Student Loan Forgiveness 2025: Last Chance for Key Programs?

The student debt crisis in the United States has reached a critical point. With more than 43 million Americans owing federal student loans totaling over $1.6 trillion, many are watching closely as forgiveness programs undergo major changes in 2025.

Student Loan Forgiveness 2025

This year marks a turning point: several temporary programs and waivers introduced in recent years are set to expire, while others are being fully implemented. Borrowers who fail to act now may miss opportunities to eliminate tens of thousands of dollars in debt.

This updated guide breaks down what’s changing in Public Service Loan Forgiveness (PSLF), the Income-Driven Repayment (IDR) Waiver, and the Borrower Defense to Repayment program, along with other forgiveness pathways. More importantly, it outlines the exact action steps borrowers must take in 2025 to maximize relief.

Why 2025 Matters More Than Ever

Since the Supreme Court struck down broad one-time loan forgiveness in 2023, the Biden administration has shifted its focus to targeted programs. Many of these were temporary fixes designed to correct decades of servicing errors.

- IDR Account Adjustment is being phased out after 2025.

- PSLF improvements from temporary waivers require consolidation before the cutoff.

- Borrower Defense settlements are in their final stages.

In short, 2025 is the last chance for many borrowers to secure forgiveness under expanded rules.

The Numbers Behind Student Debt in America

To understand why these programs matter, it helps to look at the scale of student debt. According to the Federal Reserve (2024 data), here’s the breakdown:

| Category | Number of Borrowers | Total Debt Outstanding | Average Balance |

|---|---|---|---|

| Total Federal Student Loan Borrowers | 43 million+ | $1.6 trillion | ~$37,000 |

| PSLF-eligible (public sector, nonprofits) | ~9 million | $350 billion+ | ~$39,000 |

| Income-Driven Repayment (IDR) participants | 8.5 million+ | $460 billion | ~$54,000 |

| Borrower Defense applicants (cumulative) | 1.2 million+ | $16 billion+ | Varies |

Source: U.S. Department of Education, Federal Reserve

This data shows why deadlines in 2025 matter: the programs in question impact millions of borrowers with billions in potential forgiveness.

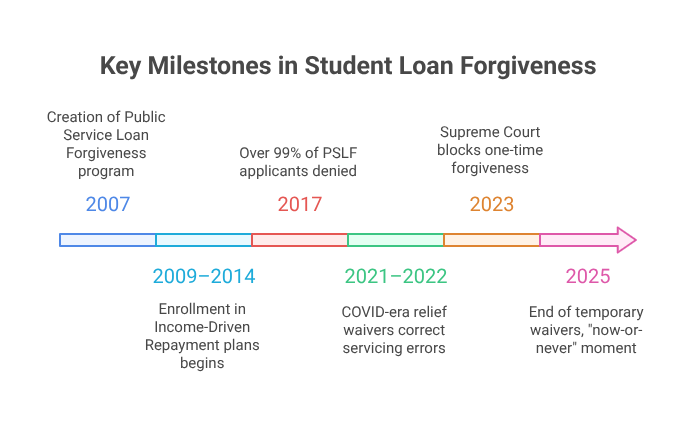

A Brief History of Student Loan Forgiveness

To appreciate the urgency of 2025, it helps to understand how we got here:

- 2007 – The Public Service Loan Forgiveness program (PSLF) is created under the Bush administration.

- 2009–2014 – Borrowers begin enrolling in Income-Driven Repayment (IDR) plans, but confusion about eligibility grows.

- 2017 – The first wave of PSLF applicants reaches the 10-year mark, but over 99% are denied due to technicalities.

- 2021–2022 – COVID-era relief leads to temporary PSLF and IDR waivers, correcting servicing errors.

- 2023 – The Supreme Court blocks one-time $10k–$20k forgiveness but greenlights targeted relief efforts.

- 2025 – Many of those temporary waivers are ending, making this a “now-or-never” moment for millions.

This history explains why 2025 is such a defining year—it’s the convergence of reform, correction, and expiration.

Public Service Loan Forgiveness (PSLF): Still the Most Powerful Program

The Public Service Loan Forgiveness program provides full discharge after 120 qualifying monthly payments for borrowers working in eligible government or nonprofit jobs.

What Changed Recently

- The Limited PSLF Waiver (expired in 2022) allowed more payment types to count.

- The IDR Account Adjustment (still active in 2025) is helping borrowers retroactively earn PSLF credit.

Why 2025 Is Crucial

- Borrowers must consolidate older FFEL or Perkins loans into Direct Loans before the IDR adjustment deadline.

- After 2025, payments made before consolidation will no longer retroactively count toward PSLF.

Real-Life Example

Imagine a social worker who has been making payments since 2009 under the wrong plan. Thanks to the IDR adjustment, many of those years now count toward PSLF—if she consolidates by the 2025 deadline. Missing the deadline would erase over a decade of progress.

Action Steps for PSLF Borrowers

- Use the PSLF Help Tool on StudentAid.gov to certify employment.

- Consolidate non-Direct Loans immediately if you haven’t already.

- Submit an annual PSLF form to avoid tracking errors.

Income-Driven Repayment (IDR) Waiver: Expiration in 2025

The IDR Account Adjustment is the most sweeping retroactive fix to repayment counts ever made. It ensures many past periods of repayment, deferment, and forbearance count toward forgiveness.

Key Benefits

- Borrowers may gain years of qualifying payments toward IDR forgiveness.

- Some long-term borrowers are receiving immediate discharge.

Real-Life Example

A borrower with $60,000 in loans who has been paying inconsistently since 1998 could qualify for full discharge in 2025, even if they weren’t on an official IDR plan for much of that time.

2025 Deadlines

- The consolidation deadline for maximum retroactive credit is expected in 2025.

- Only after that will payments made under IDR plans count moving forward.

Action Steps for IDR Borrowers

- Check your payment count with your servicer after the IDR adjustment is applied.

- Consolidate loans (FFEL, Perkins) into Direct Loans before the deadline.

- Enroll in the SAVE Plan, which lowers payments and accelerates forgiveness for balances under $12,000 (forgiveness in 10 years).

Borrower Defense to Repayment: Last Window for Claims

The Borrower Defense program allows forgiveness if your school misled you or engaged in misconduct.

Where It Stands in 2025

- The Sweet v. Cardona settlement is nearing completion, approving relief for hundreds of thousands of borrowers.

- New rule changes in 2025 may narrow eligibility.

Real-Life Example

A student who enrolled at a for-profit college that exaggerated job placement rates may qualify for 100% forgiveness if they submit a Borrower Defense claim before the deadlines tighten.

Action Steps

- File a Borrower Defense claim on StudentAid.gov if you attended a school under investigation.

- Gather evidence (ads, emails, loan documents) to strengthen your case.

- Monitor Department of Education updates, as timelines may shift.

Other Forgiveness Opportunities in 2025

While PSLF, IDR, and Borrower Defense get the most attention, other programs remain relevant:

- Teacher Loan Forgiveness: Up to $17,500 for teachers in qualifying schools.

- Closed School Discharge: For those whose schools shut down mid-enrollment.

- Total and Permanent Disability (TPD) Discharge: Expanded to Social Security and VA disability recipients.

What Happens If You Miss the 2025 Deadlines?

Failing to act in 2025 could have long-term consequences:

- Borrowers could lose credit for years of payments, resetting their forgiveness timeline.

- Monthly payments could rise under standard repayment schedules.

- Interest capitalization may increase total balances significantly.

- Emotional stress and financial strain could deepen, delaying life goals like buying a home, saving for retirement, or starting a family.

For many, 2025 isn’t just another deadline—it’s the difference between a debt-free future and another decade of repayment.

Political and Legal Uncertainty in 2025

Borrowers must also navigate a shifting political landscape:

- Supreme Court’s 2023 decision blocked Biden’s one-time cancellation, but allowed targeted relief.

- Lawsuits from conservative states continue to challenge the executive authority to cancel debt.

- Congressional gridlock means new legislation is unlikely, leaving most relief dependent on executive action.

The bottom line: deadlines may shift, but waiting is risky.

Common Mistakes Borrowers Make in 2025

Many borrowers risk losing out simply because of avoidable errors. Here are some of the most common:

- Failing to consolidate older loans before deadlines.

- Assuming servicers will automatically apply credits (you must often verify).

- Not submitting PSLF employment certifications annually.

- Delaying Borrower Defense claims until rules become stricter.

- Ignoring SAVE enrollment and paying more than necessary.

Avoiding these mistakes could mean the difference between $0 balance and 10+ more years of payments.

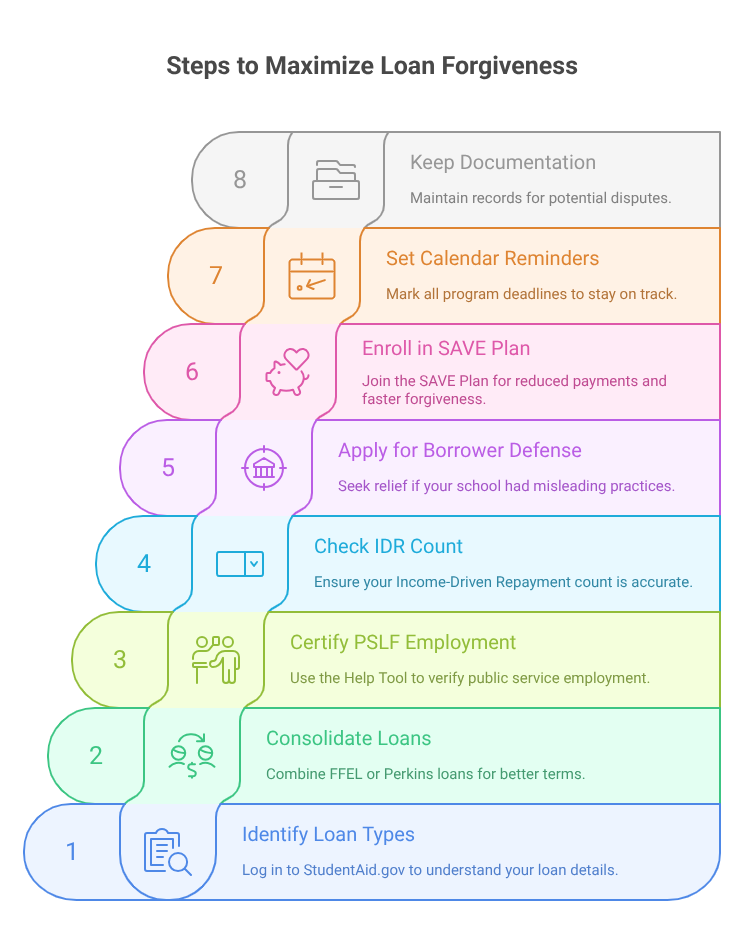

Expanded Borrower Action Plan for 2025

Here’s a step-by-step roadmap for taking action now:

- Identify your loan types: Log in to StudentAid.gov and download your loan summary.

- Consolidate immediately if you have FFEL or Perkins loans.

- Certify PSLF employment through the Help Tool if you work in public service.

- Check your IDR count update and contact your servicer if it looks incorrect.

- Apply for Borrower Defense if you attended a school that used misleading practices.

- Enroll in the SAVE Plan for reduced payments and faster forgiveness.

- Set calendar reminders for every program deadline in 2025.

- Keep documentation (payment records, forms, emails) in case of future disputes.

What Happens After 2025?

Borrowers often ask: What’s next once these waivers expire? While no one can predict with certainty, here are likely scenarios:

- PSLF: The program will continue, but without the expanded credits from the IDR adjustment. Future applicants will face stricter payment tracking.

- IDR: Borrowers will need to remain on SAVE or other IDR plans and make consistent payments for 20–25 years. No more retroactive credits.

- Borrower Defense: Claims may still be possible but approvals will likely be narrower and slower.

- New reforms: Depending on the 2024 election results, new forgiveness programs could be proposed—or existing ones rolled back.

For now, the safest path is clear: act in 2025 while expanded opportunities are still available.

Don’t Wait Until It’s Too Late

For millions of Americans, 2025 is the last chance to benefit from expanded forgiveness opportunities. Missing consolidation deadlines or failing to submit forms could mean losing out on immediate or accelerated debt relief.

With $1.6 trillion in outstanding federal student loans, this isn’t just a policy issue—it’s a financial lifeline for families across the country. If you’re eligible, act now. The window is closing, and once it does, borrowers may be left with fewer options and longer repayment timelines.