Controversial Takes: Why Going Into Debt Might Be Smarter Than Paying Cash in 2025

A radical rethink of financial wisdom

For decades, personal finance experts have repeated one golden rule: avoid debt at all costs. Pay cash, live within your means, and stay debt-free. But as we enter 2025—a year marked by high inflation, rising interest rates, and shifting asset values—this old advice may no longer hold up.

A new wave of economists, investors, and financial strategists are suggesting something once unthinkable: that going into debt might actually be the smarter move than paying cash in 2025.

The changing value of money

The logic begins with inflation. The global inflation surge that began in 2021 hasn’t entirely cooled off. While central banks have tightened policies, prices in housing, healthcare, education, and everyday essentials remain elevated.

In real terms, the value of cash is declining faster than most people realize. According to IMF forecasts, global inflation rates are expected to remain around 4% to 5% in 2025, eroding purchasing power.

“Cash used to be security. Now, it’s a melting ice cube,” says Dr. Laura Bennett, a senior economist at the London School of Finance. “If inflation outpaces your savings interest, holding too much cash becomes a guaranteed loss.”

This dynamic makes low-interest debt—such as fixed-rate loans or mortgages—potentially advantageous. Borrowers can repay tomorrow with “cheaper dollars” compared to today’s value, effectively turning inflation into a financial ally.

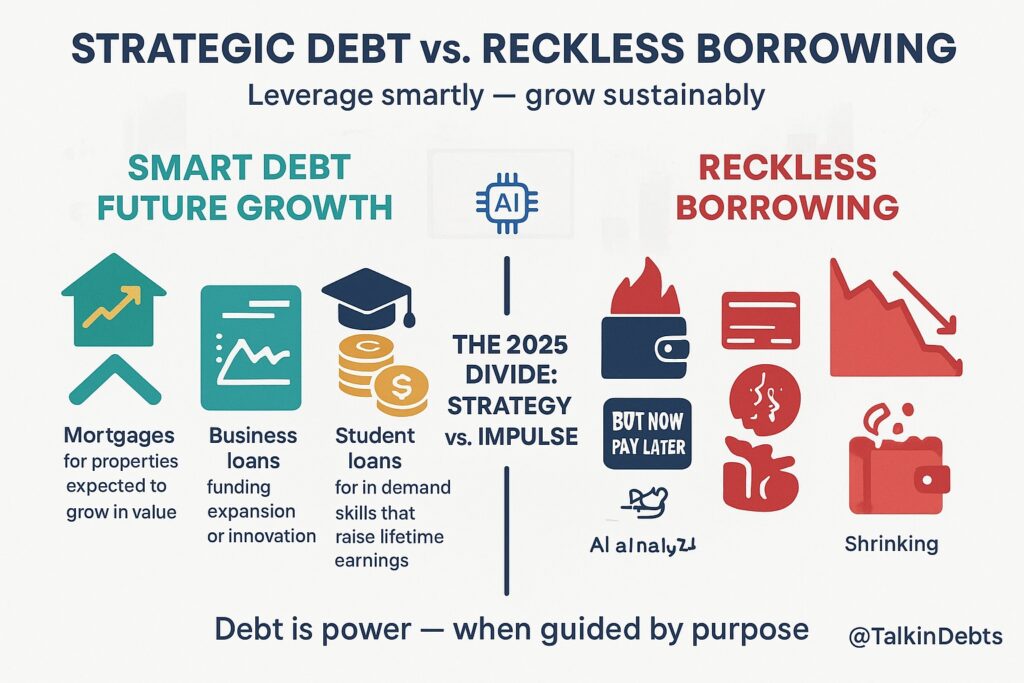

Strategic debt vs. reckless borrowing

Of course, not all debt is good debt. The new financial thinking emphasizes strategic leverage, not reckless spending.

Smart debt refers to using borrowed capital to acquire appreciating assets or enhance future income, such as:

- Mortgages for properties expected to grow in value.

- Business loans fund expansion or innovation.

- Student loans for in-demand skills that raise lifetime earnings.

Meanwhile, bad debt—such as high-interest credit cards or buy-now-pay-later traps—continues to drag households into financial stress.

The key difference in 2025’s environment? With AI-driven lending models and flexible digital finance platforms, borrowers have more tools than ever to analyze, predict, and manage their debt efficiently.

The opportunity cost of paying cash

Another major argument against paying cash outright lies in opportunity cost—the returns you miss out on when you lock funds into a purchase.

For instance, imagine you have $100,000 saved. Paying cash for a car or home improvement drains your liquidity. But if you instead finance at a 4% loan rate and invest that cash in a 6–8% yielding instrument, such as ETFs or corporate bonds, you’re potentially building wealth instead of just owning an asset.

This “cash efficiency” mindset is now common among financially savvy millennials and Gen Z investors. Many prefer to leverage cheap capital while keeping their money active in high-yield investments.

“Debt used to symbolize risk. Now it represents control—when managed correctly,” notes Jared Kim, a financial strategist at FinScope Research. “Paying cash is emotionally satisfying but economically inefficient.”

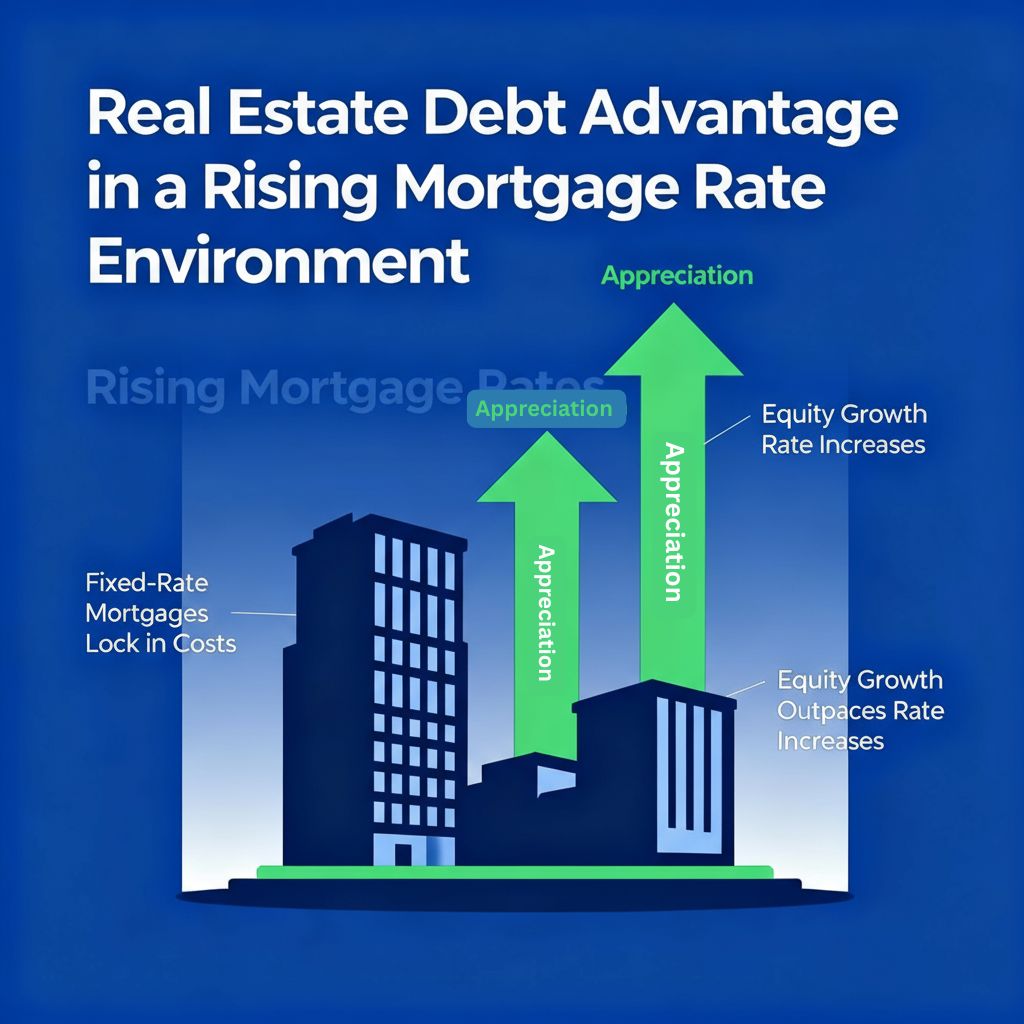

Real estate: The debt advantage

Nowhere is this shift clearer than in real estate.

Despite rising mortgage rates, property debt remains one of the most strategic forms of borrowing in 2025.

Here’s why:

- Real estate often appreciates faster than inflation.

- Fixed-rate loans shield borrowers from future interest hikes.

- Tax incentives in many countries still favor homeowners with mortgages.

Essentially, using borrowed funds to acquire a tangible asset that grows in value creates a wealth multiplier effect—something that paying cash can’t replicate.

“Even at 6% mortgage rates, if property appreciation is 8% annually, you’re still ahead,” says Kim. “Cash buyers miss that leveraged upside.”

Corporate influence: learning from big business

Interestingly, this mindset isn’t new—it’s standard practice in the corporate world.

Major companies routinely borrow even when they have billions in reserves. Why? Because debt is cheaper than equity, it keeps capital liquid for high-return projects.

Apple, for example, has borrowed billions at ultra-low rates while sitting on massive cash piles. The company leverages debt to fund buybacks, innovation, and expansion—boosting shareholder value in the process.

In 2025, more individuals are adopting similar logic: if corporations use debt strategically to grow, why shouldn’t consumers?

Psychology vs. economics

Yet, resistance to debt isn’t purely financial—it’s psychological.

Generations raised on “debt is bad” rhetoric still associate borrowing with shame or failure. But new economic conditions require a new mindset.

Financial educators now argue for “emotionally detached money management.” This approach treats debt as a mathematical tool, not a moral measure.

“Being debt-free isn’t always the smartest path—it’s just the most comfortable one,” says Bennett. “In an inflationary economy, comfort can cost you real wealth.”

When debt makes you money

Let’s break down a real-world scenario:

Case Study 1 – The Investor Approach

- In 2020, Mark paid $300,000 cash for a small investment property.

- In 2025, it’s worth $420,000—a gain of $120,000.

- However, had he taken a 70% mortgage and invested the remaining $210,000 in diversified assets earning 7% annually, his total return could have exceeded $170,000.

Case Study 2 – The Entrepreneur Move

- Lisa took a $100,000 business loan at 5% interest to expand her logistics firm.

- Her 2024 revenue grew by 20%, and profits increased $30,000 after loan costs.

- Paying cash would’ve limited her growth potential and delayed expansion by years.

These examples show that controlled leverage, when applied strategically, can accelerate financial progress far beyond a “cash-only” mindset.

The risks: debt isn’t for everyone

Despite its potential, the strategy of going into debt isn’t without risk.

Unstable incomes, variable-rate loans, and market volatility can all turn good debt into bad debt quickly.

Moreover, rising global interest rates in 2025 mean borrowers must calculate repayment sustainability carefully.

Financial experts recommend:

- Maintaining a debt-to-income ratio under 35%.

- Prioritizing fixed-rate loans over variable ones.

- Keeping emergency cash reserves equal to six months’ expenses.

Smart borrowing demands financial discipline, not blind optimism.

Digital debt tools: AI makes smarter borrowers

One factor empowering this new debt culture is technology.

AI-based personal finance platforms—like Cleo, Mint, and Rocket Money—now offer predictive repayment analysis, interest optimization, and spending control features that reduce default risks.

These digital tools allow consumers to:

- Track all debts and due dates automatically.

- Simulate how inflation and rate changes impact their finances.

- Receive real-time guidance on when to refinance or pay off.

In short, AI is making debt management scientific rather than emotional, reducing the stigma attached to borrowing.

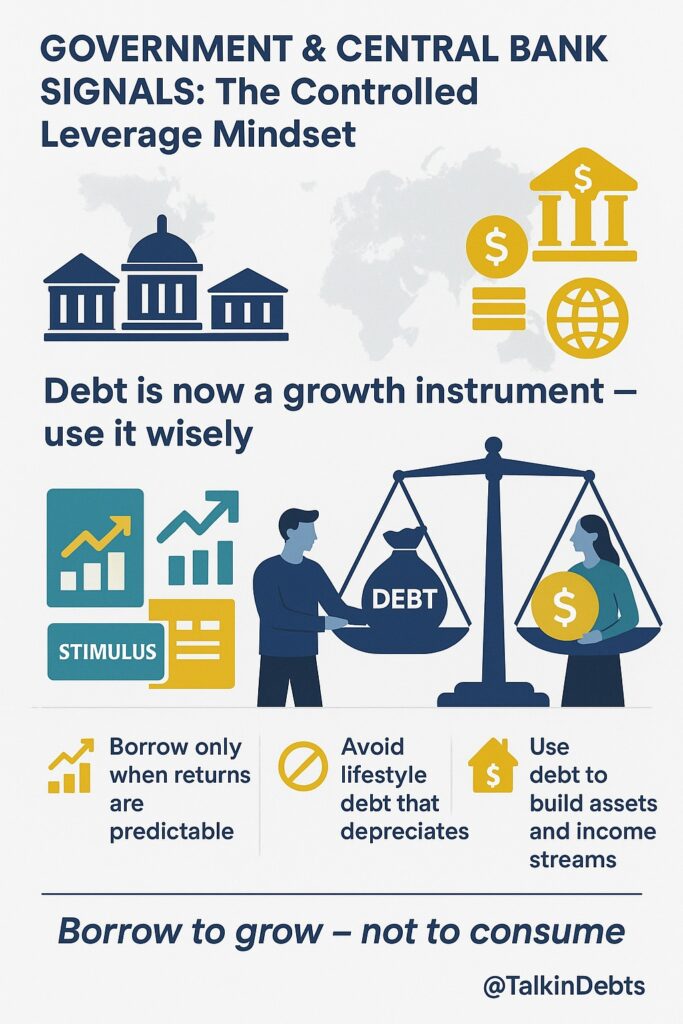

Government and central bank signals

Interestingly, central banks themselves are signaling a debt-tolerant economy.

Stimulus policies, credit expansion, and fiscal reforms across the U.S., Europe, and Asia indicate that moderate borrowing is being encouraged to sustain economic momentum.

Debt is no longer a dirty word—it’s a macroeconomic instrument for growth.

However, the flip side is that individuals must interpret these signals responsibly.

Borrowing because “the system rewards debt” without a strategy is a fast route to financial distress.

The middle ground: controlled leverage mindset

The most balanced takeaway for 2025 is not “debt good, cash bad,” but rather “controlled leverage beats cash stagnation.”

That means:

- Borrowing only when returns are predictable.

- Avoiding lifestyle debt (cars, gadgets) that depreciate fast.

- Using debt primarily to build assets or income streams.

In other words, borrow to grow, not to consume.

The new financial reality

In 2025, the rules of money have changed. Inflation, digital finance, and market unpredictability have redefined what it means to be “financially smart.”

Where past generations saw debt as danger, the new generation sees it as opportunity—when handled intelligently.

As Bennett concludes, “The question isn’t whether debt is good or bad. It’s whether you know how to use it better than the next person.”

In the end, going into debt in 2025 may not just be a controversial take—it might be the financial evolution of the decade.