TRUMP’S TARIFF GAMBLE: HIGHER PRICES, JOB LOSSES, AND ECONOMIC UNCERTAINTY

Wall Street Plunges, Americans Brace for Impact

WASHINGTON (AP) – President Donald Trump’s sweeping new tariffs are shaking up the U.S. economy, triggering a Wall Street nosedive, raising consumer prices, and risking jobs. With tariffs soaring as high as 79% on some Chinese imports, economists warn that the cost of everyday goods like clothing, furniture, and even food could skyrocket—forcing American families to bear the brunt of the trade war.

Despite claims that tariffs will push companies to manufacture in the U.S., experts caution that the process could take a decade, leaving Americans to navigate the immediate financial fallout.

MARKETS ARE IN FREEFALL AS THE ECONOMY BRACES FOR A SHOCK

Investors reacted with panic Thursday, with the S&P 500 plunging 4.8% and the Dow Jones tumbling more than 1,600 points, marking the worst market performance since the pandemic. Fears of a potential recession loom as inflation is now expected to surge beyond 4%, while economic growth may grind to a near halt.

AMERICANS FACE RISING COSTS

The Yale Budget Lab estimates that the tariffs will add an average of $3,800 in extra costs per U.S. household this year. The hardest-hit industries include:

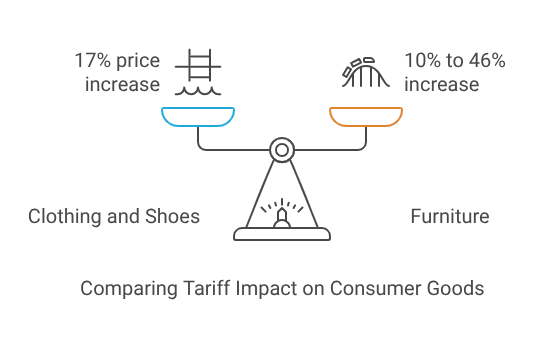

- Clothing and Shoes – Prices could rise 17% as the U.S. places heavy tariffs on Vietnam (46%) and Indonesia (32%), two of the world’s biggest suppliers of apparel and footwear. Nike, which produces half of its shoes in Vietnam, is expected to pass some of these costs on to consumers.

- Furniture – The Home Furnishings Association, representing 13,000 U.S. retailers, predicts price hikes of 10% to 46%, with Vietnam and China being the top furniture exporters. Even domestically made furniture will become costlier due to imported components.

- Food and Essentials – Consumer goods giants like Coca-Cola, Nestlé, and Procter & Gamble warn that tariffs on key imported ingredients—such as wood pulp for toilet paper, cinnamon, coffee, and cocoa—will drive up grocery prices.

While some exporters overseas may lower prices to remain competitive, and U.S. retailers may absorb part of the cost, most economists believe the bulk of the tariffs will fall directly on consumers.

“A DECADE TO BRING MANUFACTURING BACK”

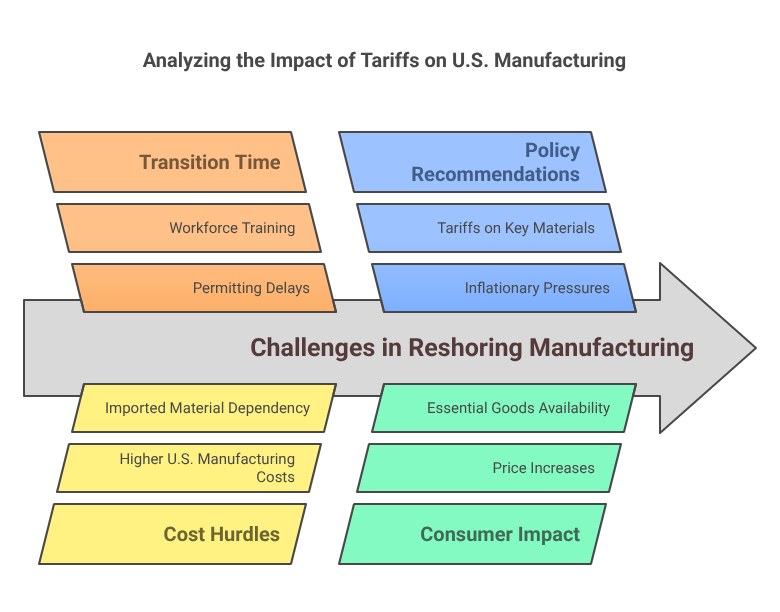

Proponents argue that the tariffs will bring jobs back to the U.S., but industry leaders caution that the transition will take time. While many support the long-term goal of reshoring manufacturing, scaling domestic production is expected to take at least a decade. Challenges such as permitting, workforce training, and the higher costs of U.S. manufacturing remain significant hurdles.

Small businesses are also preparing for the impact. While some retailers and suppliers may absorb part of the increased costs, consumers will still face higher prices on essential goods. Some manufacturers in Asia are lowering their prices and cutting shipping costs to offset the tariffs, but experts say these measures won’t be enough to prevent price hikes. Even domestically produced goods rely on imported materials, making it difficult to shield consumers from rising costs.

Meanwhile, industry leaders are urging policymakers to reconsider tariffs on key materials and ingredients that are scarce in the U.S. Items such as wood pulp for paper products, cinnamon, coffee, and cocoa—staples in everyday life—are among the imports facing higher duties. Companies warn that without adjustments, manufacturing jobs could be affected, and inflation could rise further, placing additional strain on consumers.

JOBS AT RISK: MANUFACTURERS START CUTTING WORKERS

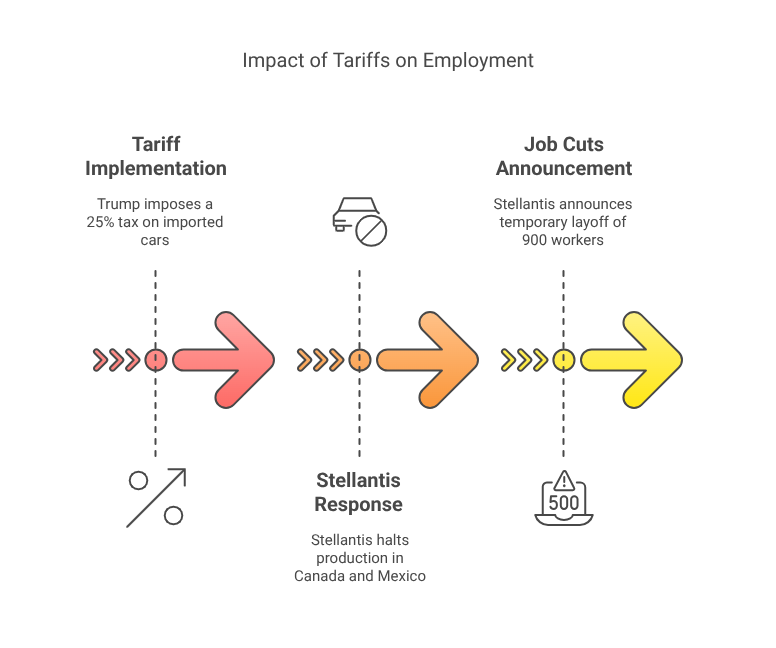

As companies respond to the tariffs, job losses are already starting. On Thursday, automaker Stellantis announced it would temporarily lay off 900 workers at its plants in Michigan and Indiana after halting production in Canada and Mexico due to Trump’s 25% tax on imported cars. More companies could follow suit.

MOUNTING UNCERTAINTY OVER ECONOMIC IMPACT

While some view the tariffs as a necessary adjustment to correct trade imbalances, concerns over rising consumer costs and potential job losses are growing. The sharp increase in prices is already affecting businesses, with retailers adjusting their pricing strategies and manufacturers weighing the cost of domestic production against global supply chains.

The true impact will depend on how long these policies remain in place and whether they lead to trade concessions from other countries. If economic strain intensifies, political and public pressure could force a reassessment of the strategy. For now, millions of Americans are left waiting to see whether the gamble will pay off—or backfire.