Europe Tightens Rules on BNPL and Consumer Credit Transparency

European regulators have rolled out a comprehensive tightening of rules governing Buy Now, Pay Later (BNPL) services and consumer credit transparency, introducing one of the most extensive overhauls in the region’s retail finance framework. The new measures aim to bring greater oversight to short-term credit providers, strengthen protections for consumers, and address concerns about rising reliance on instalment-based borrowing across online retail markets.

The updated regulatory framework expands the European Union’s consumer credit directive to cover a wider range of products, including interest-free BNPL services that have grown significantly across e-commerce platforms. Regulators say the changes are designed to close long-standing loopholes, reduce the risk of hidden debt accumulation, and ensure consistent standards across traditional lenders and emerging digital credit providers.

Analysts tracking the sector say the shift reflects mounting pressure from consumer advocacy groups and financial stability authorities, who argue that rapid growth in BNPL usage—especially among young and low-income consumers—has increased exposure to repayment risks that are currently under-regulated.

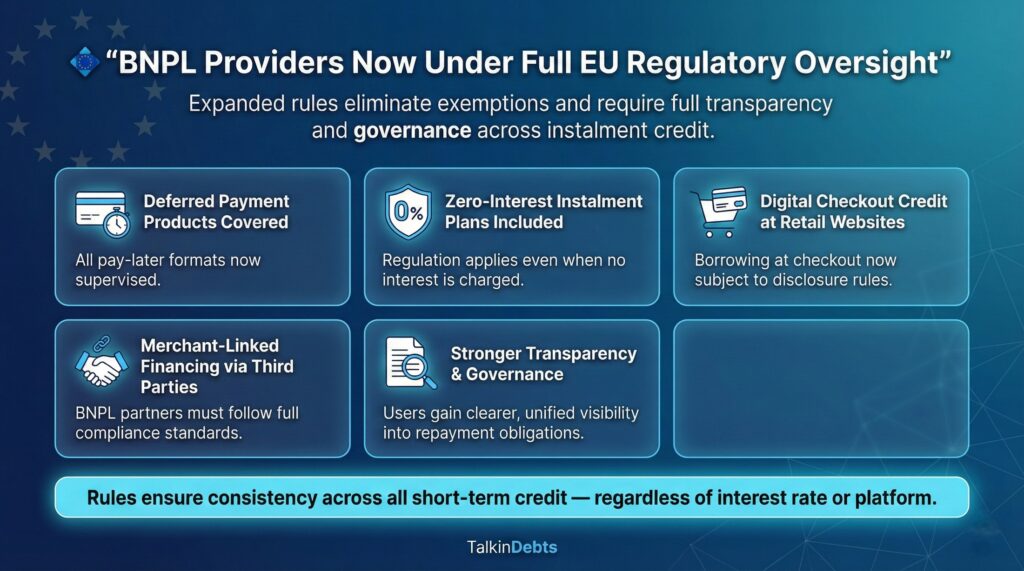

Regulators Expand Oversight to Previously Exempt BNPL Providers

BNPL firms have traditionally operated outside the scope of full consumer credit rules because many of their products are interest-free and fall below value thresholds that trigger regulation. The updated EU rules eliminate these exemptions, bringing all instalment-based credit products under formal supervision.

Regulators say the proliferation of “checkout credit” products on retail websites has led to complex borrowing patterns, making it difficult for consumers to track outstanding instalments across multiple platforms. The changes ensure that BNPL operators must meet the same transparency and governance requirements as more established financial institutions.

The expanded rulebook covers:

- Deferred payment products

- Zero-interest instalment plans

- Small-ticket digital credit offered at online checkout

- Merchant-linked financing provided through third-party platforms

Officials argue that these reforms are intended to ensure consistency across all forms of short-term credit, regardless of interest structure or merchant involvement.

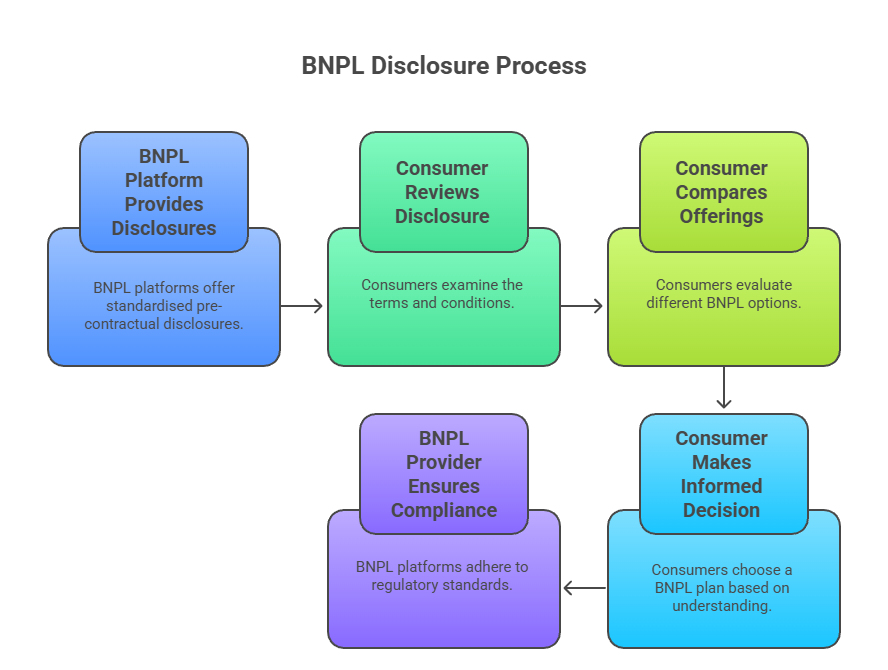

Mandatory Standardised Disclosures to Improve Consumer Understanding

A central component of the new regulations is the introduction of standardised pre-contractual disclosures. BNPL platforms must provide clear, uniform information about repayment terms, fees, penalties, and the consequences of missed payments. The focus is on ensuring that consumers can easily compare offerings between different credit providers.

Under the new framework, BNPL providers must include:

- A clear repayment calendar

- Full visibility into late fees and penalty structures

- Total cost of credit, even if interest-free

- Warnings about potential negative impacts on credit histories

- Immediate access to key terms at checkout

Regulators say the aim is to reduce the risk of consumers entering instalment agreements without understanding the terms or the effect of multiple simultaneous BNPL commitments. Consumer watchdog groups have repeatedly raised concerns about the opaque presentation of repayment obligations in online shopping environments.

Industry analysts note that these requirements align with transparency standards already applied to banks and credit card issuers.

Stricter Affordability Checks Become Mandatory

One of the most significant changes is the requirement for BNPL firms to conduct affordability assessments before granting credit. This is the first time many BNPL platforms will be legally required to perform comprehensive creditworthiness checks, similar to those performed by traditional lenders.

The checks must include:

- Verification of income

- Assessment of existing liabilities

- Evaluation of repayment history

- Review of outstanding BNPL commitments across platforms

Regulators argue that these assessments are essential to prevent over-lending and protect vulnerable consumers from high-risk borrowing. Studies by consumer protection groups show that many BNPL users accumulate multiple instalment plans simultaneously without visibility into their total obligations.

Industry observers expect affordability requirements to reshape approval criteria across BNPL platforms, potentially reducing the number of high-risk loans issued.

New Restrictions on Marketing and Advertising Practices

The regulatory update introduces strict controls on how BNPL products may be advertised. Providers are prohibited from using marketing language that encourages excessive borrowing or frames instalment credit as a lifestyle enhancement without disclosing repayment risks.

Examples of banned advertising claims include:

- “Zero-risk shopping”

- “Instant approval with no checks”

- “Upgrade your lifestyle with flexible payments.”

Platforms must also avoid presenting BNPL as a budgeting tool unless repayment obligations and potential fees are clearly stated.

Authorities say the tightening of advertising rules aims to curb aggressive promotional tactics that have become common on social media platforms and e-commerce sites.

Harmonised Rules Across EU Member States

The new framework introduces EU-wide harmonisation, ensuring that BNPL and short-term credit products are governed consistently across all member states. Previously, varying national laws allowed some providers to operate under different standards depending on jurisdiction.

Legal specialists say the harmonisation will reduce regulatory arbitrage—where companies locate operations in countries with looser rules—and strengthen consumer protections across borders. It will also simplify compliance for BNPL firms operating in multiple European markets, though some may face higher operational costs during the transition.

Increased Operational and Compliance Costs for Providers

BNPL operators are preparing for increased compliance costs as they adjust to the new regulatory obligations. Requirements for data verification, affordability checks, and standardised disclosures are expected to raise operational expenses, particularly for smaller or newer platforms.

Industry analysts say established BNPL firms with existing risk assessment systems may adapt more smoothly, while smaller providers could face challenges related to compliance infrastructure, cross-border reporting requirements, and IT system upgrades.

Some firms may introduce fees or tighten approval criteria to offset these costs, while others could exit markets where compliance expenses outweigh profitability.

Expected Impact on E-Commerce and Retail Partners

The tightening of rules may also influence merchants who rely on BNPL to drive online sales. E-commerce platforms have widely adopted BNPL to reduce cart abandonment and promote higher-value purchases.

Retailers may experience:

- Slightly lower BNPL usage due to new affordability checks

- Longer processing times for approvals

- Higher compliance-related costs are passed down from BNPL partners

- Adjusted eligibility criteria for shoppers

However, experts say the retail sector is likely to adapt quickly, given the continued consumer demand for flexible payment options. Many merchants may diversify available payment choices to reduce dependency on any single BNPL partner.

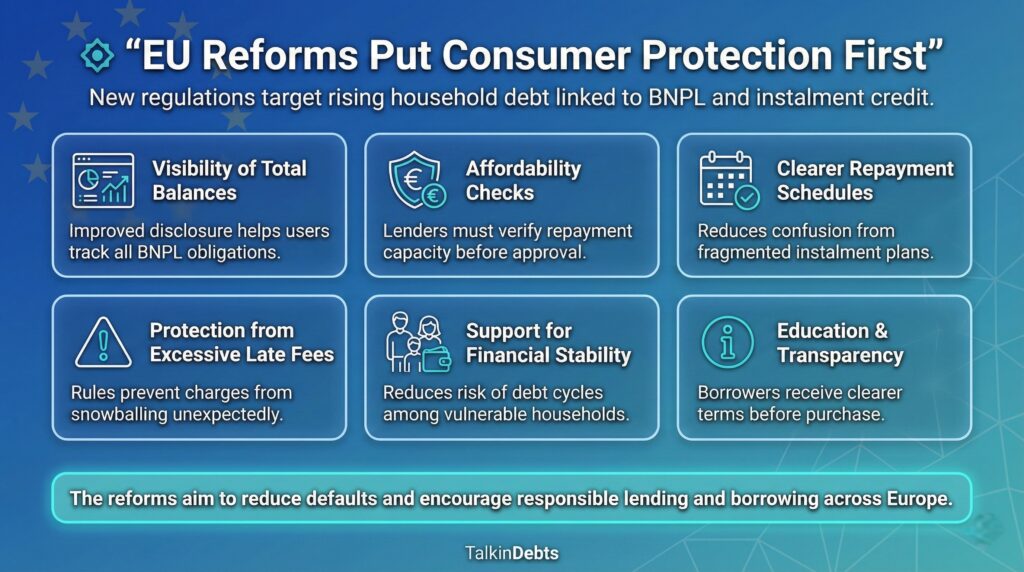

Consumer Protection at the Centre of the Reform

Regulators say the updated rules respond directly to concerns about rising household debt linked to small-ticket credit products. Recent surveys by consumer groups show that a growing share of BNPL users miss repayments, incur late fees, or juggle multiple instalment obligations without proper financial planning.

Common issues include:

- Lack of visibility into total outstanding BNPL balances

- Over-reliance on instalment credit for essential purchases

- Confusion caused by fragmented repayment schedules

- Late fees are accumulating faster than borrowers anticipate

Authorities argue that improving transparency and requiring affordability checks will reduce default rates and prevent borrowers from entering debt cycles caused by unclear or poorly explained terms.

Industry Response Remains Mixed

BNPL providers have expressed mixed views about the regulatory overhaul. While some firms say the new rules will help build trust and strengthen the legitimacy of the sector, others warn that increased compliance burdens may slow innovation or limit access for consumers who rely on short-term credit for budget management.

Executives at established BNPL platforms argue that stricter rules will eliminate weaker or non-compliant competitors and raise overall industry standards. Smaller firms, however, say the measures may restrict their ability to compete with larger players that already operate under banking-style compliance frameworks.

Market analysts note that consolidation within the BNPL market may accelerate as a result of the regulatory changes.

Focus on Long-Term Consumer Financial Stability

Regulators say the overarching goal of the reforms is to promote long-term financial stability by ensuring that consumers can make informed borrowing decisions. Authorities believe that the combination of transparent disclosures, stricter checks, and responsible advertising will reduce the incidence of hidden debt accumulation.

Financial stability bodies warn that the rapid expansion of BNPL has contributed to a shift in household borrowing patterns, with more consumers relying on instalment credit for everyday expenses. They argue that early intervention through regulatory reform is essential to prevent systemic risk.