Global Debt Enters 2026 at Record Levels, World Debt Clock Shows No Slowdown

As the world steps into 2026, global debt has reached an unprecedented milestone. According to the World Debt Clock, total global debt has surged to record levels, reinforcing concerns that governments, corporations, and households are entering the new year with historically high financial obligations—and little sign of relief ahead. This new-year snapshot paints a sobering picture of an economy still leaning heavily on borrowing, even as interest rates remain elevated and growth slows across major regions.

The scale of global indebtedness is no longer a theoretical risk discussed only in policy circles. It is a measurable, real-time figure ticking upward every second, shaping inflation, consumer spending, credit markets, and sovereign stability worldwide.

A Record-Breaking Start to 2026

Global debt entering 2026 now exceeds levels seen at any previous point in modern economic history. The World Debt Clock, which aggregates sovereign, corporate, and household borrowing across countries, shows no material slowdown in the pace of accumulation. Instead, borrowing remains deeply embedded in how economies function post-pandemic, post-stimulus, and amid ongoing geopolitical uncertainty.

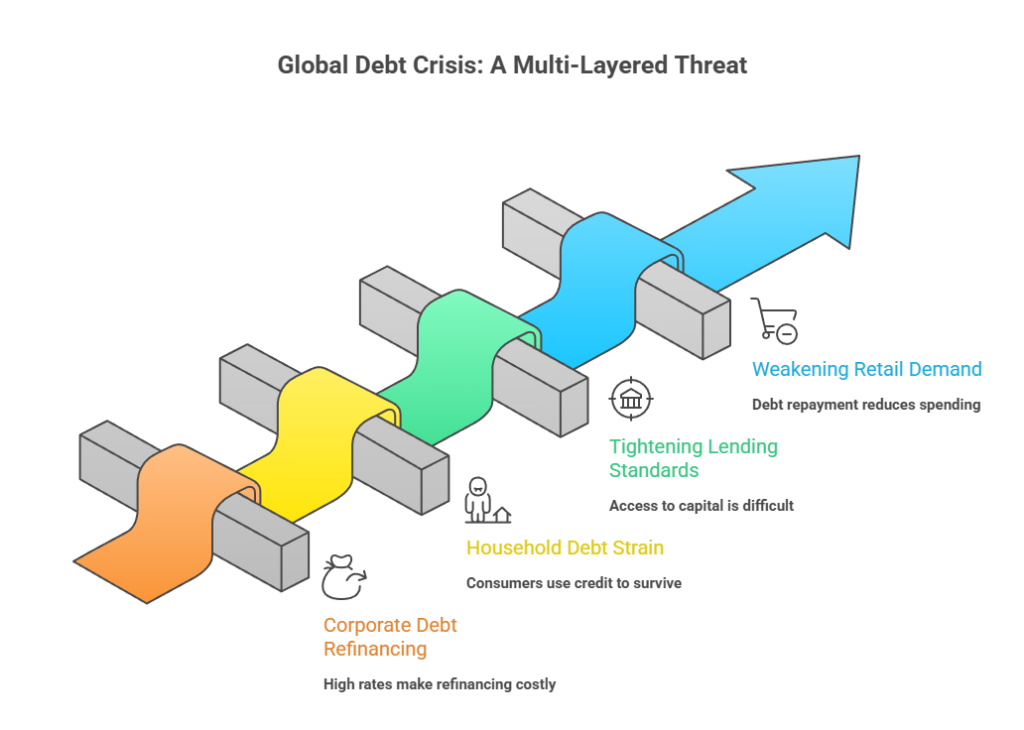

Governments continue to refinance old liabilities while issuing fresh debt to fund social programs, infrastructure, defense, and climate commitments. Corporations are rolling over loans taken during ultra-low-rate years, often at significantly higher costs. Meanwhile, households—pressured by rising living expenses—are increasingly dependent on credit cards, personal loans, and buy-now-pay-later schemes.

This combination has created a synchronized debt expansion across nearly every economic layer.

Sovereign Debt: Governments Under Mounting Pressure

Public debt remains the largest contributor to the global total. Major economies have entered 2026 with debt-to-GDP ratios well above pre-2020 norms. Fiscal discipline has proven difficult to restore after years of stimulus-driven growth, pandemic relief packages, and emergency spending.

Advanced economies continue to run persistent deficits as aging populations push up healthcare and pension costs. Emerging markets, meanwhile, face a dual challenge: rising external debt obligations and weaker local currencies, which increase repayment burdens on dollar-denominated loans.

Institutions such as the International Monetary Fund have repeatedly warned that sovereign debt vulnerabilities are expanding, particularly in low- and middle-income countries. Debt servicing costs now consume a growing share of government revenues, crowding out spending on development, education, and public services.

Corporate Debt: Refinancing in a High-Rate World

Corporate debt has quietly become one of the most fragile components of the global debt structure. During years of cheap money, companies borrowed aggressively to expand, acquire competitors, and buy back shares. As 2026 begins, many of those loans are reaching maturity.

Refinancing at today’s higher interest rates is proving costly, especially for highly leveraged firms and startups that relied on growth projections rather than profitability. Sectors such as technology, commercial real estate, retail, and logistics are already showing stress, with defaults and restructurings rising in multiple markets.

Banks and private credit funds are tightening lending standards, making access to fresh capital more difficult. This has forced many companies to cut costs, delay investments, or exit markets altogether—adding to broader economic uncertainty.

Household Debt: Consumers Feeling the Strain

While sovereign and corporate borrowing dominate headlines, household debt remains the most visible and socially sensitive layer of the crisis. As inflation reshaped household budgets over recent years, consumers increasingly turned to credit to maintain living standards.

Mortgage balances remain high in countries with overheated housing markets. Credit card debt continues to rise, particularly in economies where wages have not kept pace with food, rent, and energy costs. Delinquencies are ticking upward, especially among younger borrowers and middle-income households.

Financial stress at the consumer level has direct consequences for economic growth. When households prioritize debt repayments over discretionary spending, retail demand weakens, affecting businesses and employment across sectors.

Why the World Debt Clock Keeps Accelerating

The World Debt Clock’s relentless upward movement reflects deeper structural issues rather than short-term shocks. Several forces continue to fuel global borrowing:

Low productivity growth has limited governments’ ability to grow out of debt. Demographic shifts are increasing long-term fiscal commitments. Climate adaptation and energy transition projects require massive upfront investment. Geopolitical tensions are driving higher defense spending. At the same time, political resistance to austerity remains strong in many democracies.

Even as central banks attempt to normalize monetary policy, the global financial system remains highly sensitive to tightening. This has reduced policymakers’ appetite for aggressive debt reduction, reinforcing a cycle of refinancing and incremental borrowing.

Regional Debt Hotspots in Early 2026

Different regions are experiencing the debt surge in distinct ways. In North America, household and federal debt remain elevated, with consumer credit playing an outsized role in sustaining demand. Europe continues to grapple with uneven fiscal positions across member states, raising long-term questions about debt sustainability and coordination.

In Asia, rapid credit expansion in certain emerging markets contrasts with deleveraging efforts in others. Meanwhile, parts of Africa and Latin America face mounting repayment risks as global liquidity tightens and export revenues fluctuate.

Global institutions such as the World Bank have highlighted the growing divergence between countries that can manage high debt through strong institutions and those vulnerable to sudden financial shocks.

Implications for Interest Rates and Inflation

Record global debt levels complicate the outlook for interest rates and inflation in 2026. Central banks must balance the need to control inflation with the risk that higher rates could destabilize heavily indebted governments and borrowers.

Persistent debt also creates upward pressure on inflation through deficit spending and supply-side constraints. If inflation proves sticky, rate cuts may be delayed, further increasing debt servicing costs across the economy.

This dynamic has raised concerns about a prolonged period of financial repression, where inflation runs modestly above interest rates to gradually erode real debt burdens—a strategy historically used by governments facing excessive liabilities.

Financial Markets React to the Debt Reality

Bond markets are increasingly sensitive to fiscal signals as investors demand higher yields to compensate for risk. Credit spreads have widened in several regions, reflecting concerns about defaults and fiscal sustainability.

Equity markets, while still resilient in parts, are showing signs of volatility as earnings expectations adjust to slower growth and higher financing costs. Currency markets have also become more reactive, particularly for countries with large current account deficits and high external debt.

For investors, 2026 begins with a renewed focus on balance sheet strength, cash flow stability, and sovereign credibility.

The Long-Term Risk: Debt Without Growth

The most significant danger is not high debt itself, but high debt combined with weak growth. If economies fail to generate sufficient productivity gains and income growth, debt ratios will continue to rise, increasing the likelihood of crises, restructurings, or prolonged stagnation.

History shows that excessive debt can constrain policy choices, amplify economic downturns, and deepen inequality. The current trajectory suggests that without coordinated reforms, the global economy may face years of subdued growth under the weight of accumulated liabilities.

Is There a Path to Stabilization?

Stabilizing global debt will require a mix of fiscal discipline, targeted investment, and structural reform. Improving productivity through technology, education, and infrastructure is critical. So is reforming tax systems to broaden revenue bases without stifling growth.

Debt restructuring and relief may become unavoidable for certain countries, particularly those already facing solvency pressures. At the same time, better credit regulation and consumer protection can help limit excessive household borrowing.

However, these solutions demand political will and international coordination—both of which remain challenging in a fragmented global environment.

A Defining Economic Theme of 2026

As 2026 begins, the World Debt Clock serves as a stark symbol of the global economy’s dependence on borrowing. The absence of any visible slowdown underscores how deeply debt has become embedded in modern economic systems.

For policymakers, businesses, investors, and consumers alike, record global debt is no longer a future risk—it is the defining economic reality of the present. How the world responds in the coming years will shape financial stability, growth prospects, and living standards for the decade ahead.