US Debt Clock Crosses $34 Trillion: What It Means for Taxpayers

Washington, D.C: The U.S. national debt has crossed an unprecedented milestone of $34 trillion, according to the latest figures from the U.S. Debt Clock. This record-setting surge has reignited debates among economists, policymakers, and everyday Americans about the long-term consequences for taxpayers, inflation, and future generations.

The number, which has been climbing steadily for decades, reflects the combined weight of federal spending, rising interest payments, slower-than-expected revenue growth, and ongoing political gridlock. Analysts warn that the implications of this massive debt load will eventually fall on taxpayers, either through higher taxes, reduced government services, or both.

A Historic Moment for U.S. Debt

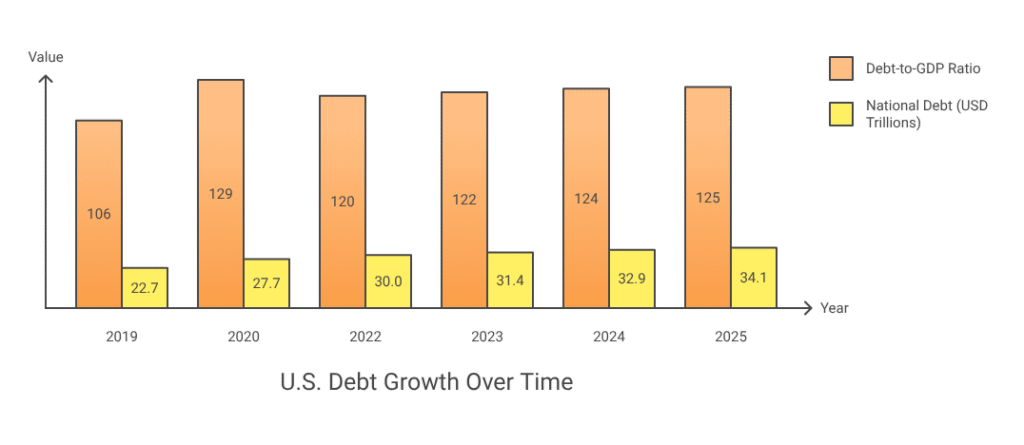

The U.S. national debt surpassed $30 trillion in early 2022, but in less than four years, it has ballooned by another $4 trillion. This sharp increase has been fueled by pandemic relief spending, global conflicts, soaring healthcare costs, and higher interest rates that make servicing the debt significantly more expensive.

📊 U.S. Debt Growth Over Time

| Year | National Debt (USD Trillions) | Debt-to-GDP Ratio |

|---|---|---|

| 2019 | $22.7T | 106% |

| 2020 | $27.7T | 129% |

| 2022 | $30.0T | 120% |

| 2023 | $31.4T | 122% |

| 2024 | $32.9T | 124% |

| 2025 | $34.1T | ~125% |

According to the U.S. Treasury Department, debt growth is now outpacing GDP expansion, raising concerns about America’s fiscal sustainability. Economists note that the debt-to-GDP ratio at 125% mirrors levels last seen during World War II.

“Crossing $34 trillion is not just a symbolic threshold. It’s a flashing red warning sign,” said Dr. Laura Benson, senior economist at the Fiscal Policy Institute. “Unless significant changes are made, taxpayers will shoulder the burden in the form of higher taxes or reduced benefits.”

Where the Money Is Going

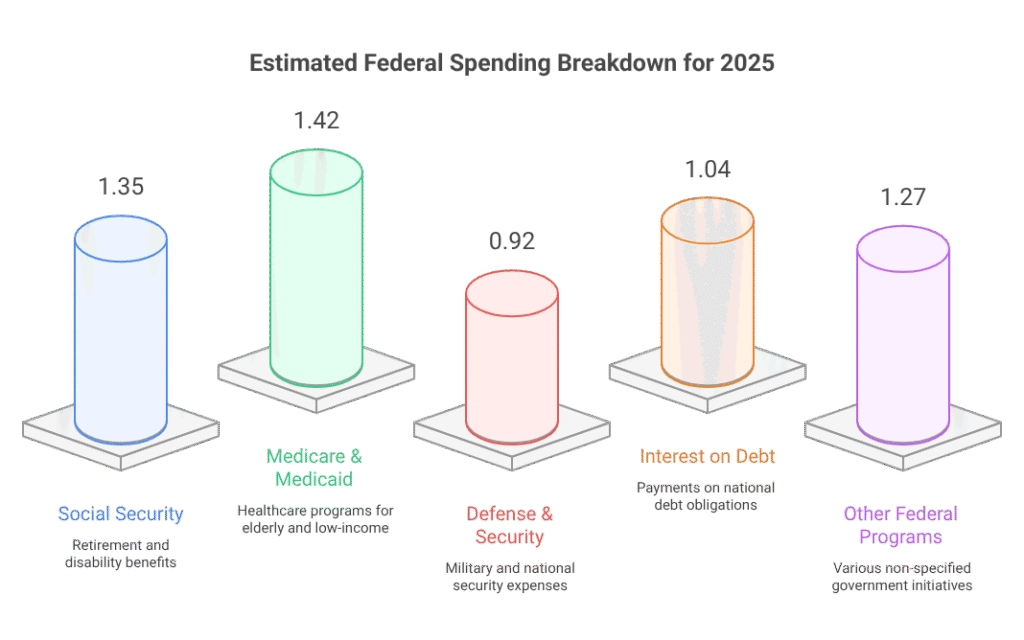

The ballooning national debt reflects spending priorities across multiple sectors.

📊 Federal Spending Breakdown (2025 Estimates)

| Category | Spending (USD Trillions) |

|---|---|

| Social Security | $1.35T |

| Medicare & Medicaid | $1.42T |

| Defense & Security | $0.92T |

| Interest on Debt | $1.04T |

| Other Federal Programs | $1.27T |

| Total Annual Budget | $5.99T |

What alarms economists is that interest payments now exceed defined spending for the first time in U.S. history. That means more taxpayer dollars are going to bondholders than to the Pentagon or public education.

How the Debt Impacts Taxpayers in 2025

While trillion-dollar figures may seem distant, the impact is personal for every American household.

📊 Debt Per American (2025)

| Category | Amount |

|---|---|

| Per U.S. Citizen | $101,500 |

| Per U.S. Taxpayer | $262,400 |

| Annual Federal Interest Payments | $1.04 Trillion |

| Interest Cost per Citizen | $3,000+ |

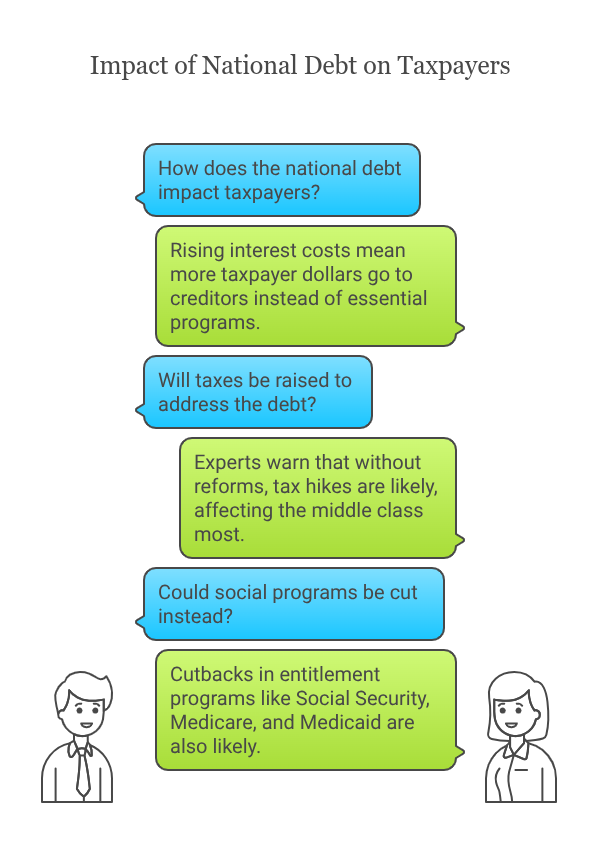

1. Rising Interest Costs

Interest on the national debt has become the fastest-growing federal expense. In 2025, the U.S. government will spend more than $1 trillion on interest payments alone, surpassing both defense and education spending. This means a greater share of taxpayer dollars goes toward paying creditors rather than funding essential programs.

2. Potential Tax Hikes

Experts argue that without meaningful reforms, the government will eventually be forced to raise taxes. Possibilities include:

- Higher income tax rates

- Reduced deductions and credits

- New forms of federal taxation, such as wealth or carbon taxes

“It’s not a matter of if but when,” warned Mark Harris, a tax policy analyst. “The math doesn’t add up without raising revenue. The middle class will feel it most.”

3. Cuts to Social Programs

If Washington avoids tax hikes, another likely scenario is cutbacks in entitlement programs such as Social Security, Medicare, and Medicaid. These programs already face funding shortfalls, and the debt crisis accelerates their instability.

Political Gridlock and Fiscal Stalemate

The debate on the debt ceiling has long divided Congress. Democrats emphasize the need for increased spending on healthcare, climate initiatives, and infrastructure, while Republicans prioritize spending cuts and deficit reduction.

Despite repeated negotiations, Washington has relied on temporary fixes and short-term deals, rather than enacting structural reforms.

President Joe Biden, in a recent press briefing, defended his administration’s spending priorities:

“Investments in infrastructure, healthcare, and education are essential for America’s growth. But we must also work together to ensure fiscal responsibility.”

Meanwhile, Republican leaders argue that unchecked spending is the greatest economic threat.

“The debt crisis is the biggest national security threat we face today,” said House Speaker Kevin McCarthy. “Every taxpayer will pay the price if Washington refuses to make tough choices.”

The Global Picture: Foreign Creditors and U.S. Vulnerability

A large portion of U.S. debt is held by foreign creditors. China and Japan together hold more than $2 trillion in U.S. Treasury securities.

📊 Top Foreign Holders of U.S. Debt (2025)

| Country | Holdings (USD Billions) |

|---|---|

| Japan | $1,088B |

| China | $867B |

| United Kingdom | $716B |

| Belgium | $372B |

| Luxembourg | $355B |

| Others Combined | $3,200B |

This dependence on foreign nations raises strategic concerns. Analysts warn that if major creditors reduce their holdings, U.S. interest rates could spike, making borrowing even more expensive for taxpayers.

Debt and Inflation: A Dangerous Mix

The record-breaking debt comes at a time when Americans are already grappling with higher inflation and rising interest rates. While inflation has cooled from its 2022–2023 peaks, the Federal Reserve remains cautious.

High debt levels complicate inflation control. Governments under fiscal strain may resort to printing more money, weakening the dollar, and eroding household savings.

“The American taxpayer is squeezed on both ends—higher prices at the store and higher taxes on their paycheck,” noted Dr. Susan Mitchell, professor of economics at Georgetown University.

Generational Divide: Who Pays the Price?

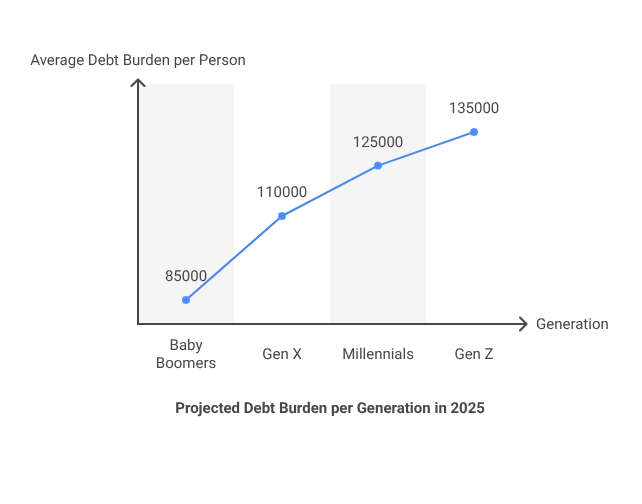

For younger generations, the debt crisis presents a stark challenge. Millennials and Gen Z, already facing student loan burdens, housing affordability issues, and stagnant wages, are projected to carry the heaviest load.

📊 Debt Burden Per Generation (2025 Estimates)

| Generation | Avg. Debt Burden per Person |

|---|---|

| Baby Boomers (59–77 yrs) | $85,000 |

| Gen X (44–58 yrs) | $110,000 |

| Millennials (28–43 yrs) | $125,000 |

| Gen Z (18–27 yrs) | $135,000 |

According to the Committee for a Responsible Federal Budget, each American citizen’s share of the national debt now exceeds $100,000, and this figure is expected to rise sharply unless reforms are enacted.

Possible Solutions on the Table

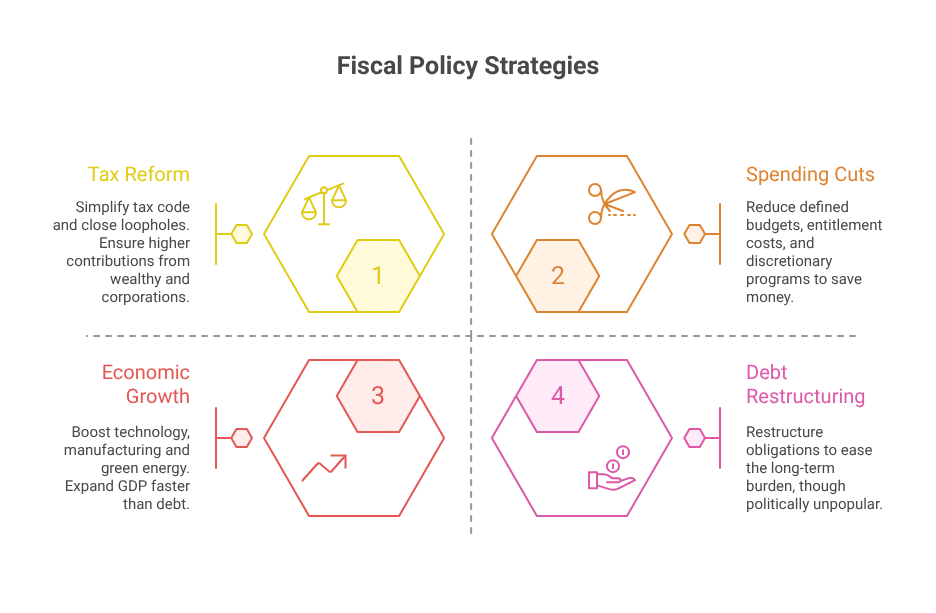

While solutions exist, they are politically and economically difficult. Experts suggest a mix of:

- Comprehensive Tax Reform – Simplifying the tax code, closing loopholes, and ensuring higher contributions from corporations and the wealthy.

- Spending Cuts – Reducing defines budgets, entitlement costs, and discretionary programs.

- Economic Growth Initiatives – Boosting sectors like technology, manufacturing, and green energy to expand GDP faster than debt.

- Debt Restructuring – Although politically unpopular, some economists argue for restructuring certain obligations to ease the long-term burden.

Yet, none of these options comes without trade-offs.

What This Means for the 2026 Elections

The national debt crisis is expected to dominate the 2026 midterm elections. Polls show that voter concern about government spending has risen sharply, particularly among middle-class households hit hardest by inflation and higher borrowing costs.

Candidates from both parties will be under pressure to present credible plans for fiscal responsibility. The party that convinces voters it can stabilize America’s finances may hold the key to controlling Congress.

The Road Ahead

The crossing of $34 trillion in U.S. debt is more than just a headline—it marks a turning point that will shape economic and political debates for decades. For taxpayers, it means preparing for a future where the burden of today’s borrowing directly impacts tomorrow’s paychecks, benefits, and opportunities.

Unless leaders in Washington move beyond partisan fights and embrace long-term fiscal discipline, the cost of inaction will only grow. For now, the U.S. Debt Clock keeps ticking—and every second adds to the bill taxpayers must eventually pay.