Auto Loan Apocalypse: Why 1 in 5 Canadians Are Underwater on Car Payments Amid EV Transition Chaos

Canada’s automotive sector is facing a financial storm as nearly 1 in 5 Canadians find themselves “underwater” on their auto loans, owing more than their vehicles are currently worth. Analysts warn that a combination of extended loan terms, rising interest rates, and the country’s ongoing electric vehicle (EV) transition has created unprecedented challenges for both consumers and the automotive industry.

As policymakers push for a greener automotive future, questions are being raised about the financial sustainability of these measures for average Canadians.

A Historical Perspective: Auto Loans in Canada

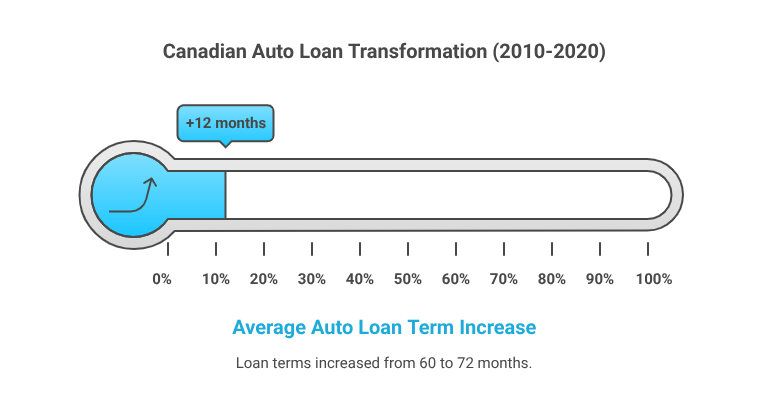

Over the past decade, Canadian auto loans have undergone a significant transformation. Between 2010 and 2015, the average auto loan term hovered around 60 months. By 2020, it had extended to 72 months for new vehicles, with many used-car loans also stretching longer than 60 months.

This trend has been driven by several factors:

- Rising vehicle prices: New car prices have increased steadily due to inflation, supply chain challenges, and technology enhancements.

- Low-interest environment: During the pandemic, historically low rates encouraged longer loans with smaller monthly payments.

- Subprime lending growth: Financial institutions increasingly offered loans to borrowers with lower credit scores, contributing to higher default risk.

The result is that a growing share of Canadians owe more on their vehicles than the cars are worth, leading to a negative equity crisis.

Negative Equity on the Rise

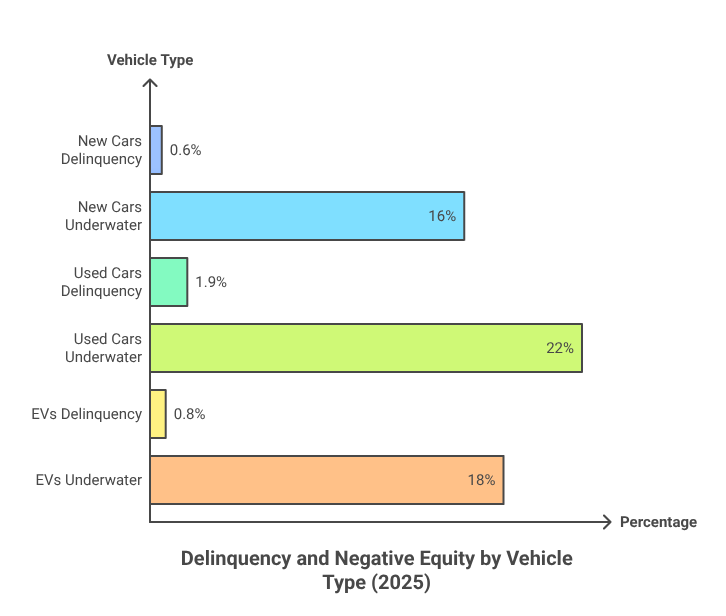

According to the Canadian Auto Finance Association (CAFA), the 60-day delinquency rate for used vehicle loans reached 1.9% in Q1 2025, up from 1.8% in 2024. New vehicle loans fared slightly better at 0.6%, but the upward trend is clear.

Negative equity, where borrowers owe more than the market value of their vehicles, has become a growing concern.

Delinquency and Negative Equity by Vehicle Type (2025)

| Vehicle Type | Average Loan Term (Months) | Average Interest Rate (%) | 60-Day Delinquency Rate (%) | % of Loans Underwater |

|---|---|---|---|---|

| New Cars | 72 | 7.5 | 0.6 | 16% |

| Used Cars | 60 | 9.0 | 1.9 | 22% |

| EVs | 72 | 6.5 | 0.8 | 18% |

Source: Canadian Auto Finance Association, Q1 2025

Analysts note that longer loan terms combined with rising interest rates create a cycle where borrowers struggle to build equity, further increasing financial vulnerability.

The Role of the EV Transition

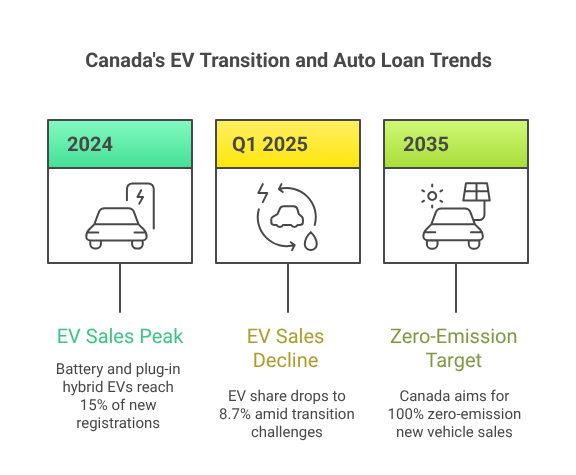

Canada has committed to a 100% zero-emission target for new vehicle sales by 2035. While this goal aligns with climate objectives, the transition has complicated the auto loan landscape. In Q1 2025, battery and plug-in hybrid EVs comprised only 8.7% of new registrations, down from 15% in 2024.

Several challenges are slowing EV adoption:

- High upfront costs: Despite long-term fuel and maintenance savings, EVs remain significantly more expensive than conventional vehicles.

- Limited charging infrastructure: Rural regions, in particular, have inadequate charging networks, creating consumer hesitation.

- Consumer uncertainty: Questions around battery lifespan, technology upgrades, and resale value reduce willingness to invest in EVs.

These factors contribute indirectly to negative equity, as EVs often require higher loan amounts, and uncertain resale values can leave borrowers underwater.

Regional and Demographic Disparities

Negative equity is not uniform across Canada. Urban centers and provinces with higher vehicle costs are disproportionately affected.

Regional Distribution of Auto Loans Underwater (2025)

| Province | % of Auto Loans Underwater | Average Loan Term (Months) | Average Monthly Payment ($) |

|---|---|---|---|

| Ontario | 19% | 72 | 650 |

| Quebec | 17% | 70 | 620 |

| British Columbia | 22% | 73 | 680 |

| Alberta | 15% | 68 | 600 |

| Other Provinces | 16% | 70 | 610 |

Younger Canadians (ages 25–34) are particularly affected, often taking longer loans for new and used vehicles, including EVs, and facing higher negative equity risk due to depreciation and loan structures.

International Comparison: Canada vs Other Nations

While Canada struggles with underwater loans, similar trends are observable in other countries. The United States reports approximately 18% of auto loans underwater, while in Germany, longer loan terms and high EV adoption mitigate but do not eliminate negative equity concerns.

The key differentiator is EV policy: countries with generous subsidies and robust charging infrastructure experience fewer negative equity issues because buyers are less concerned about depreciation.

Economic Implications

The rise in underwater auto loans has broader economic consequences:

- Consumer Spending Decline: Canadians allocating a large share of income to auto payments have reduced spending power for other goods and services.

- Financial Sector Risk: Banks and credit unions face increasing exposure to delinquent loans.

- Automotive Industry Slowdown: Fewer new vehicle sales impact manufacturers, dealerships, and associated employment.

- Macro-Economic Effects: Prolonged negative equity may contribute to slower GDP growth, particularly if auto sales decline further.

Expert Perspectives

An auto finance expert notes:

“If negative equity continues to rise, it could limit consumer mobility and reduce overall vehicle turnover. Policy adjustments are crucial to prevent prolonged financial stress among Canadians.”

An industry expert adds:

“Flexible loan structures and targeted EV incentives are critical. Without them, many Canadians could face extended debt periods and a higher risk of default.”

An economist observes:

“The interplay of rising interest rates, higher vehicle prices, and EV policy is creating an environment where Canadians are increasingly financially stretched. Policymakers need to strike a balance between environmental goals and economic feasibility.”

Government and Industry Responses

Authorities and industry stakeholders have initiated several measures to alleviate the crisis:

- Loan Restructuring Programs: Financial institutions are offering options to extend or refinance loans at lower interest rates.

- EV Incentives and Rebates: Federal and provincial programs aim to reduce upfront EV costs for consumers.

- Charging Infrastructure Expansion: Investment in public charging stations is underway, particularly in rural regions.

- Consumer Education Campaigns: Awareness programs promote long-term savings and the environmental benefits of EVs.

- Resale Value Support: Automakers and finance companies explore guaranteed buyback or trade-in programs to stabilize EV resale values.

Societal Impacts

Beyond finances, underwater loans affect Canadian society:

- Delayed Life Decisions: Many young Canadians postpone homeownership, family planning, and education due to auto debt.

- Transportation Limitations: Those underwater on loans may be unable to upgrade vehicles, limiting mobility.

- Stress and Well-being: Financial stress contributes to mental health concerns, affecting overall productivity.

Future Outlook

Analysts forecast that if current trends continue, negative equity could affect one in four Canadians by 2030. Without policy adjustments, the EV transition may inadvertently exacerbate financial strain.

Potential scenarios include:

- Best-case: Expanded subsidies and loan restructuring stabilize the market; negative equity rates plateau around 20%.

- Moderate-case: EV adoption gradually improves, but negative equity persists, with regional disparities worsening.

- Worst-case: Rising interest rates and high EV costs increase underwater loans to 25–30%, impacting the broader economy.

Canada’s auto loan crisis highlights the delicate balance between environmental objectives and economic realities. While the EV transition is essential for sustainability, policymakers must address its unintended consequences on consumers’ financial health.

Coordinated efforts between government agencies, automakers, and financial institutions—through incentives, infrastructure development, and flexible financing—will be critical to ensure that Canadians can participate in the EV revolution without being burdened by prolonged debt.