Credit Card Creep: Why Small Balances Turn into Big Problems?

A small swipe here, a quick purchase there—credit cards feel incredibly convenient until the balance starts creeping up faster than expected. What begins as a harmless ₹2,000 or $50 purchase can grow into months of payments, rising interest, and a cycle of stress that many consumers struggle to break. Credit card creep isn’t about overspending on luxury items; most people fall into debt because of groceries, fuel, medical bills, or unexpected emergencies. Small balances quietly build up, and before long, repayment feels overwhelming.

For everyday consumers, understanding how credit card debt grows—and how to stop it—can make the difference between manageable finances and long-term delinquency. This guide breaks down why credit card creep happens, how interest magnifies even tiny balances, and what practical steps you can take to regain control.

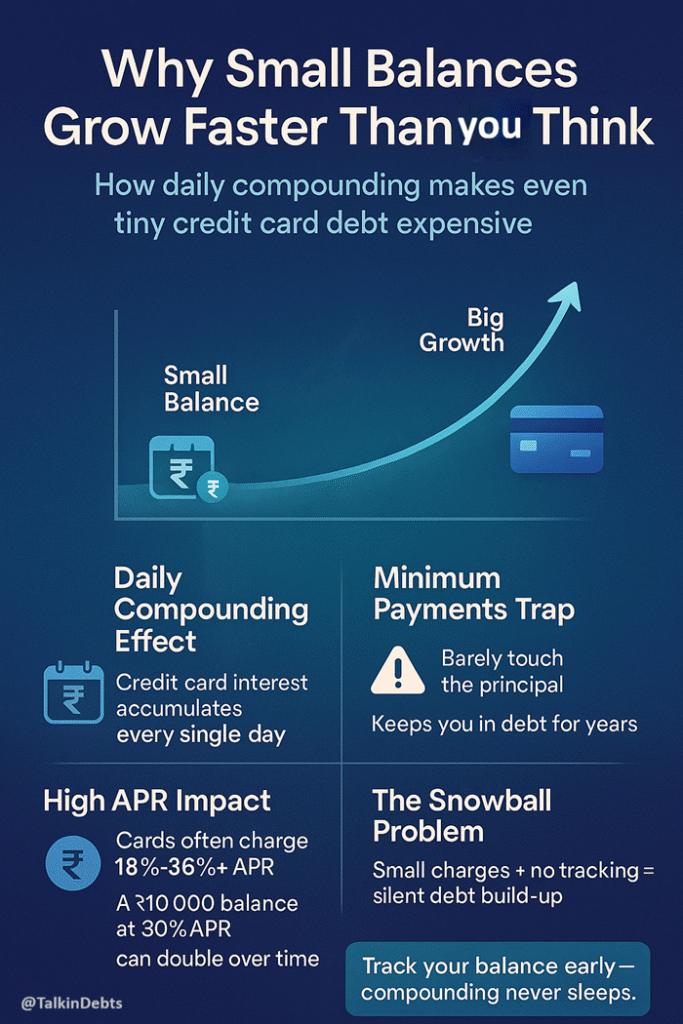

Why Small Balances Grow Faster Than You Think

Credit cards come with convenience, rewards, and flexibility, but they also carry one of the highest forms of consumer interest. Even a small revolving balance becomes expensive when the Annual Percentage Rate (APR) ranges from 18% to 36% or more.

The problem starts when people underestimate how interest is calculated. Unlike a loan with fixed payments, credit card interest compounds daily. This means:

- Even small unpaid balances accumulate interest every single day.

- The longer you carry a balance, the more the interest compounds.

- Minimum payments barely reduce the principal, keeping you in debt longer.

A ₹10,000 balance at 30% APR, if only minimum payments are made, can take years to clear—and you may end up paying double the original amount.

Credit card creep doesn’t come from a single big mistake. It comes from several small charges that snowball quietly, especially when you are not tracking spending or when unexpected expenses force you to revolve your balance.

The Psychology Behind Credit Card Creep

Many consumers don’t realize how behavioural habits influence debt growth. Credit cards create a disconnect between spending and the pain of payment. Cash leaves your hand immediately—but with a card, the impact comes later.

Some of the most common psychological triggers include:

1. “I’ll Pay It Off Next Month” Mentality

This mindset makes small purchases feel harmless. But life often brings surprises—car repairs, medical visits, family needs—making it difficult to clear the previous month’s balance.

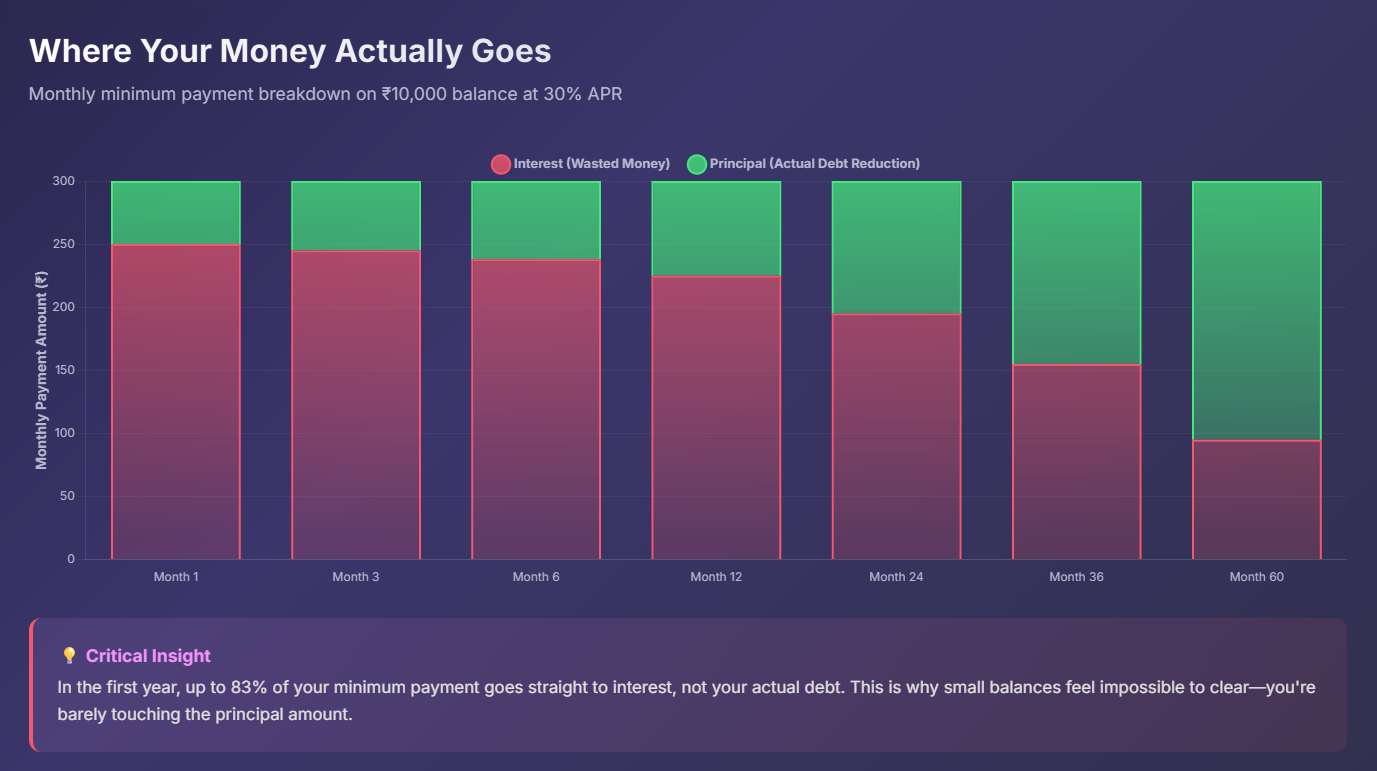

2. The Minimum Payment Trap

Credit card companies highlight minimum payments because they profit when you pay less upfront. But minimum payments keep consumers indebted far longer.

3. Overspending on Small Transactions

Coffee, food delivery, quick gadgets, subscriptions—individually small, but collectively huge over time.

4. Rewards Illusion

People tend to overspend when chasing cashback or reward points, believing they are saving when they’re actually spending more than needed.

Understanding these patterns helps you become more intentional with credit card use.

How High Interest Turns a Small Balance into a Big Problem

Interest is the silent engine behind credit card creep. When interest rates are high, even disciplined consumers can struggle.

Imagine:

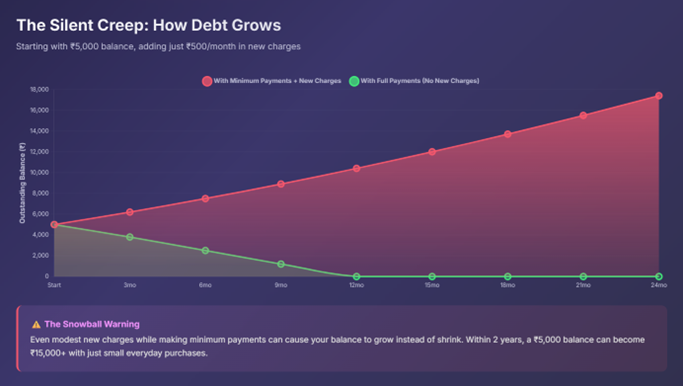

- You carry a small balance of ₹5,000 or $75.

- You make only the minimum payment each month.

- Your card has an APR of 28%.

Within a year, you could still owe close to the original amount—even after paying every month—because most of your payment went toward interest instead of the actual balance.

Daily Compounding Makes the Debt Grow Faster

Most cards calculate interest using Average Daily Balance, meaning every rupee or dollar you leave unpaid accumulates interest every day. If you’re revolving balances on multiple cards, the debt multiplies even faster.

Late Fees Accelerate the Creep

When payment deadlines are missed:

- Late fees are added

- Interest rate may increase

- Credit score can drop

- Minimum payment amounts rise

This combination increases both financial and emotional pressure.

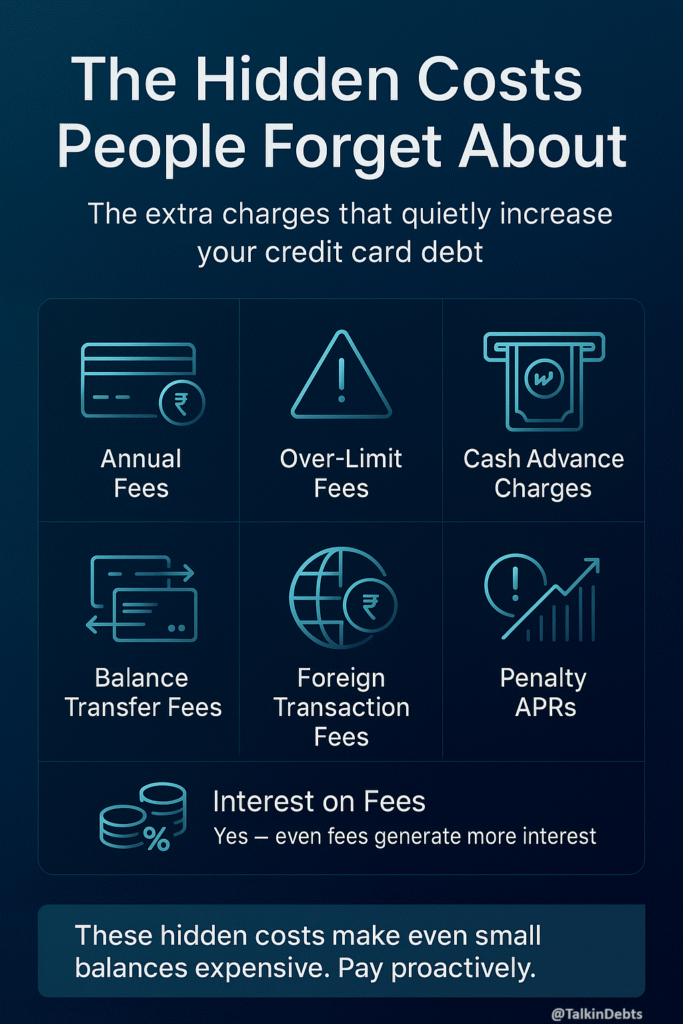

The Hidden Costs People Forget About

Along with interest, consumers often overlook the additional charges that quietly increase credit card debt:

- Annual fees

- Over-limit fees

- Cash advance charges

- Balance transfer fees

- Foreign transaction fees

- Penalty APRs

- Interest on fees (yes, fees also accrue interest)

These hidden costs make even a low balance surprisingly expensive. That’s why proactive repayment is essential.

Warning Signs That Credit Card Creep Has Already Started

Many people don’t realize they’re slipping into unhealthy credit card habits until they’re already struggling. Early warning signs include:

- You’re only able to make minimum payments.

- Your credit utilization is above 30%.

- You are using credit cards to cover basic living expenses.

- You continuously shift balances between cards.

- You check your balance less often to avoid stress.

- You’re maxing out cards more frequently.

Catching these warning signs early allows you to take corrective action before debt becomes unmanageable.

Practical Ways to Stop Small Balances from Growing

Managing credit card debt does not require complex strategies. A few simple habits can reverse credit card creep quickly.

1. Pay More Than the Minimum—Even a Little Helps

Paying just 10–20% more than the minimum each month reduces both interest and repayment time dramatically.

2. Follow the 24-Hour Spending Rule

Before making a non-essential purchase, give yourself 24 hours to decide. This reduces impulse spending.

3. Prioritize High-Interest Cards First

If you have multiple cards, pay down the highest-interest card first (Avalanche Method). This saves the most money.

4. Set a Fixed Monthly Budget for Card Payments

Instead of paying whatever is due, set a higher fixed amount you commit to every month.

5. Avoid Cash Advances Completely

Cash advances come with immediate fees and higher interest from day one.

6. Automate Your Payments

Automatic payments prevent late fees and protect your credit score.

7. Track Your Spending Weekly

Reviewing transactions weekly helps you catch unnecessary expenses and stay in control.

8. Freeze Your Card Temporarily

Most modern apps allow you to “lock” the card. This stops impulse purchases without cancelling the card.

Smart Strategies to Reduce Existing Credit Card Debt

If you are already carrying a balance, the right repayment strategy can bring relief quickly.

1. Snowball Method (Motivation-Focused)

Pay off the smallest balance first for quick wins.

2. Avalanche Method (Interest-Focused)

Target the highest-interest card to save money.

3. Balance Transfer Cards

0% APR promotional offers can help, but only if you have a clear repayment plan.

4. Negotiating a Lower Interest Rate

Many issuers reduce interest when requested—especially for long-standing customers.

5. Debt Consolidation Loans

A single, lower-interest loan can replace multiple high-interest cards.

6. Cut Unnecessary Subscriptions

Subscriptions quietly contribute to debt creep. Clearing them frees up money for repayment.

Using one or more of these strategies can significantly reduce repayment stress.

How Credit Card Creep Impacts Your Credit Score

A growing balance doesn’t just affect your wallet—it affects your financial future.

1. High Utilization Lowers Credit Score

If your card is consistently above 30% of its limit, your score can drop significantly.

2. Late Payments Hurt the Most

Even one missed payment can stay on your credit report for years.

3. Paying Down Debt Improves Your Score Quickly

Reducing utilization and paying on time can increase your score within months.

A strong credit score opens doors: lower interest loans, better credit cards, and improved financial flexibility.

Building Healthy Credit Habits for the Future

Avoiding credit card creep isn’t just about eliminating debt—it’s about building sustainable financial habits.

Some long-term practices include:

- Always pay your full statement balance when possible.

- Review your credit report every year.

- Keeping old credit accounts open to improve credit age.

- Using credit cards like a debit card and tracking every expense.

- Maintaining an emergency fund to avoid relying on credit in crises.

These habits protect your financial health and prevent debt from returning.

Why Managing Credit Card Debt Matters More Than Ever

The cost of living is rising globally, and many households now rely on credit cards just to manage basic expenses. As interest rates remain high, credit card debt grows faster and becomes heavier than in previous years.

Managing credit card creep is no longer optional—it’s a necessary step toward financial security. A small balance today can easily become a long-term burden if ignored, but the good news is that early action can stop the cycle.

Understanding how credit card debt grows, recognizing warning signs, and developing disciplined spending habits can help you stay in control. With the right strategies, even consumers with financial stress can break free from revolving debt and build stronger financial resilience.

Staying mindful of your spending, interest rates, and repayment plans empowers you to use credit as a tool—not a trap.