Debt Consolidation for Beginners: When It Works and When It Doesn’t

Managing multiple loans can feel overwhelming. Different lenders, different interest rates, and different due dates often create confusion, stress, and missed payments. For many consumers, debt consolidation appears to offer a straightforward solution: combine everything into one loan and regain control. While this strategy can be effective in the right circumstances, it can also lead to higher costs and deeper financial trouble when misunderstood.

This article explains debt consolidation in simple, practical terms. It breaks down how it works, how it affects your credit, the situations where it delivers real benefits, and the scenarios where it fails. If you are considering consolidation for the first time, this guide will help you make a more informed and responsible decision.

What Debt Consolidation Actually Is

Debt consolidation is the process of replacing several existing debts with a single new loan or credit arrangement. Instead of managing multiple monthly payments, you make one payment to one lender.

The debts commonly included in consolidation are unsecured consumer debts such as:

- Credit card balances

- Personal loans

- Retail or store card balances

- Small short-term loans

The consolidated loan usually comes with a fixed repayment schedule, a defined interest rate, and a specific end date. The goal is to simplify repayment and, in some cases, reduce the overall cost of debt.

However, consolidation does not eliminate debt. It only restructures it. The total amount you owe does not disappear, and in some cases, it can increase depending on the loan terms.

Why Debt Consolidation Feels Appealing

Debt consolidation appeals to consumers for both practical and psychological reasons.

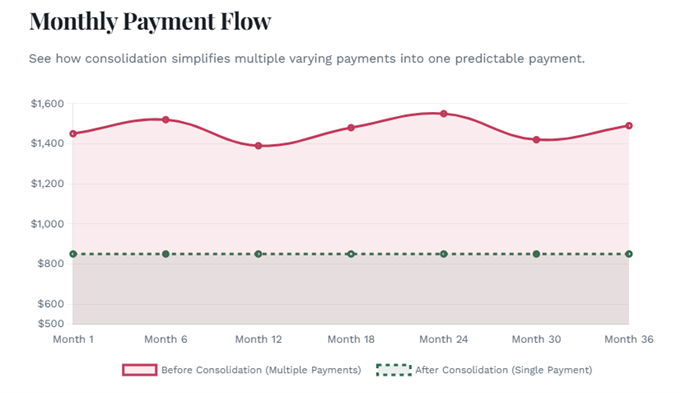

From a practical standpoint, managing one payment is easier than managing several. Fewer due dates reduce the risk of missed payments, late fees, and penalty interest rates. This simplicity alone can help borrowers regain a sense of control.

From a psychological perspective, consolidation provides structure. Many people feel less anxious when they see a single balance declining each month rather than multiple balances moving at different speeds.

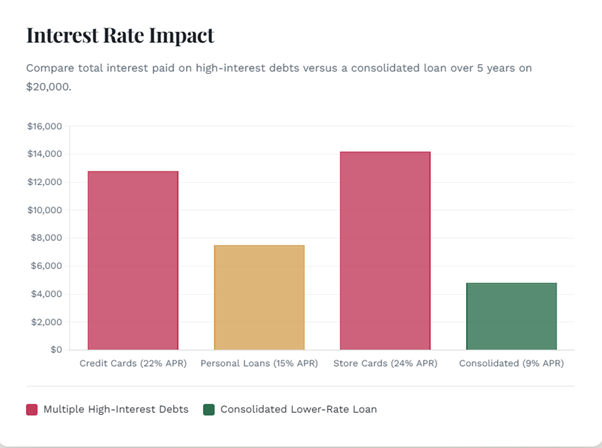

There is also the promise of savings. If the new loan has a lower interest rate than existing debts, consolidation can reduce monthly payments and total interest paid over time. This is particularly attractive for people carrying high-interest credit card balances.

Despite these benefits, consolidation only works when the numbers and behavior align.

Types of Debt Consolidation Options

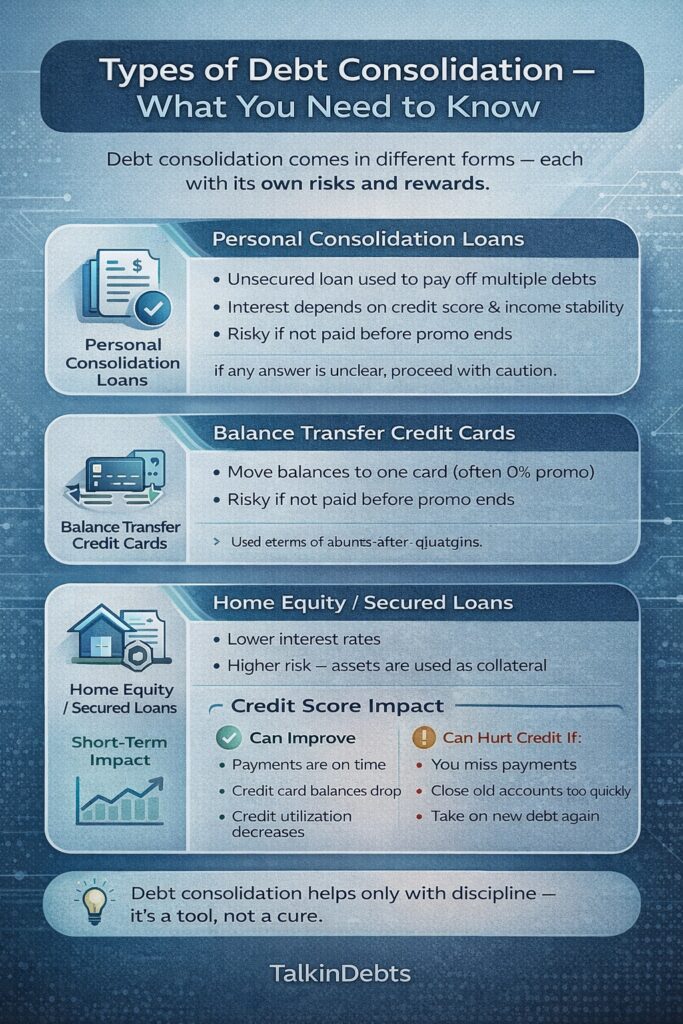

Debt consolidation is not a single product. It can take several forms, each with different risks and outcomes.

Personal consolidation loans are the most common option. These are unsecured loans used specifically to pay off existing debts. Their interest rates depend on credit history and income stability.

Balance transfer arrangements move credit card balances onto a single card, often with a promotional low or zero interest period. These can be effective short-term tools but become expensive if balances are not paid off before promotional rates expire.

Home equity or secured loans use assets as collateral. While these loans may offer lower interest rates, they carry higher risk because missed payments can result in asset loss.

Each option must be evaluated carefully, particularly by beginners who may focus only on monthly payment reductions rather than long-term consequences.

How Debt Consolidation Impacts Your Credit Score

Credit impact is one of the most misunderstood aspects of debt consolidation.

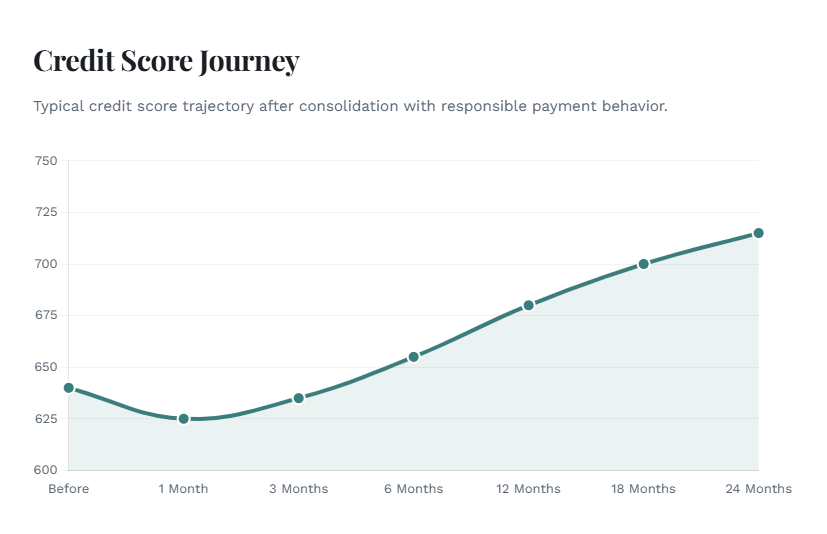

Initially, applying for a new loan usually causes a small, temporary decline in your credit score due to a credit inquiry. This effect is typically short-lived.

Over time, consolidation can improve your credit score if:

- You make all payments on time

- High credit card balances are paid off

- Your credit utilization ratio decreases

However, consolidation can damage your credit if:

- You miss payments on the new loan

- You close long-standing credit accounts too quickly

- You accumulate new debt on cleared credit cards

Credit improvement is not guaranteed. It depends entirely on consistent repayment and disciplined financial behavior after consolidation.

When Debt Consolidation Works Well

Debt consolidation can be highly effective under the right conditions.

It works best when most of your debt carries high interest rates. Replacing expensive revolving credit with a lower-rate loan can significantly reduce interest costs.

Stable income is another key factor. Consolidation assumes you can meet the new monthly payment consistently. Without a predictable income, even a reduced payment can become unmanageable.

Behavior change is essential. Consolidation works only if you stop relying on credit for everyday expenses. Clearing old balances but continuing to spend creates a cycle of repeated debt.

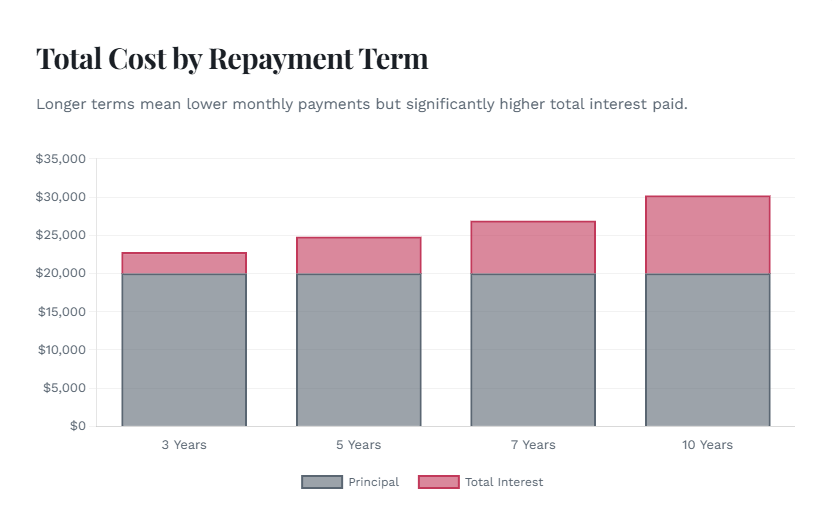

A reasonable loan term also matters. Shorter or moderate repayment periods help ensure that consolidation leads to faster debt reduction rather than prolonged repayment.

Finally, consolidation is most effective when used as part of a broader financial plan that includes budgeting, expense tracking, and realistic financial goals.

When Debt Consolidation Fails

Debt consolidation often fails when borrowers misunderstand its purpose or limitations.

One common failure occurs when the new interest rate is not significantly lower than existing rates. In such cases, consolidation offers convenience but no real savings.

Another issue arises when repayment terms are extended too long. Lower monthly payments may feel helpful, but longer terms usually result in higher total interest costs.

Consolidation also fails when spending habits do not change. Many borrowers fall into the trap of using cleared credit cards again, effectively doubling their debt.

Fees can also undermine consolidation benefits. Origination fees, balance transfer charges, and penalties can quietly offset expected savings.

In more severe cases, consolidation simply delays financial distress when debt levels are too high relative to income.

Common Debt Consolidation Mistakes Beginners Make

Beginners often focus on short-term relief rather than long-term outcomes.

One major mistake is choosing consolidation based solely on monthly payment reduction. This ignores the total cost of the loan over time.

Another error is converting unsecured debt into secured debt. While lower interest rates may seem attractive, using assets as collateral increases financial risk.

Some borrowers close all old accounts immediately, unintentionally shortening their credit history. Others leave accounts open without discipline, increasing temptation to overspend.

Many people also consolidate without addressing the root causes of debt, such as poor budgeting, inconsistent income planning, or lifestyle inflation.

Debt Consolidation Compared to Other Debt Strategies

Debt consolidation is only one of several debt management approaches.

Debt management plans focus on structured repayment and negotiated interest reductions, often without taking out a new loan.

Debt settlement involves negotiating reduced balances but can significantly damage credit and carry legal and tax implications.

In some cases, simple budgeting adjustments and repayment prioritization may be sufficient, especially for smaller debt balances.

Choosing the right approach depends on the size of the debt, income stability, credit standing, and long-term financial goals.

How to Evaluate Debt Consolidation Before Committing

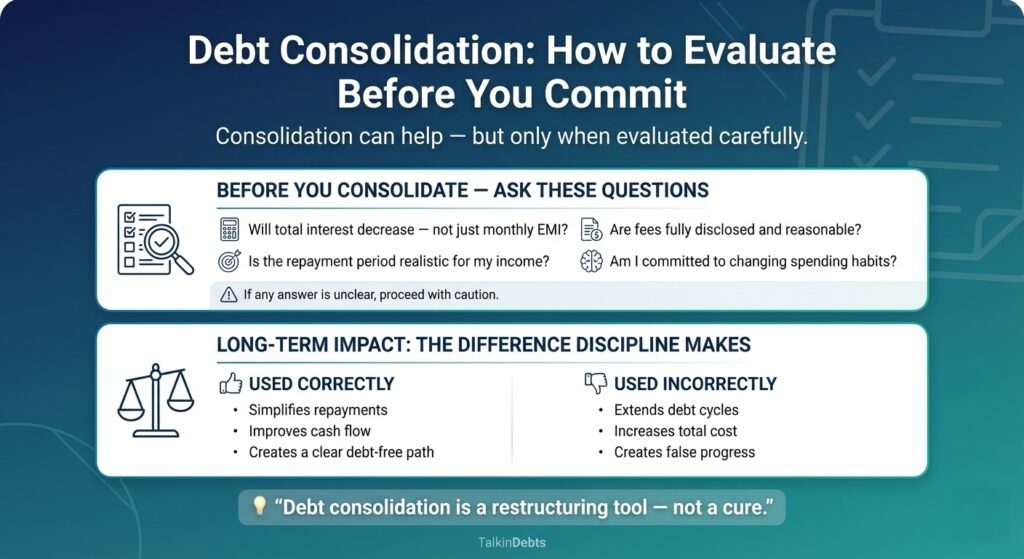

Before proceeding with consolidation, borrowers should ask critical questions.

Will the new loan reduce the total interest paid over time, not just the monthly payment?

Is the repayment period realistic and aligned with income stability?

Are fees clearly disclosed and reasonable?

Am I committed to changing my spending habits?

If any of these questions cannot be answered confidently, consolidation should be approached with caution.

A careful comparison of loan terms, repayment timelines, and total costs is essential before making a decision.

Long-Term Financial Impact of Debt Consolidation

When used correctly, consolidation can provide long-term financial benefits. It can simplify money management, improve cash flow, and create a clear path toward becoming debt-free.

When used incorrectly, it can extend debt cycles, increase total costs, and create a false sense of progress.

The difference lies in understanding that consolidation is not a solution by itself. It is a financial restructuring tool that requires discipline, planning, and consistent repayment.

Final Perspective

Debt consolidation can be a valuable option for beginners struggling with multiple loans, but it is not a one-size-fits-all answer. It works best for borrowers with stable income, high-interest debt, and a genuine commitment to changing financial behavior.

Without careful evaluation, realistic planning, and strong discipline, consolidation can quietly make debt problems worse rather than better.

The most important takeaway is simple: debt consolidation should support long-term financial stability, not provide temporary relief at a higher future cost. Thoughtful decision-making determines whether consolidation becomes a step forward or a financial setback.