US & Canada Report Rising Credit Card Delinquencies — What It Means for Families

Rising credit card delinquencies across the United States and Canada are sending a clear warning signal to households and policymakers alike. After years of cheap credit and pandemic-era relief, families on both sides of the border are now confronting the reality of sustained high interest rates, elevated living costs, and shrinking financial buffers. While overall economic growth remains unevenly positive, household debt stress is becoming harder to ignore.

Recent financial system data indicate that more consumers are falling behind on credit card payments than at any point since before the pandemic. Although delinquency growth has slowed compared with the sharp spikes seen in 2024, levels remain well above historical norms. For millions of families, this is not just a macroeconomic statistic — it is a direct reflection of daily financial strain.

Credit card delinquencies: what the data reveals

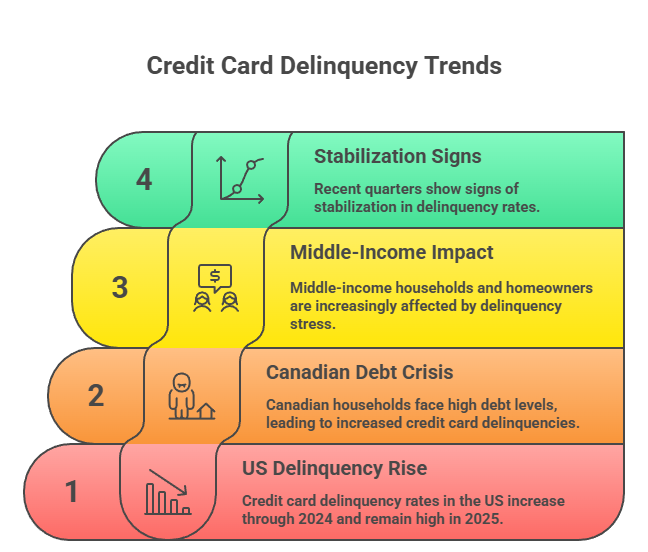

In the United States, credit card delinquency rates rose steadily through 2024 and remained elevated throughout 2025. While recent quarters show signs of stabilization, the share of accounts moving into 30-day and 60-day past-due status continues to exceed pre-2020 averages. This suggests that many households are struggling to keep up with revolving debt obligations even as inflation cools.

Canada is experiencing a similar, and in some respects more concerning, trend. Canadian households carry some of the highest debt levels among developed economies. As a result, even modest increases in borrowing costs or income disruptions can quickly push families into delinquency. Credit cards, often used as short-term liquidity tools, have become a pressure valve — and increasingly a point of failure.

What makes the current cycle different is that delinquency stress is no longer confined to lower-income or traditionally high-risk borrowers. Middle-income households, dual-income families, and homeowners are now appearing more frequently in delinquency data, reflecting how widespread cost pressures have become.

Why families are falling behind

Several interconnected factors are driving rising credit card delinquencies across North America.

First, the cumulative impact of higher interest rates has significantly increased the cost of carrying revolving debt. Even when central banks pause or begin easing, existing balances accumulated at higher rates continue to generate heavy interest charges. Minimum payments rise, but principal balances often barely decline.

Second, the cost of essentials remains elevated. Housing, groceries, utilities, insurance, and transportation expenses have outpaced wage growth for many households. Credit cards are increasingly used not for discretionary spending, but to cover basic living costs — a clear sign of financial stress.

Third, emergency savings have been depleted. Many families relied on savings built during the pandemic to absorb earlier inflation shocks. By 2025, those buffers have largely disappeared, leaving households more vulnerable to even small disruptions such as medical bills, car repairs, or temporary income loss.

Finally, changes in credit reporting and loan repayment structures have contributed to the rise in visible delinquencies. In the US, the return of certain loan obligations to credit files has altered the delinquency landscape, while in Canada, refinancing and mortgage renewal pressures are indirectly pushing more consumers toward unsecured credit.

The US–Canada comparison: same problem, different risks

While both countries are experiencing rising credit card delinquencies, the underlying risks differ in important ways.

In the United States, delinquency stress is closely tied to income volatility and unsecured borrowing. Younger borrowers, subprime cardholders, and households with multiple revolving accounts are showing the highest risk. Credit cards are often used to bridge income gaps, particularly for gig workers or families facing unstable employment.

In Canada, household leverage amplifies the issue. Many families are highly exposed to housing-related debt, and upcoming mortgage renewals pose a major financial challenge. Even small payment increases at renewal can force households to rely more heavily on credit cards, increasing delinquency risk across the entire credit profile.

In both countries, the problem is not excessive luxury spending. Instead, it is the growing gap between income growth and the cost of maintaining a basic standard of living.

What rising delinquencies mean for everyday families

For households, rising credit card delinquencies carry immediate and long-term consequences.

A single missed payment can damage credit scores, making future borrowing more expensive or inaccessible. As delinquency worsens, lenders may apply penalty interest rates, reduce credit limits, or close accounts entirely. This limits financial flexibility precisely when families need it most.

Persistent delinquency also increases stress and reduces resilience. Families juggling multiple past-due accounts often delay other obligations, creating a cascading effect that can lead to deeper financial hardship.

Most importantly, credit card delinquency is often a symptom, not the root problem. It signals that a household’s financial structure is no longer sustainable under current conditions.

Warning signs families should not ignore

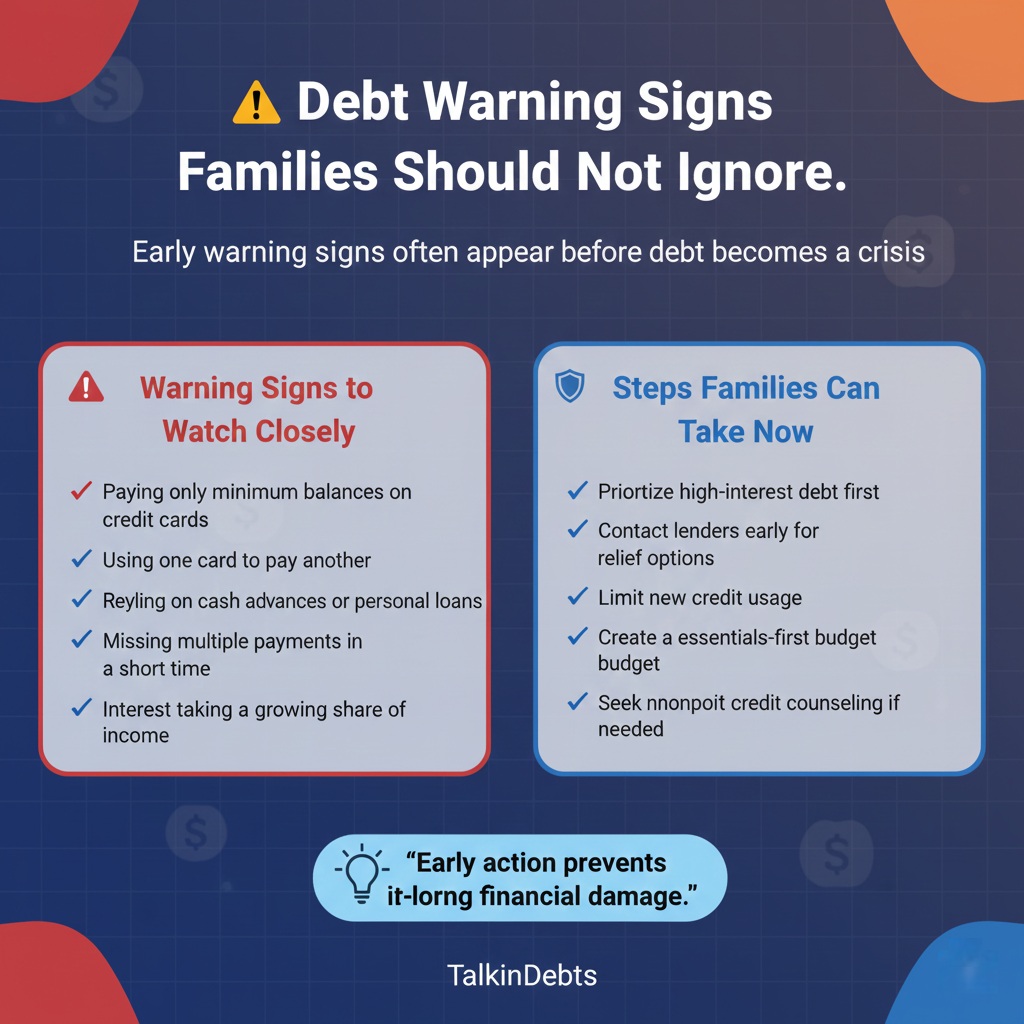

Households should take rising delinquency risks seriously if they notice any of the following:

- Regularly paying only the minimum balance on credit cards

- Using one credit card to pay another

- Relying on cash advances or personal loans to manage monthly expenses

- Missing payments on more than one account within a short period

- Seeing interest charges consume an increasing share of monthly income

These indicators suggest that corrective action is needed before the situation worsens.

Practical steps families can take right now

While macroeconomic conditions are outside individual control, households can take concrete steps to reduce delinquency risk.

Start by prioritizing high-interest debt. Focus extra payments on the card with the highest interest rate or the one closest to becoming delinquent. Preventing a missed payment is often more valuable than reducing balances evenly.

Communicate with lenders early. Many banks offer hardship programs, temporary payment relief, or modified repayment plans for customers who reach out before accounts become seriously past due.

Limit new credit usage. Avoid adding new charges unless absolutely necessary. Preserving available credit can provide flexibility if an emergency arises.

Create a realistic, essentials-first budget. Identify non-negotiable expenses and cut back where possible, even temporarily. Short-term restraint can prevent long-term damage.

Seek professional guidance if needed. Non-profit credit counseling services can help households restructure debt and negotiate with creditors without worsening financial standing.

What this means for lenders and the broader economy

Rising credit card delinquencies are closely watched by financial institutions and regulators because they often precede broader economic stress. Higher delinquency rates can lead to tighter lending standards, reduced credit availability, and increased borrowing costs for everyone.

Banks are already adjusting risk models, particularly for unsecured lending. This could make it harder for households to access credit precisely when they need it most, reinforcing a negative cycle.

For policymakers, the data highlights the uneven impact of economic recovery. While headline inflation may ease, household-level financial stress remains a critical concern.

Looking ahead: cautious stability, persistent pressure

The current outlook suggests that credit card delinquencies may stabilize rather than spike sharply in the near term. However, stability at elevated levels still represents significant strain for families.

Unless wage growth meaningfully outpaces living costs or household debt burdens decline, delinquency risks will remain part of the financial landscape in both the US and Canada.

For families, the key takeaway is clear: credit cards are becoming a pressure point rather than a safety net. Acting early, reducing reliance on high-interest debt, and addressing financial stress proactively can make the difference between temporary difficulty and long-term damage.

In an environment where financial margins are thin, awareness and early action are the strongest tools households have to protect their financial future.