Debt Management: A Step-by-Step Guide to Financial Freedom

Introduction to Debt Management

Debt is a reality for millions of people worldwide, but managing it effectively is crucial for financial stability and long-term success. Whether it’s credit card debt, student loans, or medical bills, understanding how to tackle debt can relieve stress and improve your financial health.

Importance of Managing Debt

Poorly managed debt can lead to financial hardship, stress, and even bankruptcy. By taking control of your finances and adopting smart debt management strategies, you can regain control, reduce financial strain, and achieve your financial goals faster. Additionally, effective debt management helps build financial discipline, ensuring better money habits in the long run.

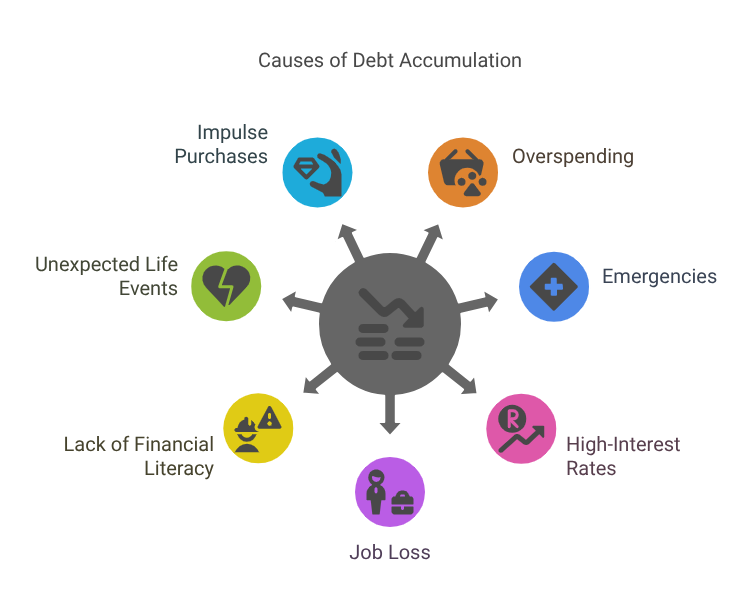

Common Causes of Debt Accumulation

- Overspending: Living beyond your means can quickly lead to mounting debt.

- Emergencies: Unexpected medical bills or car repairs can disrupt financial stability.

- High-Interest Rates: Credit cards and payday loans often have excessive interest rates that make repayment difficult.

- Job Loss: Sudden unemployment can force people to rely on credit to make ends meet.

- Lack of Financial Literacy: Many people accumulate debt simply because they do not understand how interest, loans, and repayment plans work.

- Unexpected Life Events: Divorce, the death of a loved one, or other major life changes can strain finances and lead to increased borrowing.

- Impulse Purchases: Many individuals fall into the trap of impulse spending, which can accumulate quickly over time, leading to substantial financial burdens.

Top Debt Management Strategies

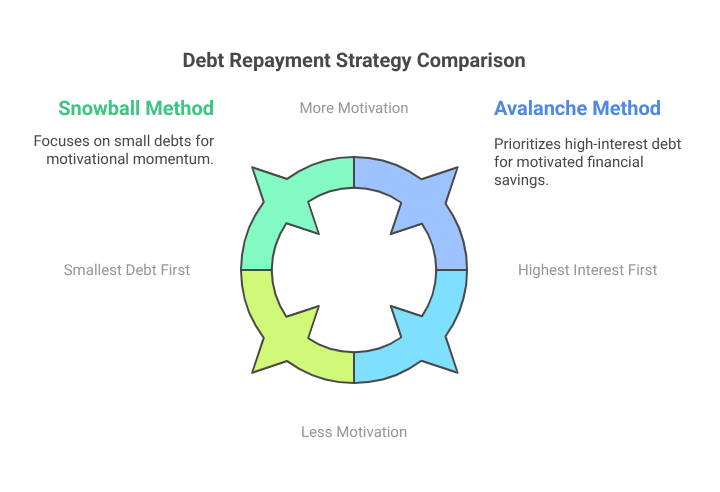

Snowball vs. Avalanche Method

Two of the most popular ways to pay off debt are the Snowball and Avalanche methods:

- Snowball Method: Focus on paying off the smallest debt first while making minimum payments on the rest. Once the smallest debt is cleared, move to the next smallest. This method builds momentum and motivation.

- Avalanche Method: Prioritize paying off the debt with the highest interest rate first. This approach minimizes interest payments and saves more money in the long run.

Negotiating Lower Interest Rates

- Contact creditors and request a lower interest rate.

- Demonstrate a strong payment history to strengthen your case.

- Consider transferring balances to lower-interest credit cards.

- Explore refinancing options for long-term loans.

- Check if your credit score qualifies for better lending terms.

- Seek professional advice from financial counselors who specialize in debt negotiation.

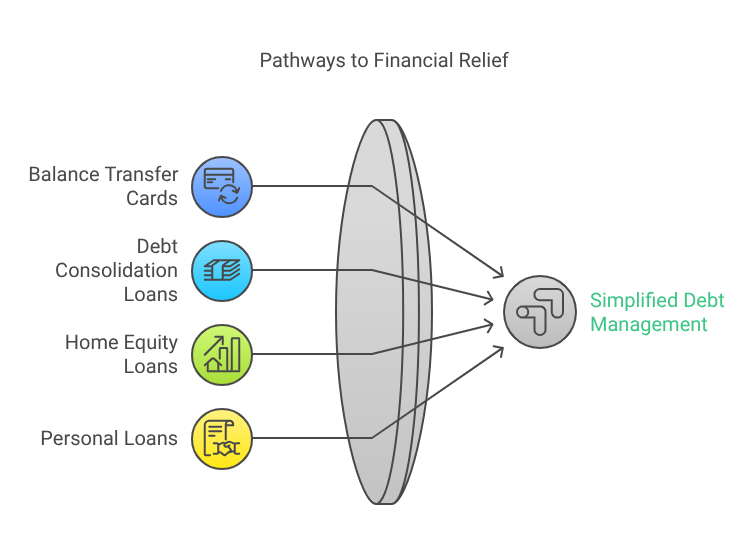

Consolidating Debt

Debt consolidation involves combining multiple debts into one loan with a lower interest rate. This simplifies repayment and can reduce the overall interest burden.

- Balance Transfer Credit Cards: These allow you to move high-interest credit card debt to a card with lower or 0% interest for a limited time.

- Debt Consolidation Loans: These loans combine multiple debts into one, often with a lower interest rate.

- Home Equity Loans: If you own a home, you may be able to consolidate debt using a home equity loan with a lower interest rate.

- Personal Loans: Some lenders offer fixed-rate personal loans specifically for consolidating high-interest debt.

Creating a Realistic Budget

A well-planned budget is essential for effective debt management. Follow these steps to create one:

- Track Your Expenses: Write down everything you spend money on for at least a month.

- Prioritize Essentials: Allocate funds for rent, groceries, transportation, and healthcare first.

- Cut Unnecessary Spending: Identify areas where you can reduce expenses, such as dining out or subscriptions.

- Set Debt Repayment Goals: Assign a portion of your income to debt repayment based on your financial capacity.

- Use the 50/30/20 Rule: Spend 50% of your income on needs, 30% on wants, and 20% on savings and debt repayment.

- Create an Emergency Fund: Set aside money for unexpected expenses to avoid relying on credit in times of need.

Debt Management Plans (DMPs)

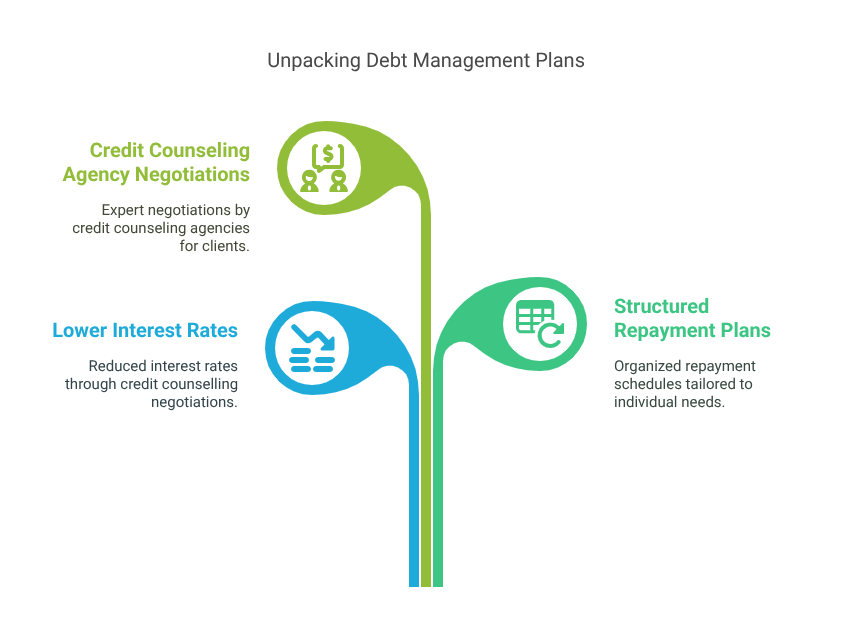

What Are Debt Management Plans?

A Debt Management Plan (DMP) is an arrangement where a credit counseling agency negotiates lower interest rates and structured repayment plans with creditors on your behalf.

- The agency works with creditors to reduce interest rates and waive late fees.

- You make one monthly payment to the agency, which then distributes the funds to creditors.

- These plans typically take 3 to 5 years to complete.

- Credit counseling services often provide educational resources to help individuals avoid future debt problems.

Pros and Cons of DMPs

Pros:

- Lower interest rates and waived fees

- Single monthly payment simplifies finances

- Helps avoid bankruptcy

- Professional financial guidance

- Potential credit score improvement over time

- Encourages disciplined spending habits and responsible money management

Cons:

- Takes several years to complete

- Some creditors may not participate

- Can temporarily impact the credit score

- Requires commitment and discipline

- Not suitable for secured debts (e.g., mortgages or car loans)

- May involve service fees that add to overall repayment costs

Tools & Resources for Debt Management

Debt Management Tools

Several tools can help track and manage debt effectively. These include budgeting calculators, debt repayment planners, and financial tracking tools that allow individuals to analyze their spending habits and identify areas where they can save money. By using these resources, individuals can make informed decisions about their financial future and create a structured plan to eliminate debt efficiently.

How the Debt Rating Checker Helps

A Debt Rating Checker assesses your overall financial health and helps determine the best course of action to manage debt more efficiently. It provides insights into:

- Credit Utilization: Determines if you are using too much of your available credit.

- Payment History: Reviews late or missed payments that impact your credit score.

- Debt-to-Income Ratio: Measures your ability to handle debt based on your income.

- Customized Debt Solutions: Suggest options tailored to your financial situation.

- Long-Term Debt Planning: Offers recommendations to help individuals establish a long-term strategy for maintaining financial health.

Conclusion

Debt management is not a one-size-fits-all approach, but by understanding the available strategies and using the right tools, you can take control of your finances. Start today by reviewing your debt, setting up a repayment plan, and utilizing the best resources to stay on track. Financial freedom is within reach if you remain consistent and proactive in managing your obligations.

The key to success is commitment, discipline, and strategic planning. By taking small steps today, you can pave the way for a debt-free and financially secure future. Take action now and regain control over your finances!