70% of people struggling with debt reported anxiety, sleeplessness, or depression tied to financial stress. By simplifying access to relief and shortening the time under financial restrictions, the 2025 rules can contribute to emotional recovery alongside financial rehabilitation.

Toward a More Financially Inclusive Canada

The new Canadian bankruptcy rules represent a thoughtful and progressive approach to a growing national concern. With rising inflation, wage stagnation, and mounting debt, these updates provide Canadians with a realistic and humane way to reset their financial lives.

Whether you are an overburdened student, a struggling entrepreneur, or someone whose job simply doesn’t pay enough, the 2025 reforms give you options—and hope.

If you’re considering filing for bankruptcy or exploring a consumer proposal, this is the time to speak with a Licensed Insolvency Trustee and make use of Canada’s updated system. Relief is no longer reserved for the few. It’s now a tool for all who truly need it.