US Businesses Struggle as Loan Defaults Surge to Highest Level in a Decade

US Companies Face Rising Loan Delinquencies as Economic Pressures Mount

Corporate loan delinquencies in the US have reached their highest level in nearly a decade, with over $28 billion in overdue debt at the end of 2024, according to newly released banking data. This marks an increase of $2.2 billion in the last quarter alone and $5.4 billion compared to a year earlier, reflecting growing financial strain on businesses amid high interest rates and economic uncertainty.

Key Factors Behind Rising Delinquencies

The surge in overdue corporate loans is driven by persistently high interest rates and new tariffs, both of which are creating additional financial burdens for businesses.

- Interest Rates Remain High: Many businesses expected borrowing costs to decline in 2024 as inflation cooled, but the Federal Reserve has delayed rate cuts due to rising consumer prices, which increased by 3% in January. Since most corporate bank loans have variable interest rates, companies are facing higher repayment costs, putting pressure on their cash flow.

- Impact of Tariffs: The introduction of new tariffs by the Trump administration could further strain business finances by increasing costs for imported goods and materials. Smaller and mid-sized companies, which have fewer resources to absorb higher costs, are expected to be hit the hardest.

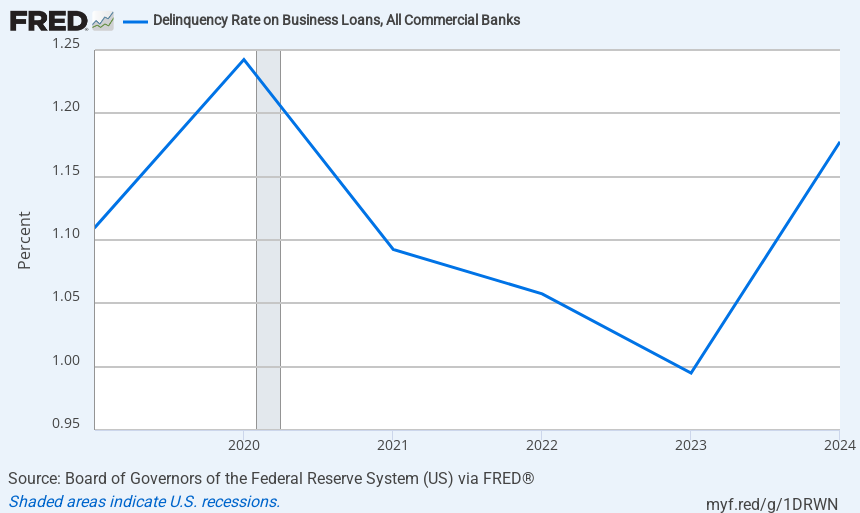

Rising Corporate Loan Delinquencies: 2024 Sees Highest Rate in Nearly a Decade

Who Is Most Affected?

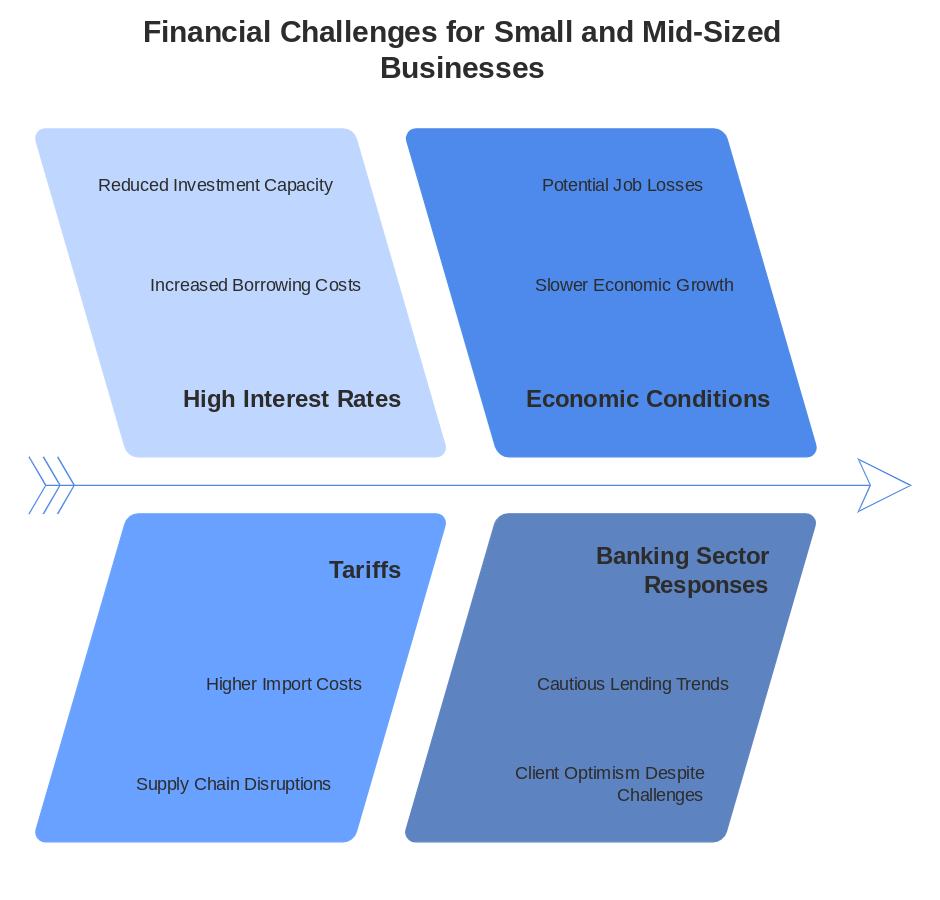

While large corporations are better positioned to navigate financial challenges, small and mid-sized businesses are showing signs of distress. These companies often lack the financial flexibility and supply chain resilience needed to withstand rising costs. Experts warn that if tariffs remain in place and interest rates stay high, financial struggles for these businesses could worsen in 2025.

“Mid-sized companies are going to struggle in a high-interest rate environment,” said David Hamilton, Head of Capital Markets Research at Moody’s. “Tariffs, if they last long enough, could have a severe economic impact on small and mid-sized businesses.”

Banking Sector Response

Despite rising delinquencies, banks remain relatively stable. Bank of America, one of the largest lenders to small businesses, reported that its clients remain optimistic despite the challenges. Corporate credit has been resilient compared to other types of debt, such as auto loans and credit card debt, which began showing signs of distress earlier in the economic cycle.

However, lending trends indicate caution. Corporate borrowing dropped by $100 billion in the fourth quarter of 2024, though part of this decline is attributed to changes in regulatory definitions of corporate loans.

Outlook for 2025

While corporate loan delinquencies (currently at 1.3%) remain well below the 5% peak seen during the 2008 financial crisis, economists warn that financial pressure on businesses is likely to continue.

If interest rates remain high and tariffs persist, business borrowing could decline further, leading to tighter credit conditions, slower economic growth, and potential job losses. Many analysts believe small and mid-sized businesses will face the greatest risks in the coming months, as they have less capacity to absorb prolonged economic pressures.

The coming year will be crucial in determining how businesses adapt to these financial challenges and whether policymakers take steps to mitigate economic distress.