BNPL vs. Credit Cards: Which One Is Safer for Your Wallet?

Buy Now, Pay Later (BNPL) has moved from a checkout gimmick to a mainstream payment method in just a few years. From fashion and electronics to groceries and travel, BNPL options now sit alongside credit cards across North America, Europe, and the UAE. For many consumers, BNPL feels safer, cheaper, and more transparent than traditional credit cards. But is it really better for your wallet — or just a different kind of debt trap?

BNPL vs. Credit Cards

Understanding the true risks and protections behind BNPL and credit cards is critical in today’s high-interest, high-cost environment. Both products allow delayed payment, but they operate under very different rules, regulations, and long-term financial consequences.

This comparison breaks down how BNPL and credit cards actually work, where consumers get caught off guard, and which option is safer depending on spending behavior, income stability, and region.

How BNPL Works in Practice

BNPL services allow consumers to split purchases into smaller payments, often interest-free, over short periods such as four to six weeks or a few months. Providers typically approve users instantly at checkout, using light credit checks or alternative data.

At first glance, BNPL appears consumer-friendly:

- No visible interest

- Fast approval

- Simple installment schedules

- No minimum payment stress

However, this simplicity hides important realities. BNPL providers earn revenue through merchant fees, late payment penalties, and, increasingly, longer-term installment plans that do charge interest. Many consumers underestimate how quickly multiple BNPL purchases stack up across different platforms.

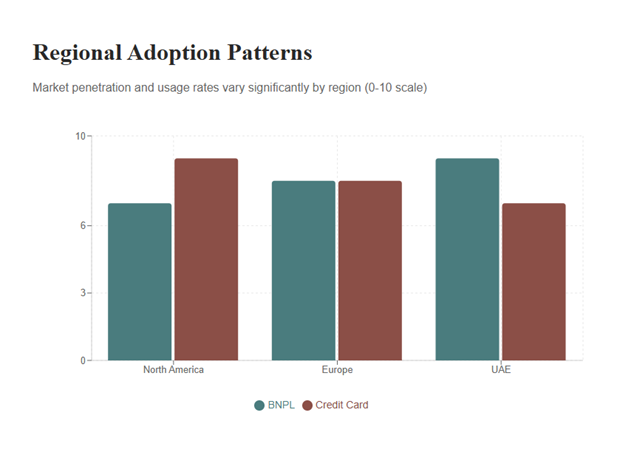

In North America and Europe, BNPL adoption surged during inflationary periods, especially among younger consumers who either lack access to traditional credit or want to avoid high credit card interest rates. In the UAE, BNPL has expanded rapidly through fintech partnerships and e-commerce growth, often marketed as a budgeting tool rather than a debt product.

How Credit Cards Really Affect Your Wallet

Credit cards remain the most widely used form of consumer credit globally. Unlike BNPL, they offer a revolving credit line that can be reused as balances are repaid. This flexibility is both their greatest strength and their biggest danger.

Key features of credit cards include:

- Monthly billing cycles

- Minimum payment requirements

- Interest charges on unpaid balances

- Credit limit-based spending controls

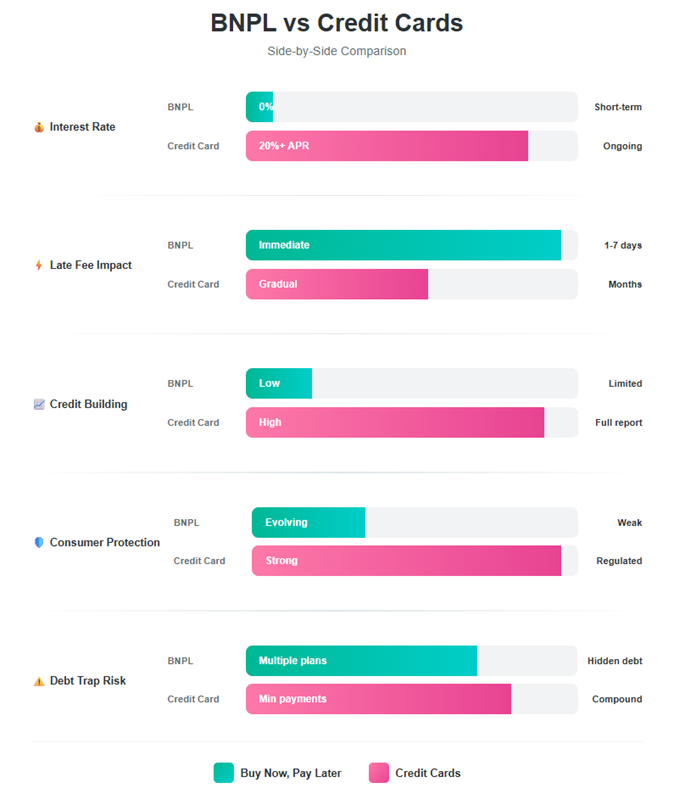

In theory, credit cards reward disciplined users with fraud protection, cashback, and credit score growth. In reality, high interest rates — often exceeding 20% annually — turn carried balances into long-term financial burdens.

In the US and Canada, rising interest rates have pushed average credit card APRs to historic highs. In Europe, regulatory caps exist in some countries, but fees and penalty interest still add up. In the UAE, credit card usage is tightly linked to income documentation, but penalties for late payments can escalate quickly.

The Illusion of “Interest-Free” Spending

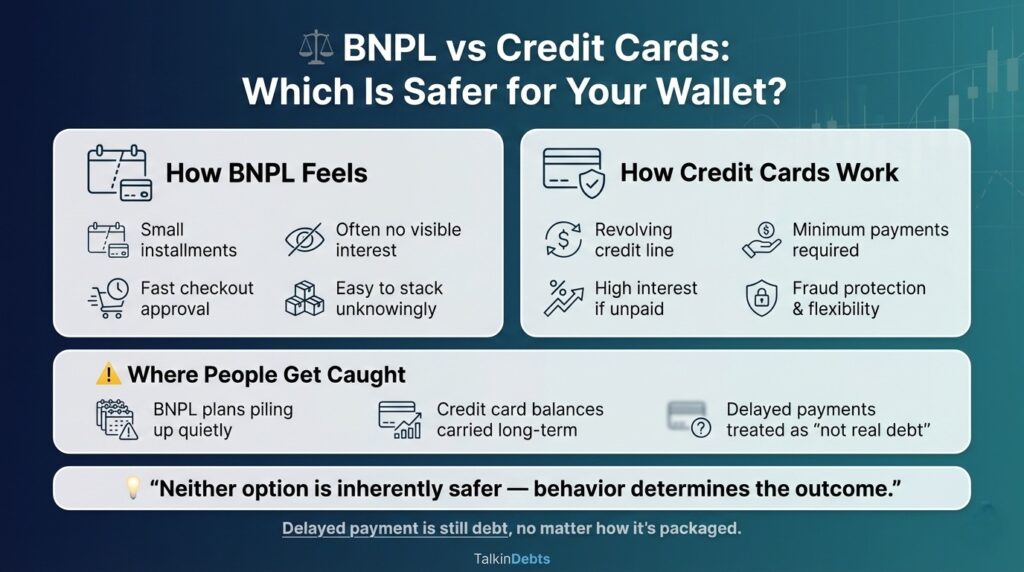

One of the most powerful psychological differences between BNPL and credit cards is how costs are presented.

BNPL emphasizes:

- Small installments

- Short timelines

- Zero-interest messaging

Credit cards emphasize:

- Monthly balances

- Interest rates

- Minimum payments

This framing matters. Consumers using BNPL are more likely to spend more per transaction because the upfront cost feels smaller. Studies across retail markets show higher average order values when BNPL is offered, especially for discretionary items.

The risk is not interest — it’s overcommitment. A consumer may juggle five or six BNPL plans simultaneously without realizing their combined monthly obligation rivals a credit card bill. Missed BNPL payments often trigger late fees, account freezes, and negative reporting once providers escalate collections.

Credit Reporting: A Key Difference Consumers Miss

Credit cards directly impact credit scores in almost all markets. Payment history, credit utilization, and account age all influence long-term creditworthiness.

BNPL reporting varies widely:

- In the US and Canada, many BNPL providers do not fully report positive payment behavior but may report delinquencies.

- In Europe, reporting standards differ by country and provider.

- In the UAE, BNPL credit reporting is evolving and increasingly integrated with local credit bureaus.

This creates an imbalance. Responsible BNPL users may not build credit, while missed payments can still damage future borrowing ability. Credit cards, despite their risks, offer a clearer and more predictable path to credit profile development when managed correctly.

Consumer Protections and Dispute Rights

Another critical difference lies in consumer protection.

Credit cards generally offer:

- Strong fraud protection

- Chargeback rights

- Regulatory oversight

- Transparent dispute mechanisms

BNPL protections are improving but remain inconsistent. Many BNPL providers act as payment intermediaries rather than lenders, limiting consumer recourse when disputes arise. Refund delays, unclear liability during returns, and automated collections processes can create stress for users who assumed BNPL was risk-free.

In regulated markets like Europe, authorities are now moving to bring BNPL under consumer credit laws. In North America, regulators are increasing scrutiny, but protections still lag behind traditional credit. In the UAE, regulation is tightening, but consumer awareness remains low.

Late Payments: Where the Real Damage Happens

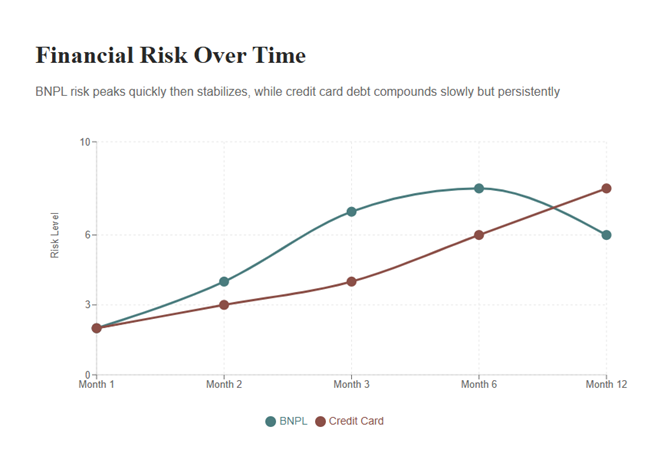

Missed payments reveal the true cost difference between BNPL and credit cards.

With BNPL:

- Late fees are often flat but accumulate quickly

- Accounts may be suspended across multiple merchants

- Automated reminders escalate rapidly

- Some providers transfer accounts to collections faster than expected

With credit cards:

- Interest compounds on unpaid balances

- Penalty APRs may apply

- Minimum payments increase

- Long-term debt cycles become harder to escape

BNPL pain is immediate and sharp. Credit card pain is slower but more financially destructive over time. Neither is forgiving of income instability or poor budgeting.

Regional Risk Differences: North America, Europe, and the UAE

In North America, BNPL appeals to consumers avoiding high interest rates, but lack of regulation creates blind spots around debt accumulation. Credit cards remain deeply embedded in credit scoring systems, making them difficult to avoid entirely.

In Europe, stronger consumer protections reduce extreme outcomes, but BNPL growth among younger consumers raises concerns about hidden debt outside traditional banking oversight.

In the UAE, both BNPL and credit cards are tightly linked to income verification, but aggressive fee structures and rapid collection activity make missed payments especially risky. Consumers often underestimate how quickly financial institutions escalate unpaid balances.

Which Option Is Actually Safer?

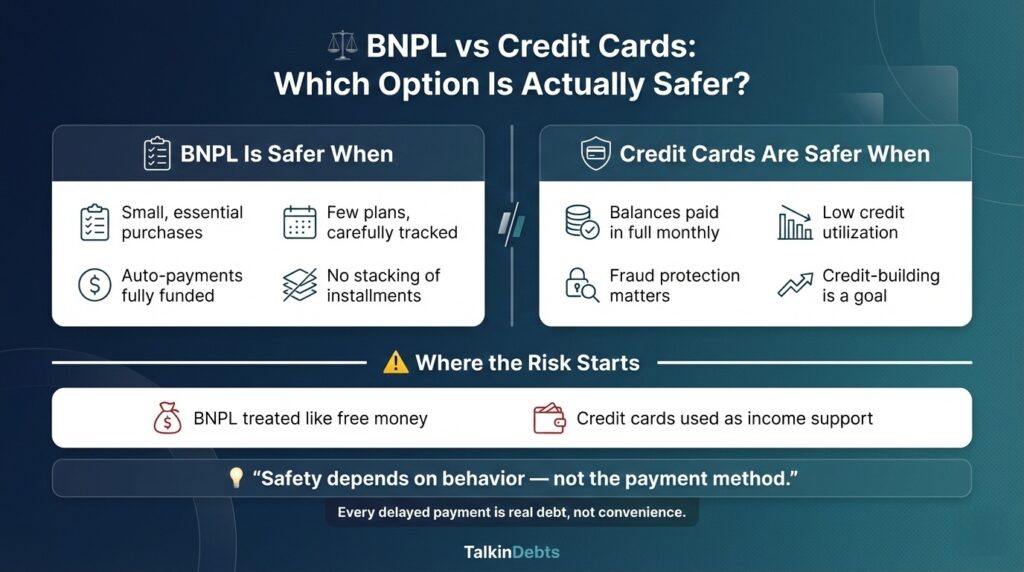

There is no universal winner. Safety depends on behavior, not branding.

BNPL is safer when:

- Purchases are small and essential

- Installments are limited and tracked carefully

- Payments are automated and fully funded

- Users avoid stacking multiple plans

Credit cards are safer when:

- Balances are paid in full monthly

- Spending stays well below credit limits

- Users value fraud protection and flexibility

- Credit score building is a priority

The danger arises when BNPL is used like free money or when credit cards are used as income supplements.

The Bigger Picture: Debt by Design

Both BNPL and credit cards are designed to encourage spending. The difference lies in how transparent the consequences are. Credit cards show their cost loudly. BNPL hides it quietly until payments collide.

In an era of rising living costs and financial pressure, consumers must treat every delayed payment option as real debt — not a convenience feature. The safest wallet is not the one with more payment options, but the one with fewer obligations and clearer limits.

Final Thought

BNPL is not the enemy of financial health, and credit cards are not inherently dangerous. The real risk is misunderstanding how modern credit products are engineered to feel painless upfront while becoming expensive later.

The safer choice is not BNPL versus credit cards — it is awareness versus assumption.