7 Signs You’re Heading Toward a Debt Trap: How to Stop It Early

A debt trap rarely begins with a dramatic mistake. For most people, it develops slowly through routine decisions, financial pressure, and the belief that things will improve “soon.” What starts as manageable borrowing gradually becomes dependence, and before long, debt begins to dictate daily life.

The danger lies not only in how much debt you carry, but in how and why you are using it. Recognizing early warning signs can prevent years of financial strain, damaged credit, and emotional stress. The earlier you act, the more options you retain.

7 Early Warning Signs Of A Debt Trap

Below are seven clear signs that indicate you may be heading toward a debt trap — along with practical steps to stop the cycle before it becomes overwhelming.

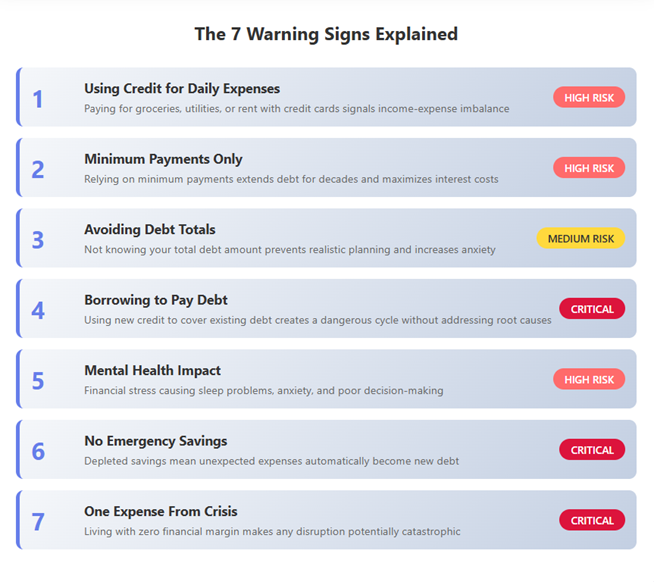

1. You’re Using Credit to Cover Everyday Living Costs

One of the earliest warning signs is using credit cards, overdrafts, or short-term loans to pay for routine expenses like groceries, fuel, utilities, school fees, or rent. This often happens quietly, especially during periods of inflation or income disruption.

At first, it feels temporary. A few swipes here and there. But when credit replaces cash for essentials, it signals a deeper imbalance between income and expenses.

Why this matters:

Paying interest on daily necessities means you’re spending more tomorrow for things you already consumed today. Over time, this inflates monthly obligations and reduces financial flexibility.

How to stop it early:

Start by identifying which expenses truly require credit. Eliminate discretionary spending immediately and redirect cash toward essentials. Even small expense reductions can restore balance before debt compounds further.

2. Minimum Payments Have Become Your Default Strategy

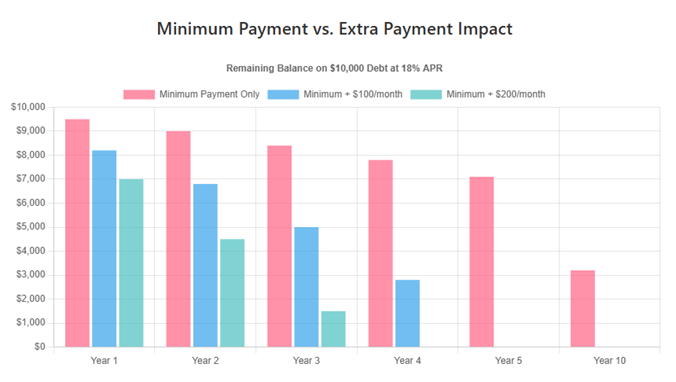

When debt first appears, minimum payments feel manageable. Over time, however, relying solely on minimum payments often becomes a habit rather than a choice.

This approach keeps accounts in “good standing” while quietly extending repayment timelines — sometimes for decades.

Why this matters:

Minimum payments are structured to benefit lenders, not borrowers. Most of your payment goes toward interest, meaning balances shrink painfully slowly.

How to stop it early:

Even a modest increase above the minimum can dramatically reduce interest over time. Choose one account to prioritize and apply any extra funds there. Progress builds confidence, which fuels consistency.

3. You Avoid Looking at Your Total Debt

Many people know they have debt but avoid calculating the full amount. Statements remain unopened. Apps are ignored. Numbers feel abstract — until they’re not.

Avoidance is not laziness; it’s fear. But fear delays action.

Why this matters:

Without a clear picture, it’s impossible to create a realistic repayment plan. Uncertainty increases anxiety and leads to reactive decisions.

How to stop it early:

List every debt in one place, including balances, interest rates, and due dates. The total may feel uncomfortable, but clarity restores control. Once debt is defined, it becomes manageable.

4. You’re Borrowing to Stay Afloat, Not to Progress

Using new credit to pay existing debt — whether through personal loans, balance transfers, or overdrafts — is one of the clearest indicators of a developing debt trap.

This behavior often feels like relief. Payments are covered. Pressure eases. But total debt frequently increases rather than decreases.

Why this matters:

Replacing one debt with another without addressing spending patterns or cash flow only delays the problem. In many cases, interest rates rise and repayment periods extend.

How to stop it early:

Before taking on new credit, ask whether it reduces total debt or merely shifts it. If no long-term improvement exists, focus instead on budgeting adjustments, income improvement, or professional guidance.

5. Financial Stress Is Affecting Your Mental Well-Being

Debt doesn’t just strain finances — it strains decision-making. Persistent worry, poor sleep, irritability, and avoidance behaviors are often linked to financial pressure.

When stress increases, people are more likely to make impulsive or short-term choices that worsen their situation.

Why this matters:

Emotional exhaustion reduces financial discipline, leading to missed payments, additional borrowing, or complete avoidance.

How to stop it early:

Create a simple, written plan with clear next steps. You don’t need perfection — you need direction. Talking openly with a financial professional or trusted advisor can also reduce stress and prevent escalation.

6. Your Savings Are Gone — or No Longer Growing

Savings act as a financial shock absorber. When savings are depleted or contributions stop entirely, even minor disruptions can push you into deeper debt.

Many people drain emergency funds to manage routine expenses, believing they will rebuild later — but later rarely comes without structural changes.

Why this matters:

Without savings, unexpected expenses almost always result in borrowing, accelerating the debt cycle.

How to stop it early:

Rebuild savings gradually, even if the amount feels small. A modest emergency buffer can prevent setbacks and reduce dependence on credit during unexpected events.

7. You Feel One Unexpected Expense Away From Crisis

If a car repair, medical bill, job disruption, or family emergency would immediately destabilize your finances, this is a critical warning sign.

This sense of fragility often exists long before payments are missed or accounts fall behind.

Why this matters:

When there’s no margin for error, debt grows rapidly, and options narrow quickly.

How to stop it early:

Focus first on stabilizing monthly cash flow. Reduce fixed expenses where possible, avoid new financial commitments, and prioritize predictable obligations. Stability creates breathing room and restores confidence.

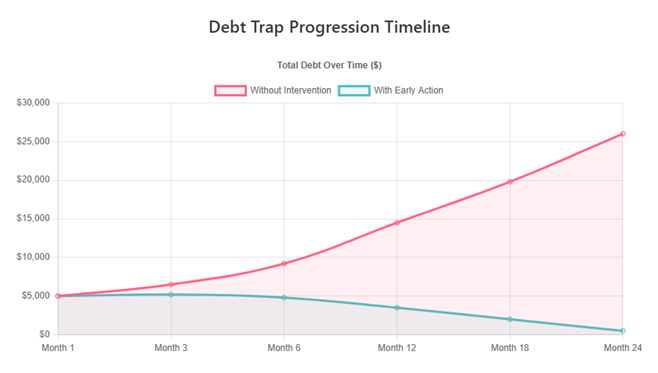

Why Early Intervention Makes a Difference

Debt becomes most dangerous when it’s ignored. Interest compounds. Stress increases. Choices become reactive rather than strategic.

Early action preserves options — from repayment flexibility to credit protection and emotional well-being. Addressing debt while it’s still manageable prevents long-term damage and financial exhaustion.

Importantly, stopping a debt trap early does not require drastic sacrifice. It requires awareness, consistency, and timely course correction.

Building a Healthier Relationship With Debt

Debt itself is not the enemy. The real risk lies in unconscious use, emotional spending, and delayed action.

Healthy financial behavior involves:

- Understanding where your money goes

- Using credit intentionally, not reactively

- Creating buffers for uncertainty

- Acting early when pressure appears

When debt is approached with clarity rather than avoidance, it becomes a solvable challenge rather than a permanent burden.

Final Thoughts

Debt traps do not announce themselves. They grow quietly through convenience, optimism, and temporary relief. Recognizing the warning signs early gives you power — power to adjust, correct, and regain control before debt dictates your future.

If even one of these signs feels familiar, it’s not a failure. It’s a signal to act.

The earlier you respond, the easier the path forward becomes.