Debt Consultation: When and Why, You Should Get Expert Advice

Debt can feel like a heavy chain dragging you down, but it doesn’t have to stay that way. For millions of individuals, unpaid bills, high interest rates, and constant creditor calls create an overwhelming financial burden. That’s where debt consultation comes in—a professional service designed to provide a clear pathway out of the chaos. Whether the struggle involves credit card balances, medical expenses, student loans, or personal loans, expert guidance can make a life-changing difference.

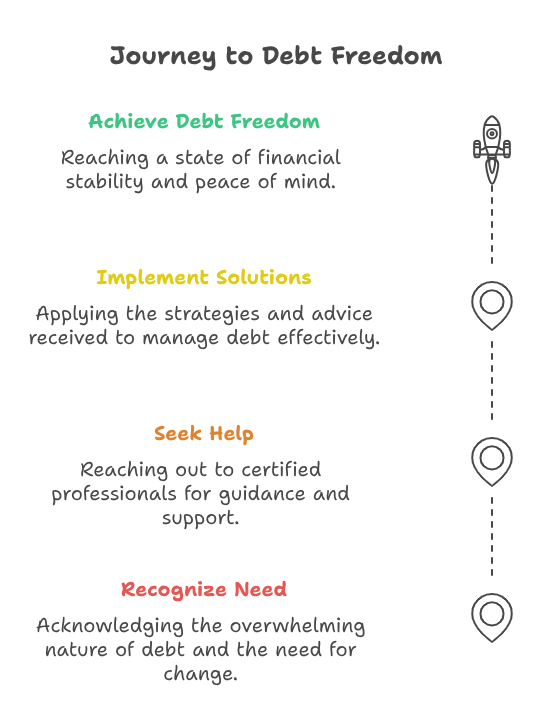

Understanding what debt consultation truly involves, recognizing the right time to seek help, knowing how to choose a reliable consultant, and preparing for the consultation process are all key steps. With the right support, achieving financial stability and peace of mind becomes entirely possible.

What Is Debt Consultation?

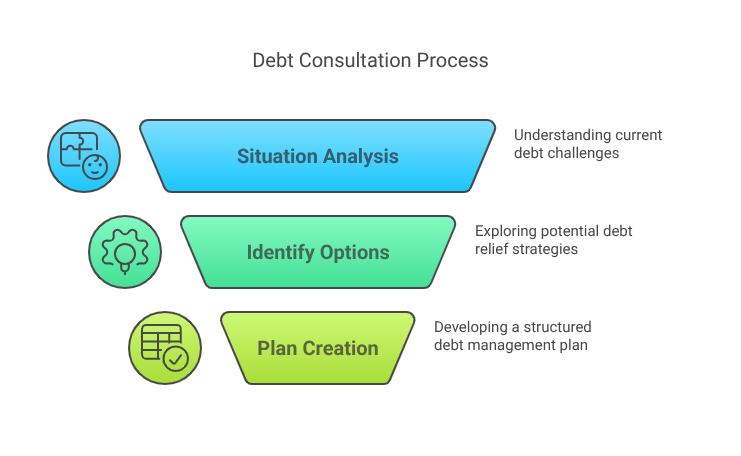

Debt consultation is a structured process where individuals receive expert financial advice tailored to their specific debt issues. The primary goal is to assess the current financial situation, identify debt relief options, and create a workable plan to regain control.

Role of Credit Counsellors and Financial Advisors

- Credit Counsellors: These specialists often work for nonprofit credit counseling agencies and help manage unsecured debt, such as credit card balances. They offer practical budgeting strategies, debt management plans (DMPs), and financial education.

- Financial Advisors: These professionals take a broader view of personal finance. Along with debt advice, they incorporate long-term goals like saving for retirement, investing, and wealth building.

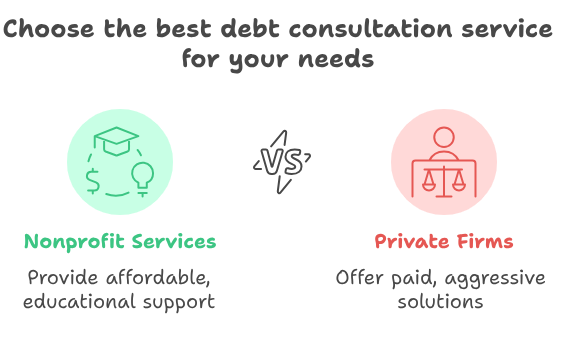

Free vs. Paid Consultation Services

- Nonprofit Services: Many nonprofit credit counseling agencies provide free or low-cost assistance for managing basic debt concerns. These services often include budgeting help, education, and structured debt management plans.

- Private Debt Relief Firms: These companies charge a fee and may offer more aggressive solutions like debt settlement, debt consolidation, or even legal representation.

Whether choosing a free service or hiring a private consultant, the objective is the same—gain professional insight, reduce debt responsibly, and develop healthier financial habits.

When Should You Seek Debt Consultation?

Timing can significantly impact the effectiveness of any debt relief strategy. Acting early not only increases your available options but also helps avoid damage to your credit score and mental health.

Signs That You Need Expert Help

- Bills are piling up faster than income.

- Only minimum payments are being made on credit cards.

- Loans are becoming unmanageable or are in default.

- Monthly budgeting feels impossible, and savings are dwindling.

- You’re turning to payday loans or borrowing from friends and family.

- Interest charges are eating up your monthly payments.

Red Flags That Indicate It’s Time to Talk to a Consultant

Recognizing the signs of financial strain early can make a huge difference in your journey toward stability.

Here are some common warning signals that suggest professional debt consultation may be necessary:

- Making only minimum payments on credit cards month after month, with balances barely shrinking.

- Credit cards or lines of credit are maxed out, leaving no room for emergencies.

- Missing payment deadlines have become frequent, resulting in late fees and credit report damage.

- Debt-to-income ratio is dangerously high, signaling financial imbalance.

- Relying on new loans or credit to repay existing obligations—leading to a cycle of dependency.

- A steady decline in your credit score, limiting future borrowing power.

- Frequent calls and notices from collection agencies, causing emotional distress.

- Ongoing anxiety or sleepless nights due to overwhelming financial pressure.

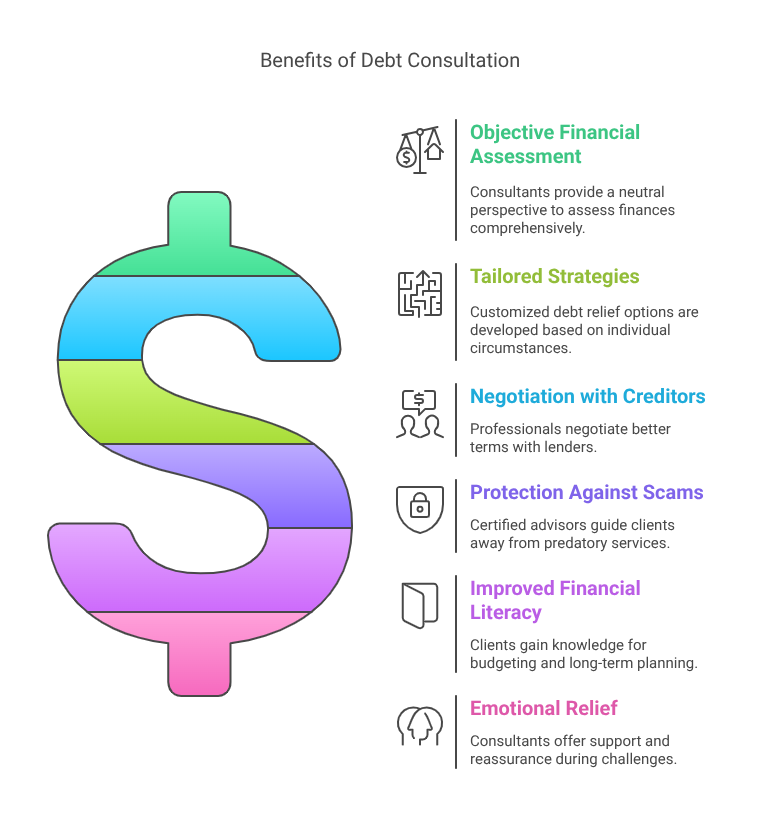

Benefits of Professional Advice

Seeking expert help doesn’t signal failure—it shows strength and commitment to reclaiming control over your finances. A qualified debt consultant can provide clarity during chaotic times and offer solutions that might not be apparent on your own.

Some of the key advantages of working with a professional include:

- Objective Financial Assessment: Consultants bring a neutral and informed perspective. They assess your income, expenses, and liabilities holistically to identify gaps and opportunities that may be overlooked.

- Tailored Strategies: No two financial situations are identical. A debt consultant helps you explore customized debt relief options like management plans, settlement, or consolidation based on your specific circumstances.

- Negotiation with Creditors: Professionals often have experience negotiating with lenders to lower interest rates, reduce fees, or set up manageable repayment plans, something difficult to do independently.

- Protection Against Scams: With so many unregulated debt relief schemes, a certified advisor can guide you toward safe, ethical options and help you avoid predatory services.

- Improved Financial Literacy: You’ll gain valuable knowledge about budgeting, saving, and long-term financial planning—skills that prevent future debt and promote lasting financial wellness.

- Emotional Relief: Beyond the numbers, consultants offer support and reassurance. Knowing that someone understands your situation and has helped others through similar challenges can provide much-needed peace of mind.

Professional guidance makes the path to debt recovery clearer, faster, and more secure. It transforms a confusing and stressful process into a structured journey toward financial stability.

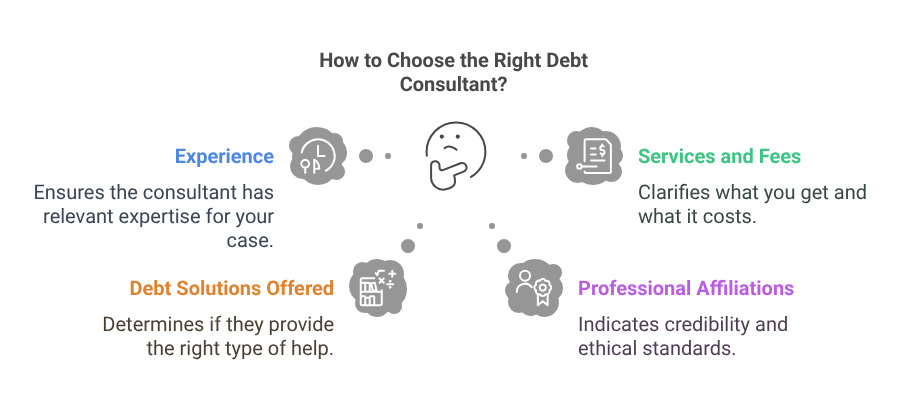

How to Choose the Right Debt Consultant

Not all consultants are created equal. Choosing a trustworthy professional is essential to ensure that the advice you receive is both practical and ethical.

Questions to Ask Before Hiring

- How many years of experience do they have with cases similar to yours?

- What services are included, and what fees apply?

- Do they offer debt management, consolidation, or settlement?

- Are they affiliated with recognized professional associations?

Checking Credentials and Accreditations

- Review their Better Business Bureau (BBB) rating.

- Read online reviews and testimonials.

- Request client references or success stories.

Avoid firms that promise immediate results or urge you to stop paying creditors without full disclosure. Reputable consultants prioritize your long-term financial health and equip you to make well-informed decisions.

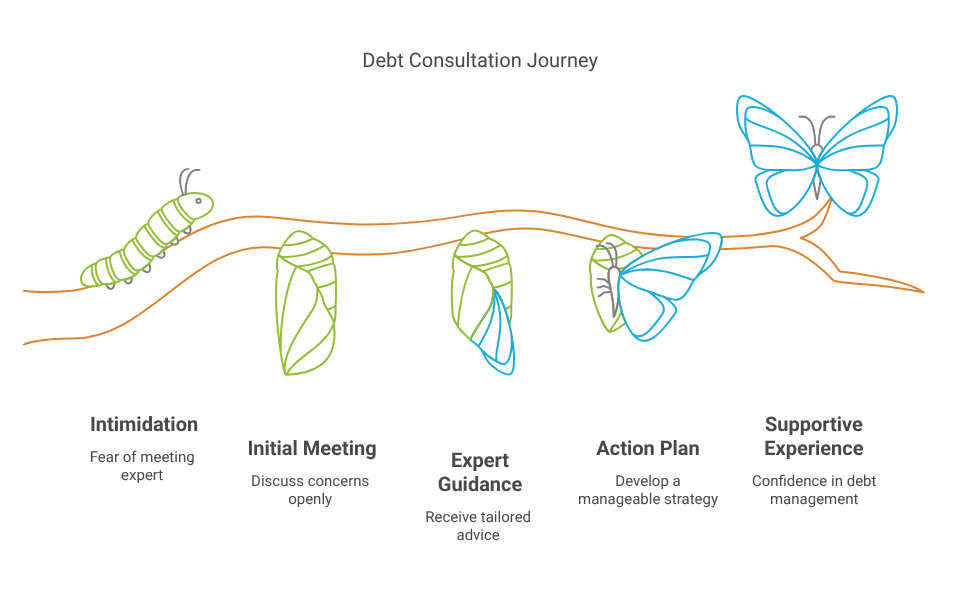

What to Expect from a Debt Consultation Session

The idea of meeting with a debt expert might seem intimidating, but the process is typically straightforward and supportive.

Debt Assessment and Strategy Planning

- Share details about income, expenses, debts, and assets.

- Provide documents such as bank statements, loan agreements, and recent bills.

The consultant evaluates this information to gain a full understanding of your financial standing.

Personalized Debt Management Plans

- Discuss suitable debt relief options such as DMP, debt settlement, or consolidation.

- Review the pros and cons of each option and how they align with your financial goals.

- Create a tailored action plan, potentially including budgeting advice and spending adjustments.

Emotional and Educational Support

- Receive educational materials and practical tools for managing stress.

- Learn techniques to rebuild confidence and avoid future debt traps.

By the end of your session, you’ll leave with clarity, direction, and a concrete plan to regain control of your finances.

Take Charge of Your Debt—Today

Debt consultation offers more than advice—it provides hope, structure, and real solutions. When financial stress becomes overwhelming, seeking help is a proactive and empowering step. Acting early can protect your credit, reduce interest costs, and help you break the debt cycle.

If you’re struggling with bills, being contacted by creditors, or feeling emotionally drained by financial stress, don’t wait. Reach out to a certified credit counselor or financial advisor. The journey toward a debt-free life starts with a single, informed decision.

You are not alone. Expert guidance is available, and your financial reset begins today.