The TikTok Debt Challenge: How Social Media Glamorizes Loan Defaults and Sparks Gen Z’s Financial Rebellion

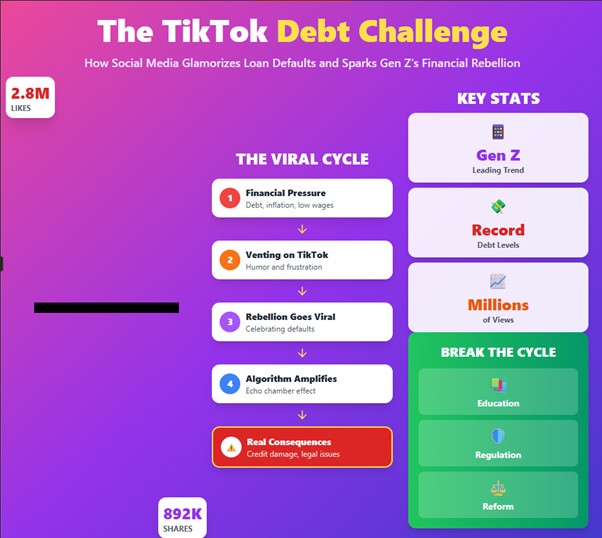

TikTok, once known for viral dances and humor-driven trends, has become an unexpected stage for a new kind of social movement — one centered around personal finance, rebellion, and debt. The latest wave gaining traction on the platform is the TikTok Debt Challenge, where young users openly share their decisions to stop repaying loans or credit cards, often framing it as empowerment or protest.

What began as scattered videos expressing financial frustration has grown into a viral phenomenon. The trend has captured global attention for how it glamorizes loan defaults, reflecting a wider generational sentiment of distrust toward financial institutions and a struggle to cope with rising economic pressure.

The Emergence of the TikTok Debt Challenge

The TikTok Debt Challenge started with creators sharing their struggles with personal loans, student debt, and credit repayments. Initially, many posts carried an undertone of humor or resignation — a way for users to vent about financial hardships. But the tone shifted quickly.

More creators began posting videos that celebrated refusing to pay debts as a symbolic act of freedom from what they describe as a “rigged financial system.” In these clips, users cut up credit cards, show screenshots of ignored payment reminders, or declare financial “independence” through non-payment.

The message spread rapidly. For many viewers, the challenge resonated as a digital expression of frustration with high living costs, rising interest rates, and limited opportunities. The trend, however, also sparked alarm among financial experts, who warn that this kind of viral defiance could normalize dangerous financial behavior among young audiences.

Gen Z’s Financial Reality

Generation Z — those born between 1997 and 2012 — faces one of the toughest financial landscapes in decades. Many entered adulthood during the pandemic, in a time marked by job uncertainty, economic slowdown, and record inflation.

Student loans, credit card debt, and unstable incomes have created a sense of financial fatigue. For some, the constant struggle to make ends meet has led to resentment toward traditional financial expectations such as credit building, saving, or mortgage planning.

At the same time, Gen Z is also the first generation to grow up entirely online, absorbing financial information — or misinformation — from influencers rather than banks or advisors. The TikTok Debt Challenge represents how this generation uses social media to make sense of, and sometimes rebel against, financial realities they feel were inherited rather than chosen.

Debt Default as a Form of Protest

For many TikTok creators, defaulting on loans is portrayed as defiance rather than failure. They frame it as taking control from lenders, corporations, or a system they see as exploitative. Some even describe non-payment as a moral or political act — a rejection of capitalism’s pressure to stay indebted.

This kind of content attracts millions of views because it taps into collective frustration. It reframes debt not as a mistake but as proof of resistance. The creators often use humor, trending sounds, and memes to make the message more relatable, giving the movement a rebellious yet entertaining tone.

However, financial analysts caution that this digital defiance ignores the long-term consequences. Defaults can damage credit scores for years, limit access to jobs or housing, and trigger legal action. What appears empowering online can create deeper financial instability offline.

The Digital Amplification of Financial Behavior

TikTok’s algorithm rewards engagement. The more emotional or shocking the content, the faster it spreads. Videos portraying rebellion, frustration, or defiance perform far better than responsible financial advice.

As a result, financial misinformation spreads quickly, wrapped in humor or storytelling. Creators who share reckless financial habits often gain visibility faster than those promoting literacy and responsibility.

This creates what economists describe as a “digital echo chamber” — where bad advice is reinforced through popularity. A single viral post can convince thousands of viewers that ignoring debt has no real consequences, especially when creators frame themselves as “freed” from financial stress.

The platform’s entertainment-driven design makes it difficult for users to separate satire from genuine advice, leaving young viewers vulnerable to misunderstanding serious financial matters.

The Broader Financial Frustration

The popularity of the TikTok Debt Challenge also signals a wider generational distrust in established systems. Gen Z faces record student debt, unaffordable housing markets, and stagnant wages despite rising costs of living.

Traditional financial milestones — home ownership, savings stability, or debt-free living — feel increasingly unattainable. For many young adults, the idea of staying financially disciplined while facing overwhelming systemic barriers feels futile.

In this environment, rejecting financial norms becomes a symbolic statement. Loan defaults, once viewed as personal failures, are now framed as collective protest — a refusal to play by rules that no longer make sense.

But while rebellion can feel empowering, experts emphasize that financial systems still function by accountability. Ignoring obligations does not change institutional power; it often reinforces economic inequality by punishing those who can least afford it.

Social Media’s Influence on Financial Literacy

Social media has become the modern classroom for money management — but it’s an unregulated one. On TikTok, financial literacy competes with entertainment, and algorithms prioritize emotion over accuracy.

Creators who discuss debt repayment, savings strategies, or credit repair struggle to gain traction compared to those who dramatize financial chaos. Even genuine advice can become distorted as trends turn personal finance into short, simplified narratives.

This imbalance has real-world implications. Surveys show that a majority of Gen Z users rely on TikTok, YouTube, or Instagram for financial information rather than banks or certified experts. As a result, misinformation becomes normalized — and trends like the TikTok Debt Challenge thrive.

Financial educators argue that platforms have a responsibility to intervene. Content moderation, educational labeling, and verified financial creators could help curb misinformation and encourage responsible digital learning.

Economic Rebellion or Digital Distraction?

Some sociologists view the TikTok Debt Challenge not as a financial trend but as a cultural rebellion. It reflects the tension between economic systems built for stability and digital cultures built for expression.

Gen Z’s online defiance mirrors the rise of other counter-narratives, such as “quiet quitting,” “anti-work” movements, and “soft saving” lifestyles — all rejecting traditional definitions of success.

However, financial experts argue that rebellion expressed through loan default only deepens economic vulnerability. Rather than dismantling systemic barriers, it reinforces dependence on high-interest credit and debt cycles.

In this sense, the trend may be more digital distraction than revolution — a temporary sense of control in a system that still holds the real power.

Turning Rebellion into Responsibility

While the TikTok Debt Challenge exposes risky behavior, it also opens a critical conversation about financial education and emotional well-being. Many creators participating in the trend aren’t promoting irresponsibility for its own sake; they’re expressing exhaustion and hopelessness.

This makes it an opportunity for reform. If institutions, educators, and policymakers listen to these digital expressions, they can address the core issues driving the rebellion: financial inequality, credit accessibility, and mental strain from debt.

Campaigns promoting financial literacy — delivered through the same social media platforms where misinformation spreads — could transform the space. Influencers who frame budgeting, saving, and responsible debt management in relatable, creative ways already exist; they simply need stronger visibility.

Shifting the narrative from defiance to education could help rebuild trust between young people and the financial systems they feel alienated from.

A Reflection of a Larger Crisis

The TikTok Debt Challenge is not an isolated phenomenon — it’s a reflection of a global economic mood. Across countries, young adults are reporting record levels of debt, declining savings, and growing skepticism about financial institutions.

What sets Gen Z apart is their ability to turn private frustration into public performance. Through TikTok, financial rebellion becomes content — both a coping mechanism and a viral expression of identity.

But the challenge also highlights a critical question: if debt becomes entertainment, where does financial responsibility fit in? The answer may define the next decade of economic behavior among young consumers.

The TikTok Debt Challenge captures the conflict between digital culture and financial reality. It shows how platforms that once spread music and humor now influence how an entire generation views money, responsibility, and power.

For many young users, the challenge is not about glorifying debt but about voicing a loss of faith in systems that seem unreachable. Yet, financial rebellion through defaults carries lasting consequences that go far beyond viral fame.

As governments, educators, and institutions work to improve financial literacy, the task is clear — transform the energy of online defiance into awareness, education, and resilience.

The movement’s rise is both a warning and a window into the collective mindset of Gen Z: frustrated, creative, and ready to question the rules — but still searching for a way to build stability in a world that feels increasingly unstable.