Is It Safe to Pay Bills Online Without a VPN?

In today’s world, online bill payments have become second nature. Whether you’re settling your electricity bill, paying rent, or clearing your phone dues, it’s fast, easy, and available 24/7. But here’s the big question many people overlook — is it really safe to pay bills online without using a VPN?

Most people assume that because a website has a padlock icon (HTTPS), their transaction is secure. However, that’s only part of the story. When you pay bills online without extra protection, your personal and financial data could still be at risk — especially on unsecured networks.

Let’s break down what happens behind the scenes, what dangers exist, and how a VPN (Virtual Private Network) adds a much-needed shield to your online payments.

The Convenience of Online Bill Payments — and the Hidden Risks

There’s no denying how convenient online bill payments are. You don’t have to stand in long queues or wait for business hours. A few clicks, and it’s done. But convenience often comes with hidden risks — especially when you’re entering sensitive information like credit card numbers, bank account details, or personal identification data.

When you pay bills online without a VPN, your device directly connects to your internet service provider (ISP), which in turn connects to the biller’s website or app. During this process, your data travels through several servers — and each of these points could be an opportunity for cybercriminals to snoop, intercept, or steal your data.

Common Scenarios Where You’re Most at Risk

- Using public Wi-Fi: Cafes, airports, and hotels often have unsecured Wi-Fi networks that make it easy for hackers to spy on users.

- Phishing or fake websites: Cybercriminals create realistic copies of utility or telecom websites to steal your login and card details.

- Malware-infected devices: Even if your connection is secure, compromised devices can leak sensitive information.

- Unencrypted connections: Not every payment gateway uses end-to-end encryption — leaving data vulnerable during transmission.

In short, even a simple electricity bill payment can expose you to potential risks if you’re not careful.

How Hackers Exploit Unprotected Connections

Hackers and cybercriminals are always looking for easy targets — and unsecured internet connections are exactly that. Without a VPN, your IP address, location, and online activity are visible to anyone with the right tools.

1. Data Interception

When you make an online payment without encryption, hackers can intercept your traffic using techniques like “man-in-the-middle” (MITM) attacks. This allows them to see your login credentials, bank details, and card numbers.

2. Identity Theft

Cybercriminals can collect personal data from multiple transactions and use it to create fake identities or gain access to your financial accounts. Even something as small as your name and billing address can be valuable to identity thieves.

3. Device Tracking and Profiling

Without a VPN, your IP address is like a digital fingerprint. Companies and malicious actors can use it to track your online habits, build profiles, and even target you with scams or fraudulent offers.

4. Fake Payment Portals

When your device isn’t protected, you’re more likely to fall for phishing traps or get redirected to fake payment pages that look almost identical to legitimate ones. Once you enter your details, the data goes straight to hackers.

These risks highlight why relying on “secure” websites alone is not enough. You need a second layer of protection — that’s where a VPN comes in.

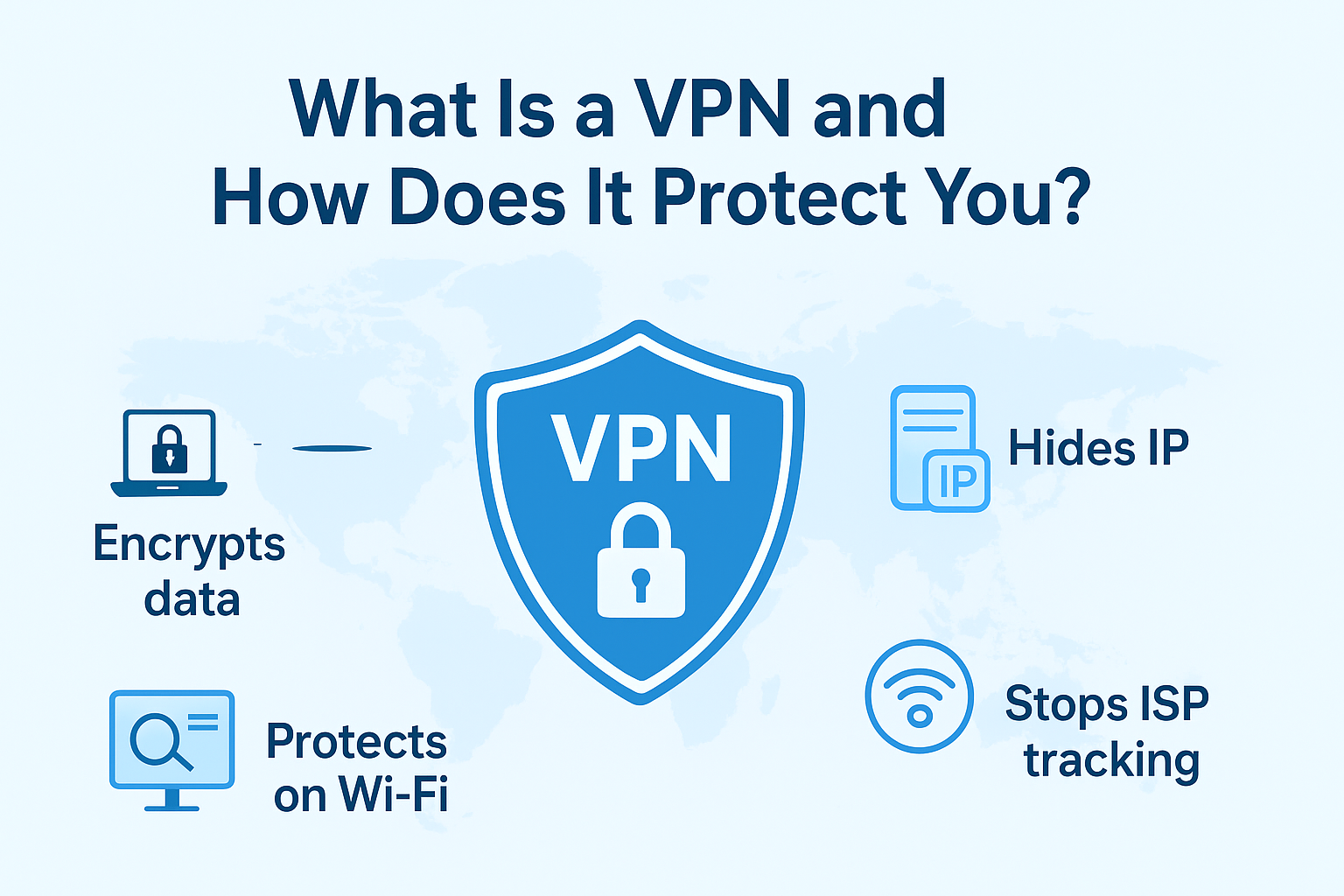

What Is a VPN and How Does It Protect You?

A VPN (Virtual Private Network) is a tool that encrypts your internet connection and hides your IP address. It routes your online activity through a secure server, making it nearly impossible for anyone — hackers, ISPs, or even public Wi-Fi administrators — to see what you’re doing.

When you use a VPN for online payments, your sensitive information gets wrapped in layers of encryption. Even if someone tries to intercept your data, all they’ll see is scrambled, unreadable code.

How a VPN Helps During Online Bill Payments

- Encrypts all your data: Ensures your banking and payment details remain private.

- Masks your IP address: Prevents websites or attackers from tracing your location or device.

- Protects you on public Wi-Fi: Keeps your connection secure even on free or open networks.

- Blocks malicious sites: Many VPNs have built-in features that warn you if a site is unsafe.

- Avoids ISP tracking: Your Internet Service Provider cannot monitor or log your transactions.

In essence, a VPN acts as an invisible security blanket between you and the internet.

The Real-World Impact: Why VPNs Matter More Than You Think

Imagine this scenario: You’re at a café, using the free Wi-Fi to quickly pay your internet bill. Within seconds of entering your card details, a hacker connected to the same network captures your payment data. You don’t realize anything’s wrong — until you see unauthorized charges on your credit card later.

Now imagine the same situation — but this time, you’re connected through a VPN. Your data is fully encrypted, and even though you’re using public Wi-Fi, hackers can’t read or access your payment details. That’s the difference between being vulnerable and being secure.

VPNs aren’t just for tech-savvy users. They’re for anyone who values privacy, security, and peace of mind.

Online Bill Payments Without a VPN: What Could Go Wrong

Let’s summarize some of the common issues people face when paying bills online without VPN protection:

| Risk | Description |

|---|---|

| Data Theft | Hackers intercept payment details and personal info. |

| Identity Fraud | Stolen data is used to open fake accounts or apply for credit. |

| ISP Tracking | Your ISP can see which websites you access and may store this data. |

| Phishing Attacks | Unprotected users are more easily targeted with fake links and sites. |

| Public Wi-Fi Dangers | Free networks can be traps for cybercriminals to steal data. |

The bottom line — you’re putting your financial safety at risk when you pay bills online without adequate protection.

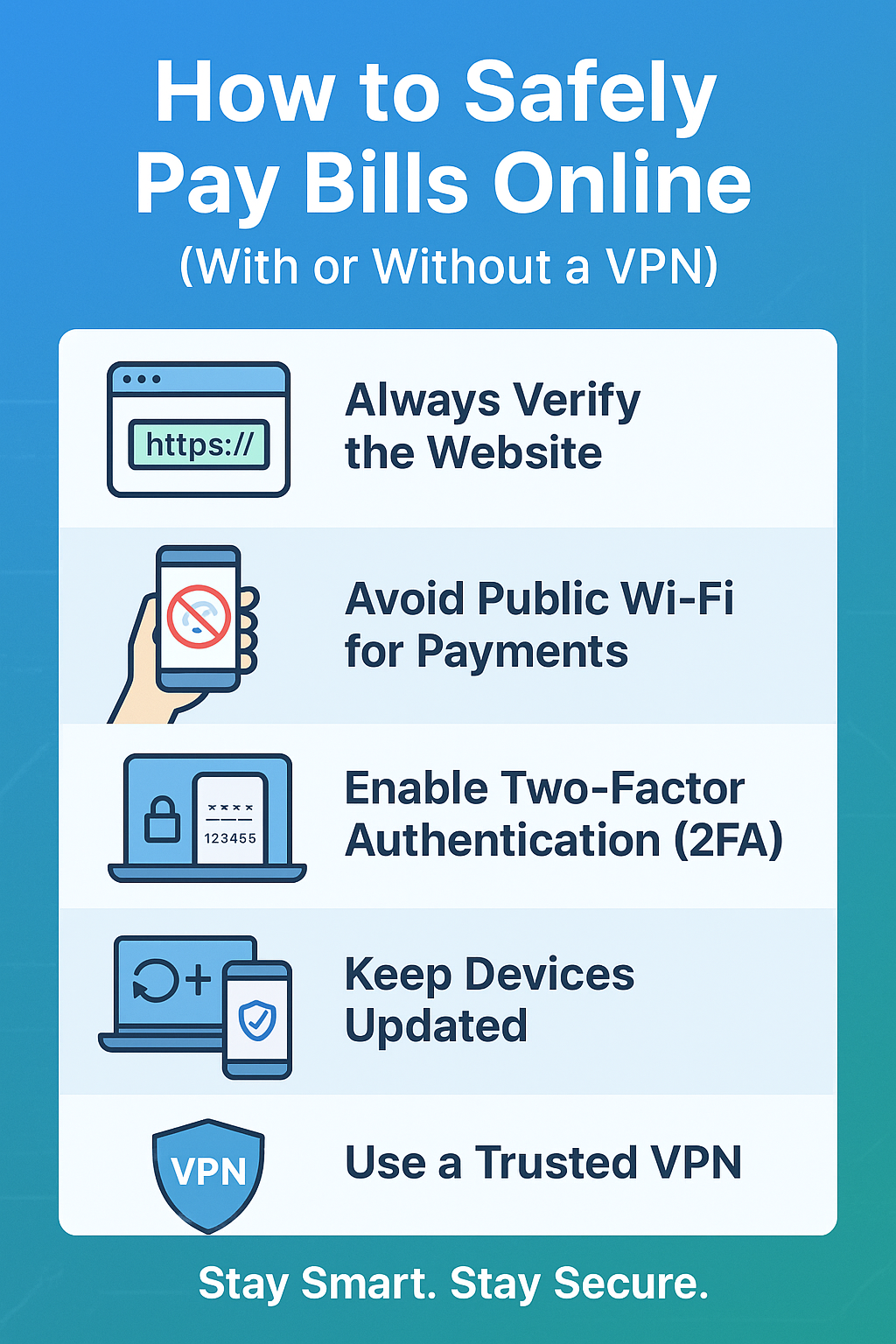

How to Safely Pay Bills Online (With or Without a VPN)

While using a VPN is strongly recommended, there are additional safety habits you should follow to minimize risk.

1. Always Verify the Website

Before entering payment details, double-check the URL. Make sure it starts with https:// and matches the official domain of your service provider.

2. Avoid Public Wi-Fi for Payments

If you must pay bills on the go, use your mobile data or connect through a VPN. Public Wi-Fi networks are the easiest targets for hackers.

3. Enable Two-Factor Authentication (2FA)

Add an extra layer of security to your accounts. Even if someone steals your password, they won’t be able to log in without the second verification code.

4. Keep Devices Updated

Always keep your phone, laptop, and browser updated to the latest versions. Updates patch known vulnerabilities that hackers often exploit.

5. Use a Trusted VPN

Not all VPNs are created equal. Free VPNs may log your data or slow down your connection. Choose a reliable one like NordVPN that offers strong encryption, no-log policies, and dedicated security features.

Why NordVPN Stands Out for Online Payments

When it comes to safe online payments, NordVPN is one of the most trusted names in digital privacy. It combines advanced encryption with an easy-to-use interface that works across all devices — from laptops to smartphones.

Here’s what makes NordVPN a great choice for secure bill payments:

- Next-gen encryption: Protects your financial data from all forms of interception.

- Threat Protection: Automatically blocks malicious websites and trackers.

- No-logs policy: Ensures your activity and payment data are never stored.

- Kill switch: Instantly disconnects your internet if the VPN connection drops.

- Ultra-fast servers: Pay bills securely without lag or interruptions.

Whether you’re at home or traveling, NordVPN keeps your online transactions private and protected.

Final Thoughts

Paying bills online without a VPN might seem harmless — until something goes wrong. The truth is, your personal and financial information is valuable, and cybercriminals are constantly finding new ways to exploit weak connections.

You wouldn’t hand your credit card to a stranger — so why leave your data exposed online?

With a VPN like NordVPN, your online payments become private, secure, and stress-free. It’s a simple, affordable step that safeguards your money and your peace of mind.

✅ Use VPN for Secure Bill Payments

Protect your financial data and enjoy worry-free online payments — anytime, anywhere.