BNPL Boom or Debt Doom? The Real Cost of ‘Buy Now, Pay Later’

The rapid rise of Buy Now, Pay Later (BNPL) services has reshaped how consumers shop, borrow, and manage monthly budgets. Apps like Afterpay, Klarna, Affirm, Tabby, and Tamara have turned instant instalment plans into a global phenomenon, especially across the US, UK, and UAE. While BNPL promises convenience and interest-free payments, its true impact on financial stability is far more complex. Beneath the smooth checkout experience lies a growing concern: Are BNPL plans helping consumers stay afloat, or pushing them deeper into hidden debt?

BNPL has become a default payment choice for millions. Younger consumers, in particular, are attracted to the flexibility of spreading payments over weeks or months without traditional credit card scrutiny. But as adoption accelerates, regulators, lenders, and financial experts warn that BNPL may be creating a debt trap disguised as convenience. Understanding the real cost of BNPL is essential for consumers who want to maintain healthy credit and avoid long-term financial risk.

The Psychology Behind the BNPL Boom

BNPL transactions are driven by behavioural triggers that influence how people spend money. Splitting payments makes expensive items feel more affordable, increasing the likelihood of impulse purchases. Studies across the US and UK show that when payments are divided into small instalments, consumers underestimate the final cost. This behaviour is closely tied to the “pain of paying” principle — when payments are delayed, the emotional barrier to spending is significantly reduced.

App notifications, instant approvals, and minimal credit checks create a frictionless experience. This convenience is one of the biggest reasons BNPL has expanded so quickly, but it also encourages users to accumulate multiple instalment plans simultaneously, often without a clear tracking mechanism. The result is a growing number of consumers juggling overlapping payments, leading to financial strain at the end of the month.

How BNPL Affects Credit Scores and Borrowing Power

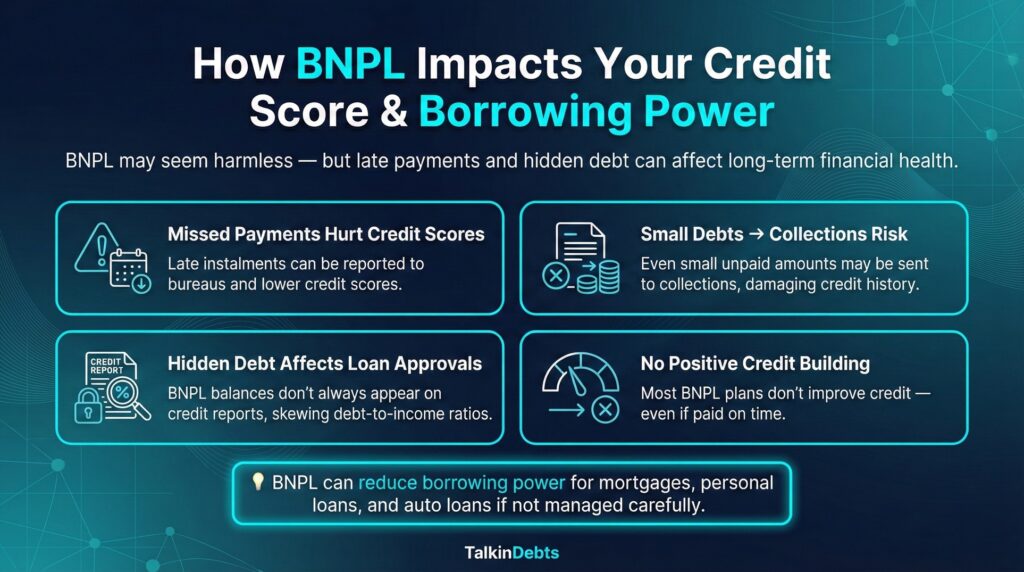

BNPL services market themselves as alternatives to traditional credit card debt, but their impact on credit health can be surprisingly significant. In many regions, BNPL activity does not appear on credit reports — yet missed payments do. This creates a dangerous disconnect between spending habits and credit visibility.

Credit Score Risks

- Missed Payments Can Trigger Negative Marks

If a user fails to pay instalments on time, many providers can report the default to credit bureaus. This lowers the credit score and affects future loan approvals. - Short-Term Loans, Long-Term Impact

Even small unpaid BNPL amounts can be sent to collections, where they are treated like any other debt. This adds long-term damage to credit histories. - Debt-to-Income Ratio Complications

Since BNPL loans often stay invisible to lenders, borrowers may unknowingly exceed their repayment capacity when applying for mortgages, personal loans, or auto loans. - No Positive Credit Building

Unlike traditional loans, most BNPL plans do not help improve credit scores when paid on time, leaving consumers with risks but no long-term credit benefit.

The Financial Health Fallout: Hidden Fees and Unmanaged Debt

BNPL may appear interest-free, but hidden fees can build up fast. Late fees, account reactivation charges, and processing costs can turn a small purchase into a costly monthly burden.

Consumers often fall into three common financial pitfalls:

1. Multiple BNPL Accounts

In the US, the average BNPL user manages 3 to 5 BNPL plans at once. With each provider operating independently, tracking repayments becomes difficult, increasing the risk of missed instalments.

2. Overbuying Due to “Zero Interest” Marketing

The perception of affordability leads consumers to spend more than they would with traditional payment methods. This behaviour is one of the main reasons BNPL users report higher monthly repayment stress.

3. Rolling Over Debt

When payments cannot be made on time, some providers allow extensions for a fee. These fees accumulate, ultimately mimicking the structure of high-cost short-term loans.

Regional Breakdown: BNPL in the US, UK, and UAE

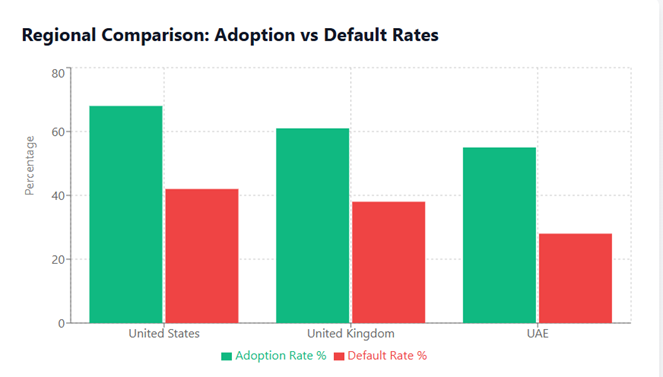

United States: Rising Default Concerns

BNPL usage in the US has surged among millennials and Gen Z shoppers. Retailers aggressively promote BNPL at checkout to increase cart conversions. However, recent financial studies reveal a concerning trend: more than 40% of regular BNPL users have missed at least one payment in the past year.

The Consumer Financial Protection Bureau (CFPB) has already issued warnings about accumulating unaffordable debt through BNPL platforms. As a result, tighter regulations are in progress to ensure providers report data consistently to credit bureaus and protect consumers from hidden fees. With inflation still pressuring household budgets, BNPL defaults are expected to rise, making responsible usage more critical than ever.

United Kingdom: Regulation Takes Center Stage

BNPL adoption is strong in the UK, especially among online shoppers looking for short-term payment flexibility. But unlike the US, the UK government is moving faster on regulation. The Financial Conduct Authority (FCA) has already pushed providers to improve transparency around fees and late payment policies.

Many UK consumers rely on BNPL for daily essentials such as groceries and household items — a worrying shift that indicates rising cost-of-living pressures. As the market expands, lenders are concerned that BNPL borrowing may further strain households already dealing with mortgage rate increases and inflation-heavy budgets.

United Arab Emirates: BNPL Fueling Retail Growth

The UAE has one of the fastest-growing BNPL markets in the Middle East. Fintech platforms like Tabby, Postpay, and Tamara have become deeply integrated with the region’s digital retail ecosystem. A high-income consumer base combined with a strong e-commerce culture has helped BNPL thrive.

While default rates remain lower than in Western markets, regulators in the UAE are closely monitoring the sector to ensure stability as usage expands. For many residents, BNPL is a convenient tool to manage lifestyle expenses — from apparel and electronics to travel packages. But the growing popularity is also raising concerns about over-leveraging, particularly among young professionals juggling multiple short-term financial commitments.

The Hidden Economic Risk: BNPL and Consumer Debt Cycles

The biggest long-term risk of BNPL is how easily it blends into everyday spending. Instead of recognizing instalments as debt, many users view them as part of their regular monthly expenses. This mindset fosters a dangerous cycle: as soon as one instalment plan ends, another begins.

This revolving debt behaviour creates:

- Reduced savings capacity

- Inconsistent cash flow

- Lower emergency fund availability

- Higher dependency on short-term credit

Economists warn that if BNPL continues expanding without strict oversight, it may contribute to broader household debt instability, similar to credit card crises seen in previous decades.

Are Consumers in Control — or Losing It?

Understanding where BNPL becomes harmful comes down to self-awareness. When used responsibly, BNPL can be a helpful budgeting tool. But when consumers rely on it to cover essentials or disguise overspending, financial control quickly erodes.

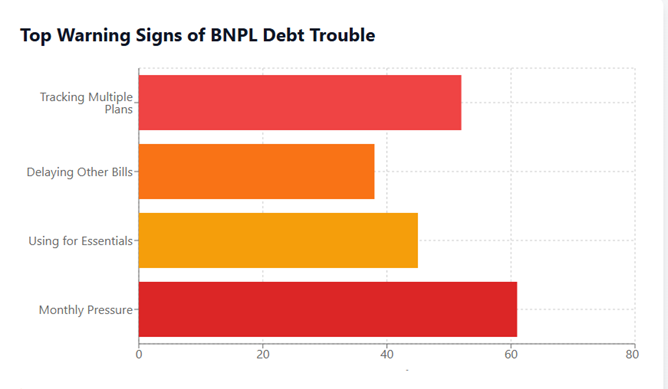

Common warning signs of BNPL debt trouble include:

- Struggling to track multiple instalments

- Using BNPL to buy non-essential items during cash-tight months

- Delaying other bill payments to complete BNPL cycles

- Relying on extensions or late-fee waivers

- Feeling monthly repayment pressure even before payday

Financial advisors across all regions recommend evaluating BNPL usage the same way as any credit product — because it is credit, even if it doesn’t feel like it.

Responsible BNPL Use: A Smarter Approach

Consumers can enjoy the benefits of BNPL without falling into debt traps by adopting a disciplined strategy:

- Treat BNPL like a loan, not a discount

- Use only one or two BNPL providers to simplify tracking

- Avoid BNPL for essential bills or recurring expenses

- Check repayment dates before confirming any purchase

- Monitor bank balances to ensure funds are available

- Avoid stacking multiple instalment plans

- Always pay on time to avoid late fees and credit damage

Setting clear boundaries ensures BNPL remains a convenient option instead of a financial burden.

What the Future Holds for BNPL

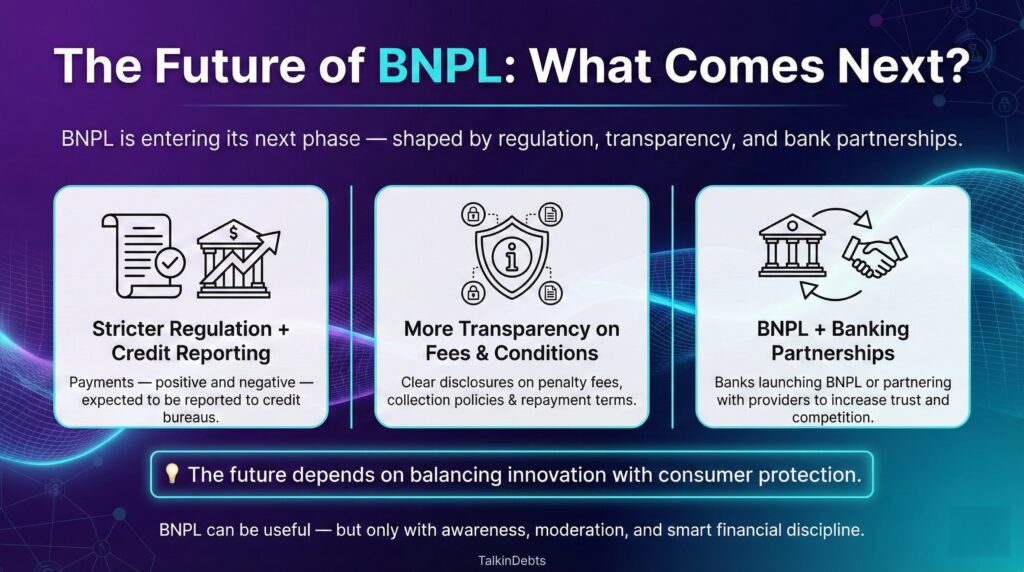

BNPL’s rapid growth is forcing a major shift in global consumer finance. Regulators, banks, fintechs, and retailers are adjusting to a world where instant instalments are becoming standard. As the market matures, three major developments are expected:

1. Stricter Regulation and Mandatory Credit Reporting

Governments in the US, UK, and UAE are moving toward policies that require BNPL providers to report payment behaviour to credit bureaus — both positive and negative.

2. Higher Transparency on Fees and Conditions

Regulators will likely enforce clearer disclosures around late fees, collection practices, and penalty structures.

3. Greater Integration With Traditional Banks

Banks are expected to offer their own BNPL solutions or partner with existing providers, increasing competition and reducing predatory practices.

The future of BNPL will depend on balancing innovation with consumer protection.

Final Thoughts

The BNPL boom reflects a shifting global mindset around debt, convenience, and financial flexibility. While the model offers short-term relief and shopping ease, its long-term consequences can undermine financial health when used recklessly. In the US, UK, and UAE, households are already feeling the pressure of managing multiple instalment plans. The real cost of BNPL is not just the late fees — it is the hidden impact on credit, spending habits, and long-term stability.

BNPL can be a useful tool, but only when approached with caution and self-discipline. Consumers must stay aware of the risks and avoid viewing instalment plans as harmless routine expenses. In a world where borrowing is becoming easier than ever, financial responsibility remains the most valuable currency.