Life After Debt: How to Plan Your First Debt-Free Vacation

Becoming debt-free is one of the most rewarding milestones in life. It’s not just about financial relief; it’s about reclaiming your freedom, your time, and your ability to dream without limits. After months or even years of budgeting, saving, and making sacrifices, the thought of your first debt-free vacation can feel like a reward you’ve truly earned. But planning this trip isn’t just about booking a flight — it’s about creating a financially smart, memorable experience that honors your hard work.

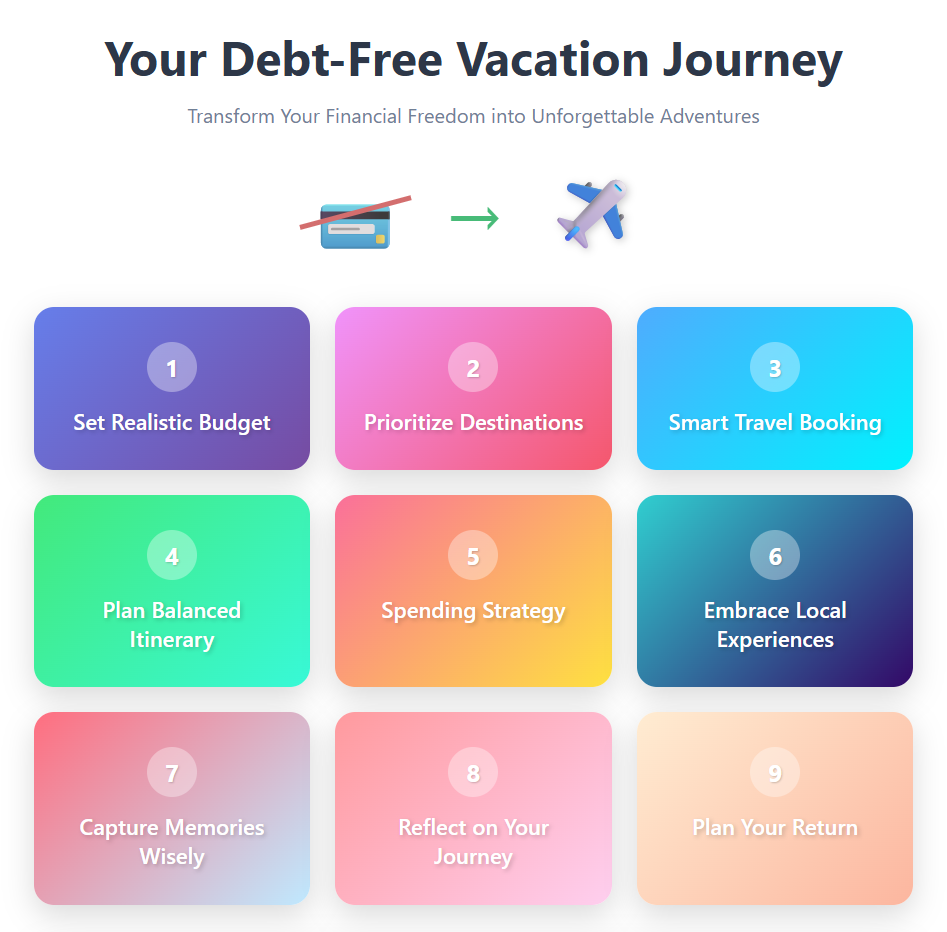

In this guide, we’ll explore practical steps to plan your first debt-free vacation while keeping the excitement high and the financial stress low.

Understanding the Joy of a Debt-Free Vacation

A debt-free vacation is more than a trip; it’s a celebration of your financial discipline. Imagine stepping onto a plane or a train knowing that every expense is fully within your means. There’s no lingering anxiety over credit card balances or pending loans. Instead, you’re free to enjoy the journey — from luxurious spas to local street food, from scenic hikes to cultural experiences — without guilt or financial strain.

This mindset shift transforms your vacation into an empowering experience. You’re not just traveling; you’re embracing financial freedom. And that joy is infectious — friends and family will notice your relaxed demeanor, and your confidence will inspire others to pursue their own debt-free goals.

Step 1: Set a Realistic Vacation Budget

Before dreaming of white sandy beaches or European castles, it’s crucial to define your vacation budget. Even though you’re debt-free, overspending can compromise the sense of financial security you’ve worked hard to achieve.

- Assess your disposable income: Determine how much money you can comfortably allocate without impacting your ongoing savings or emergency fund.

- Include all expenses: Factor in flights, accommodations, food, activities, transportation, souvenirs, and insurance. Hidden costs like airport transfers, local taxes, and tipping can quickly add up.

- Add a safety buffer: It’s wise to set aside an extra 10–15% for unexpected costs.

By setting a clear budget, you gain clarity and control — two essential ingredients for a stress-free, enjoyable vacation.

Step 2: Prioritize Destinations Wisely

Being debt-free doesn’t mean you need to splurge unnecessarily. Choosing the right destination ensures you maximize enjoyment without breaking the bank.

- Consider affordability: Look for countries or cities where your currency goes further. Southeast Asia, parts of Eastern Europe, and select Latin American destinations offer incredible experiences at lower costs.

- Seasonal planning: Traveling off-season can drastically reduce accommodation and flight costs, while also allowing you to enjoy popular attractions with fewer crowds.

- Bucket-list destinations: If your heart is set on a more expensive location, plan carefully, save in advance, and look for deals that align with your budget.

Balancing aspiration with practicality allows you to enjoy a dream vacation without financial regret.

Step 3: Leverage Smart Travel Booking

The way you book your flights, accommodations, and activities can save you hundreds, if not thousands, of dollars.

- Flight deals: Use flight comparison tools, subscribe to airline newsletters, and consider flexible travel dates. Early booking often secures the best prices.

- Accommodation hacks: Consider vacation rentals, boutique hotels, or even hostels with high ratings. Booking platforms often offer discounts or loyalty programs that can further reduce costs.

- Bundle wisely: Some travel packages combine flights, hotels, and activities at lower overall costs. Compare these with individual bookings to find the best value.

Being strategic in your bookings ensures that your debt-free vacation remains a joyful experience rather than a financial strain.

Step 4: Plan a Balanced Itinerary

Part of the joy of a vacation is the experiences you collect. Planning your itinerary in advance helps you make the most of your time while keeping spending in check.

- Mix free and paid activities: Museums, walking tours, hiking trails, and local festivals often cost little to nothing but offer memorable experiences.

- Prioritize must-do experiences: List the top attractions or activities that truly excite you, and plan your budget around them.

- Allow flexibility: Some of the best vacation memories happen spontaneously. Leave room in your schedule for unexpected adventures.

A well-planned itinerary ensures you enjoy every moment without worrying about time or money.

Step 5: Adopt a Vacation Spending Strategy

Even debt-free travellers benefit from a spending strategy. It helps you enjoy luxuries without feeling guilty.

- Daily spending limits: Decide how much you’ll spend each day on meals, entertainment, and souvenirs.

- Use cash or prepaid cards: Limiting digital transactions can help you stick to your budget.

- Track expenses in real-time: Apps and mobile banking alerts can prevent overspending before it happens.

With a spending strategy, you maintain control over your finances while still indulging in experiences that make your trip special.

Step 6: Embrace Local Experiences

One of the most enriching aspects of travel is immersing yourself in local culture. These experiences are often affordable and provide memories that far outlast material souvenirs.

- Eat like a local: Street food, markets, and family-run restaurants often offer authentic dishes at lower prices than tourist hotspots.

- Learn local customs: Participate in cultural festivals, workshops, or community events to connect deeply with your destination.

- Opt for sustainable choices: Local transportation, eco-friendly activities, and responsible tourism practices enhance your experience while supporting the local community.

These choices make your vacation not just debt-free but also meaningful.

Step 7: Capture Memories Without Overspending

Souvenirs and photos help preserve memories, but overspending on keepsakes can undercut your debt-free milestone.

- Take photos strategically: Modern smartphones offer incredible quality, so capture memories without needing professional services.

- Collect meaningful souvenirs: Choose items that have personal significance or that you can use daily.

- Journal or blog your experience: Recording your journey provides lasting memories without costing a fortune.

These habits allow you to relive your trip without adding unnecessary financial burden.

Step 8: Reflect on Your Debt-Free Journey

Your first debt-free vacation isn’t just a getaway — it’s a celebration of your financial discipline. Take time to reflect:

- Celebrate milestones: Appreciate how far you’ve come, whether it was paying off credit cards, clearing student loans, or eliminating personal debts.

- Inspire future goals: Use this trip as motivation to continue your financial journey, whether it’s investing, saving, or planning your next adventure.

- Share your story: Encourage friends or family who might be struggling with debt to see what’s possible with determination and planning.

Reflection transforms your vacation into a meaningful life event, reinforcing the benefits of being debt-free.

Step 9: Plan Your Return Strategically

Coming home from a vacation can sometimes trigger financial oversights. Protect your debt-free status with a post-trip plan:

- Resume budgeting immediately: Reintegrate your savings and expenses tracking to avoid slipping back into old habits.

- Review your spending: Analyze what worked and what didn’t during the trip for future vacations.

- Set new financial goals: Use the momentum of your debt-free trip to plan your next adventure or financial milestone.

By staying organized, you ensure that your vacation enhances your financial freedom rather than compromising it.

Celebrate Financial Freedom Wisely

Your first debt-free vacation is a milestone worth celebrating. But the real joy comes from doing so responsibly — experiencing new places, meeting new people, and creating memories without financial anxiety.

Whether you’re wandering through European streets, hiking tropical trails, or simply relaxing on a quiet beach, remember that this trip is a reward for your discipline and patience. Every penny spent wisely reinforces the power of being debt-free.

Celebrate financial freedom wisely — Check out affordable Flight deals Today and start planning a vacation that honors your journey. The world is waiting, and so are the memories you’re about to create.