New Laws Offer Debt Relief for Struggling Borrowers

Debt has long been a challenging issue for individuals and families worldwide. For many, mounting financial obligations can feel overwhelming, often leading to stress, anxiety, and uncertainty about the future. Fortunately, governments in various countries are introducing new legislation designed to provide relief for those struggling with debt. These laws aim to simplify debt resolution processes, improve borrower protections, and provide more effective ways to manage financial burdens. Understanding these new measures and how they can benefit you is essential in making informed financial decisions.

Understanding the New Debt Relief Laws

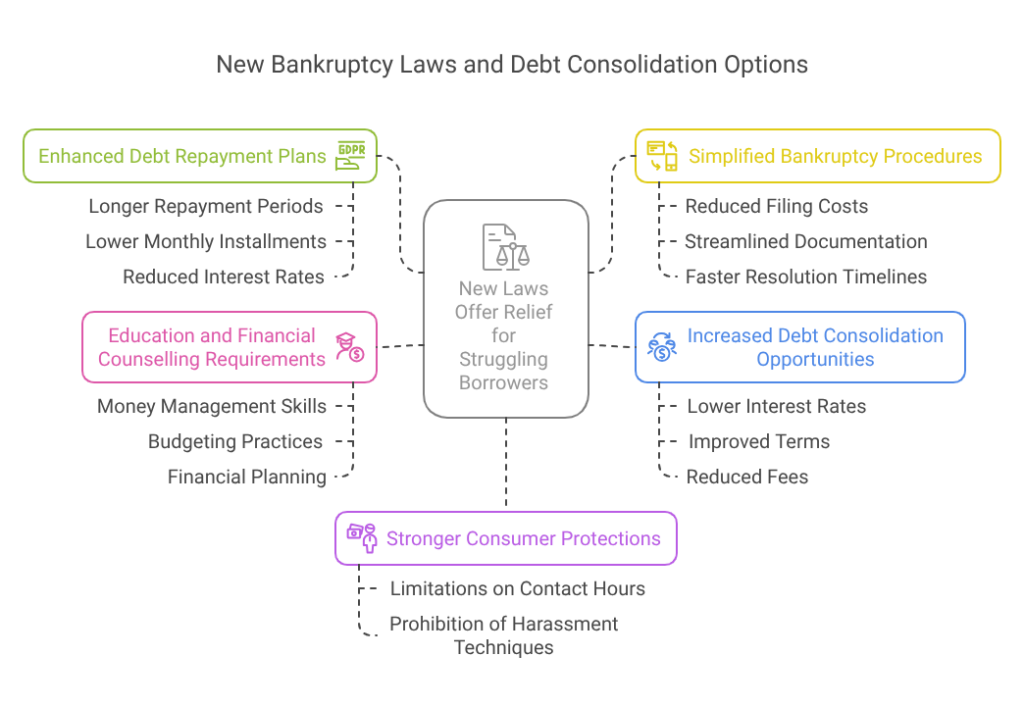

Recent updates to bankruptcy laws and debt consolidation options are offering a lifeline to borrowers. These changes vary across regions but generally include several key components:

- Enhanced Debt Repayment Plans

Many jurisdictions are introducing more flexible repayment options for individuals unable to meet their debt obligations. These revised plans often include longer repayment periods, lower monthly installments, and reduced interest rates. By extending the repayment period and lowering payment requirements, borrowers can better manage their monthly budgets without compromising essential living expenses. - Stronger Consumer Protections

New legislation is placing stricter controls on aggressive debt-collection tactics. For example, creditors may now face limitations on contacting borrowers at unreasonable hours or using harassment techniques. These reforms ensure that debt recovery processes remain fair and respectful, allowing individuals to address their obligations without undue stress or intimidation. - Simplified Bankruptcy Procedures

Some governments have revised their bankruptcy frameworks to make the process more accessible to individuals in financial distress. These changes often reduce filing costs, streamline documentation requirements, and provide faster resolution timelines. By simplifying bankruptcy procedures, more borrowers can access legal protection while working toward financial recovery. - Increased Debt Consolidation Opportunities

Debt consolidation is a powerful tool for individuals with multiple loans or credit card debts. New laws are expanding consolidation options by encouraging financial institutions to offer lower interest rates, improved terms, and reduced fees. This allows borrowers to combine several debts into one manageable payment, simplifying budgeting and reducing the risk of missed payments. - Education and Financial Counselling Requirements

Several governments are now mandating financial education programs as part of debt relief processes. Borrowers seeking assistance may need to complete counseling sessions designed to improve money management skills, budgeting practices, and financial planning. This approach aims to reduce future debt risks and promote long-term financial stability.

How These Laws Impact Borrowers

The introduction of these laws brings several significant benefits to individuals facing debt challenges:

- Reduced Financial Pressure: Lower interest rates, extended repayment terms, and improved consolidation options allow borrowers to better manage their debt without sacrificing essential expenses.

- Improved Protection: Stronger regulations on debt collection practices ensure borrowers can address their financial issues without fear of harassment or intimidation.

- Accessible Legal Support: Streamlined bankruptcy procedures provide a faster, less costly path for those seeking legal protection from creditors.

- Enhanced Financial Literacy: Required education programs empower individuals to make informed decisions about money management and avoid repeating past financial mistakes.

Steps to Take Advantage of These Laws

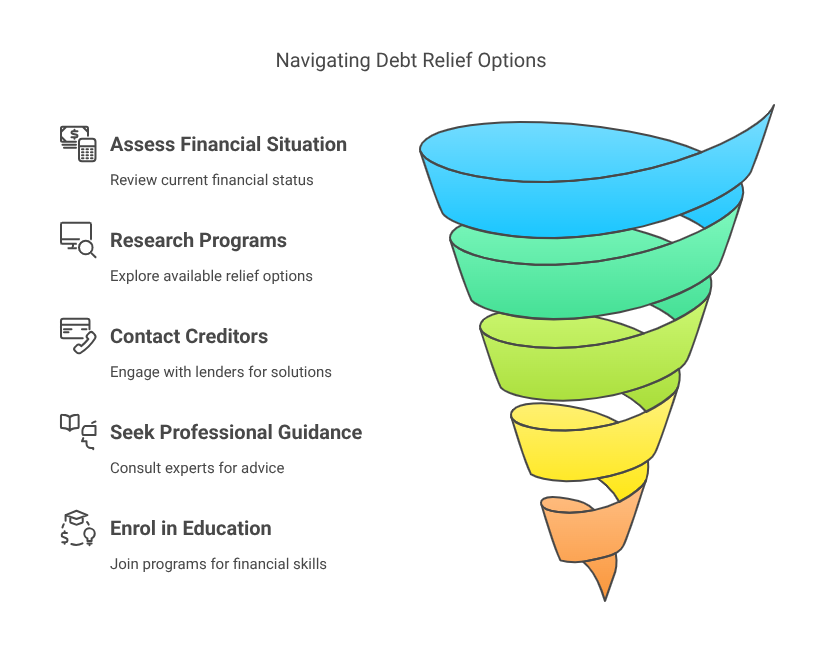

If you’re struggling with debt and believe you may benefit from these new legal provisions, consider taking the following steps:

- Assess Your Financial Situation: Start by reviewing your income, expenses, and outstanding debts. Understanding your current financial position will help you determine which relief options are most suitable for your needs.

- Research Available Programs: Different regions may offer distinct relief options. Explore government websites, consumer protection agencies, and reputable financial advisors to learn about programs specific to your location.

- Contact Creditors or Financial Institutions: Some lenders offer specialized repayment plans or consolidation options that align with the new laws. Communicate directly with creditors to explore available solutions.

- Seek Professional Guidance: Financial counselors, debt advisors, and legal experts can help you understand your rights and recommend the best course of action. Their insights can be crucial in navigating complex legal processes effectively.

- Enrol in Financial Education Programs: Even if not mandatory, these programs can equip you with valuable skills for managing your finances, improving your credit score, and preventing future debt issues.

Common Misconceptions About Debt Relief Laws

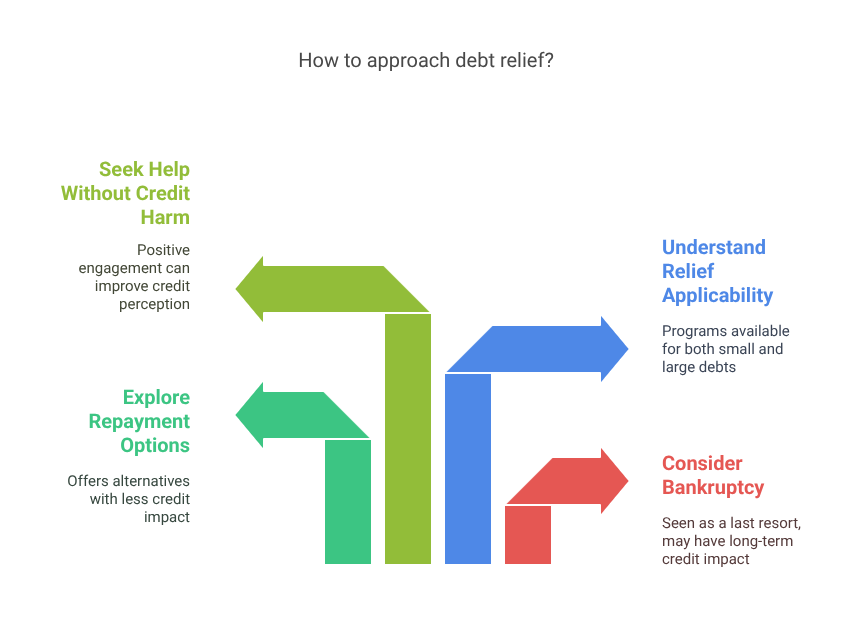

While these new regulations offer substantial benefits, several misconceptions may prevent borrowers from taking full advantage:

- “Bankruptcy is the only solution.” While bankruptcy can provide significant relief, it is often seen as a last resort. New repayment options and consolidation programs may offer effective alternatives without long-term credit impact.

- “Debt relief only applies to large debts.” Many relief programs cater to individuals with both small and large debt burdens. Exploring available options is crucial regardless of your financial situation.

- “Seeking help will harm my credit score.” Engaging in debt management programs or repayment plans under these new laws is often seen positively by creditors, showing your commitment to resolving obligations responsibly.

Long-Term Financial Strategies for Stability

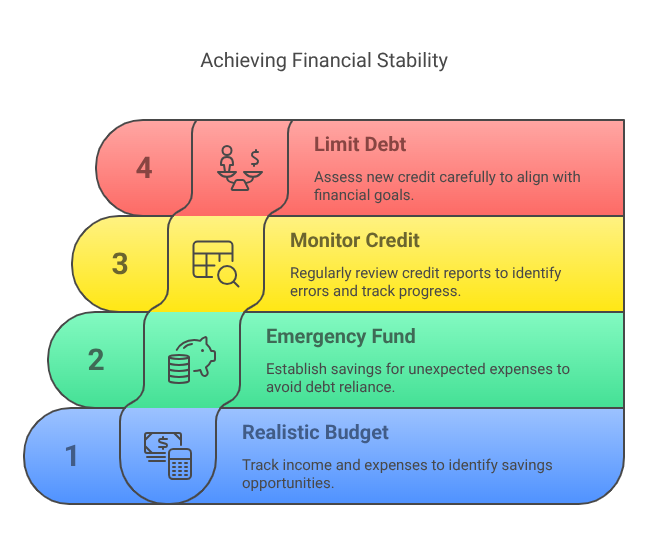

While these new laws offer immediate relief, adopting sustainable financial practices is key to long-term stability. Consider implementing the following strategies:

- Create a Realistic Budget: Track your income and expenses to identify areas where you can cut costs or improve savings.

- Build an Emergency Fund: Establishing savings for unexpected expenses can prevent future reliance on credit cards or loans.

- Monitor Your Credit Report: Regularly reviewing your credit report helps identify errors, track progress, and improve your financial health.

- Limit Unnecessary Debt: Before taking on new credit, assess whether it aligns with your long-term financial goals.

Final Recommendations

New debt relief laws are providing much-needed support for individuals burdened by overwhelming financial obligations. By understanding these changes, exploring available options, and adopting proactive financial strategies, borrowers can regain control of their finances and work toward a more secure future. If you or someone you know is facing debt challenges, taking action now can lead to lasting financial stability and peace of mind.