The ‘Debt Migration’ Phenomenon: Canadians Fleeing to Low-Cost Provinces

Interprovincial Debt Refugees Reshape Canada’s Financial Map

Toronto— Thousands of Canadians are making an unexpected move — not for better jobs or lifestyle upgrades, but to escape unmanageable debt. A growing trend known as “debt migration” is sweeping the nation, where financially distressed individuals and families are leaving high-cost provinces for more affordable regions to regain control of their lives.

The pattern is especially pronounced in provinces like Ontario, British Columbia, and Alberta, where the cost of living has become untenable for many. Meanwhile, provinces such as New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland are emerging as unlikely sanctuaries for what some are calling interprovincial debt refugees.

Debt Driving Migration Across Provincial Borders

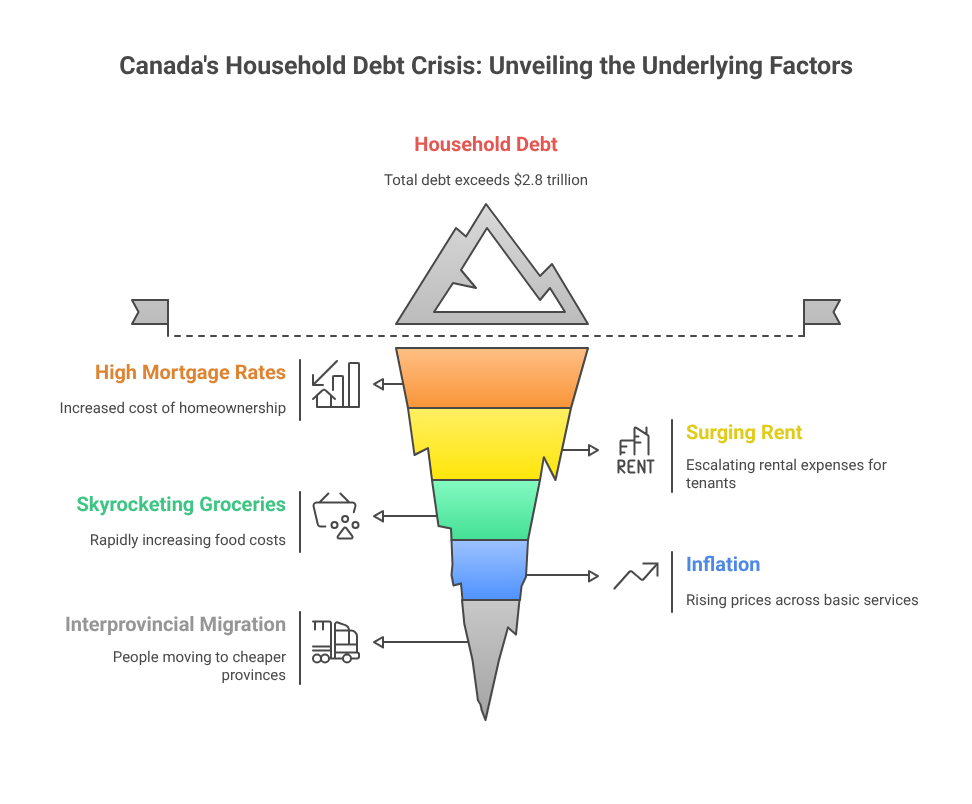

Canada’s total household debt has crossed $2.8 trillion, and more Canadians than ever are feeling the squeeze. High mortgage rates, surging rent, skyrocketing grocery bills, and inflation across basic services are combining to create unbearable financial stress.

In 2024, interprovincial migration hit a decade-high, with over 113,000 people relocating from more expensive provinces to lower-cost areas — a 13% increase from the year before. Many analysts say this rise directly correlates with the increasing burden of consumer and housing debt.

“We weren’t broke, but we were suffocating,” says Darren McLeod, who recently relocated from Brampton, Ontario, to Truro, Nova Scotia. “Everything — the mortgage, utilities, groceries — just kept rising. We realized we had to choose between our location and our peace of mind.”

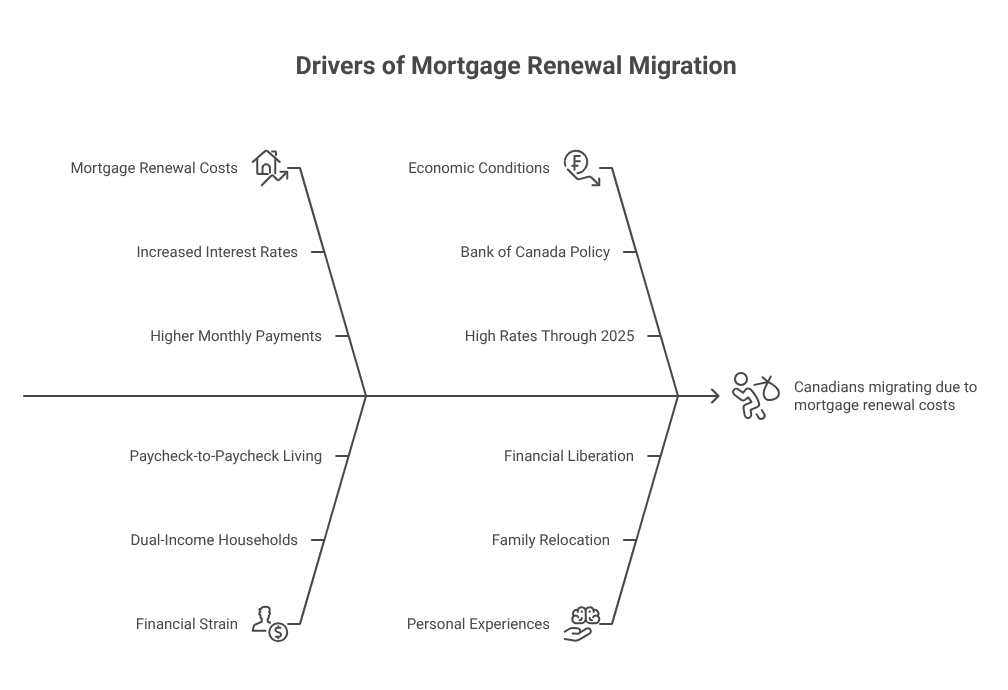

Mortgage Renewals Trigger the Exodus

A key driver behind the migration is the surge in mortgage renewal costs. Many homeowners who locked in low rates during the pandemic are now facing renewal at much higher rates. In some urban centres, mortgage payments have increased by as much as $1,000 per month, leaving even dual-income households struggling to stay afloat.

Jaspreet Gill, a mother of two who moved from Surrey, BC, to Summerside, PEI, describes the shift as “liberating but painful.” Her family was paying over $4,000 a month for a mortgage and other expenses. “We sold our townhouse, paid off the car loan and credit cards, and moved east. For the first time in years, we’re not living paycheck to paycheck,” she says.

The Bank of Canada has indicated that rates will remain high through the end of 2025, which may only intensify the number of people forced to uproot their lives.

Smaller Provinces Seeing an Influx

The migration trend is giving a surprising economic boost to smaller provinces. Real estate markets in Moncton, Charlottetown, and St. John’s are heating up. In Moncton, home sales increased by 18% over the last quarter, with average prices rising by 11% year-over-year, though still far below the national average.

Local officials are acknowledging the shift. Many towns are seeing rising demand for housing, schools, and health services as new families arrive in search of financial relief.

However, there are early signs of strain. Longtime residents are voicing concerns over rising rents and property taxes. “It’s ironic,” says Bernice Arsenault, a Charlottetown resident. “People are coming here to escape unaffordable living, but their arrival is starting to push prices up for all of us.”

The Consumer Debt Trap

Beyond mortgages, consumer debt is also pushing Canadians to leave high-cost regions. Credit card balances in Canada have crossed $108 billion, and defaults are rising across all age groups.

Many households are juggling credit cards, car loans, lines of credit, and student loans — all while trying to keep up with rising daily costs. Once one debt slips, the rest tend to follow.

Kyle Tremblay, 33, recently left Ottawa for Fredericton. “I was paying $900 a month just in minimum payments on cards and personal loans. I couldn’t keep going like that. Moving east cut my living costs in half,” he says. Kyle now rents a two-bedroom home for a third of what he paid in Ottawa, and he’s started aggressively paying down his debt.

Millennials and Gen Z Leading the Charge

Debt migration is particularly popular among younger Canadians. Faced with massive student loan balances, rising rent, and limited prospects for homeownership, many in their 20s and 30s are seeking affordability elsewhere.

According to a nationwide survey, over 60% of Canadians under 40 believe they will never be able to afford a home in cities like Toronto or Vancouver. For many, the solution lies not in waiting but in relocating.

Amara Hussain, 28, moved from Burnaby to Saint John in early 2025. “I had $40,000 in student loans, no savings, and no chance of owning anything in BC. Now I have a small condo, my debt’s under control, and I’m finally sleeping at night.”

The remote work shift has made these moves even more appealing. Many can keep their income consistent while reducing expenses by 30–50%, allowing them to get ahead financially for the first time.

A Nation Divided by the Cost of Living

The interprovincial migration is reshaping the country’s economic balance. Urban centres like Toronto and Vancouver are losing middle-income earners and younger residents — the very demographics that drive long-term economic growth.

At the same time, the influx of new residents into smaller provinces is putting pressure on housing supply, healthcare, and infrastructure. The divide between high-cost and low-cost provinces is creating what some analysts are calling “Two-Speed Canada.”

This economic and social gap could have long-term effects, ranging from Labor shortages in large cities to strained public services in rural communities.

“The new divide isn’t just East vs. West — it’s debt-heavy vs. debt-free,” says economist Raj Mehta. “Geography has become a financial strategy, and that’s a profound shift for the country.”

Federal and Provincial Policy Lagging Behind

Despite the sharp rise in interprovincial debt migration, policy responses remain fragmented. While some provinces are investing in housing or basic services, there is no coordinated national strategy to address the deeper issues fuelling this exodus.

There are growing calls for a federal affordability framework — one that includes:

- Enhanced credit regulation

- Interest rate protections for vulnerable borrowers

- Expanded access to financial counselling

- Nationwide housing support

Experts also recommend transition support programs for Canadians relocating to start over. Without intervention, there’s a risk that low-cost provinces may lose their affordability advantage as demand overwhelms supply.

“This isn’t just migration. It’s displacement caused by economic failure,” warns sociologist Dr. Renee Charron. “The question is whether we help these Canadians rebuild or watch the divide deepen.”

The Rise of the Interprovincial Debt Refugee

The term “interprovincial debt refugee” is gaining traction to describe those fleeing financially impossible conditions in high-cost provinces. They are not victims of war or natural disaster, but rather of unchecked interest rates, real estate inflation, and stagnant incomes.

For many, the move is about survival — a desperate but strategic decision to protect their financial future.

“We didn’t want to leave,” says Teresa Landry, 45, who relocated from Calgary to Bathurst, New Brunswick. “But we couldn’t keep up. Now, our mortgage is manageable, our credit cards are paid, and our kids can stay in their school. It was the hardest — and smartest — decision we’ve ever made.”

A New Financial Geography of Canada

As inflation persists and mortgage rates remain elevated, debt migration is expected to rise throughout 2025. With geography now a central part of personal finance strategy, Canadians are rethinking what it means to find stability.

For some, that means letting go of the cities they’ve always called home.

And for the country, it’s a wake-up call: affordability isn’t just a personal issue — it’s a national one.