Cost-of-Living Crisis: How Inflation and High Prices Are Increasing Household Debt

The global cost-of-living crisis has evolved from a short-term inflationary spike into a prolonged financial strain affecting households across the United States, the United Kingdom, Europe, and the Middle East. What began as post-pandemic price volatility has now become a structural challenge, where the cost of basic living consistently outpaces income growth. As a result, household debt is rising not due to lifestyle inflation, but because everyday survival is becoming increasingly expensive.

Rising prices for housing, food, energy, healthcare, and transportation have altered household financial behavior. Savings rates are declining, emergency funds are being depleted, and credit is increasingly used to bridge the gap between income and essential expenses. This shift marks a fundamental change in how households manage money—and it carries serious long-term implications for consumers, lenders, and the broader economy.

Inflation and the Erosion of Purchasing Power

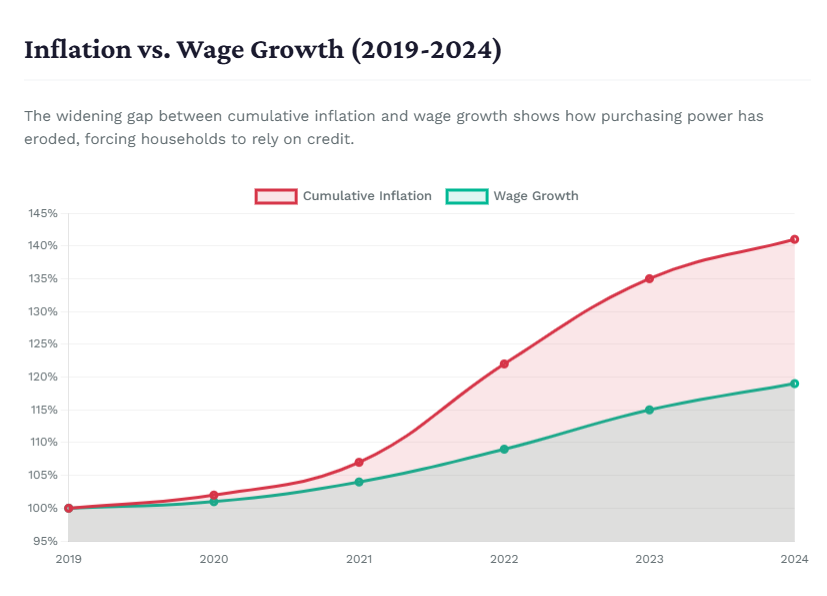

Inflation reduces purchasing power gradually but persistently. Even when headline inflation rates slow, prices rarely return to earlier levels. Instead, households face permanently higher costs for goods and services they cannot avoid. This phenomenon has created a widening mismatch between wages and living expenses.

In many regions, wage increases have been modest and uneven, failing to offset cumulative inflation over recent years. As a result, real income has effectively declined. Households are earning more on paper but affording less in practice. This erosion of purchasing power forces families to rely on credit simply to maintain their standard of living.

Inflation-driven debt accumulation is particularly dangerous because it is unplanned and reactive. Unlike debt taken on for education, property, or business growth, cost-of-living debt offers no long-term return—it merely postpones financial stress.

Housing Costs as the Central Pressure Point

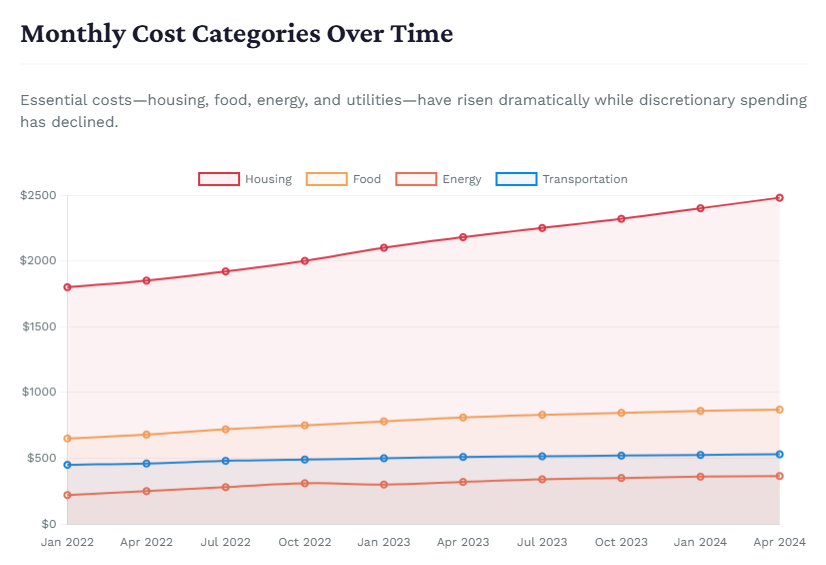

Housing remains the single largest expense for most households, and it is also the fastest-growing contributor to financial distress. Across the US, UK, EU, and Middle Eastern cities, rents have increased sharply due to limited housing supply, population growth, higher construction costs, and rising interest rates.

For renters, frequent rent hikes absorb a growing share of monthly income, leaving little room for savings or discretionary spending. For homeowners, higher mortgage rates have significantly increased monthly repayments, especially for those on variable-rate loans or refinancing cycles.

When housing costs exceed sustainable income thresholds, households often turn to unsecured credit to manage other necessities such as groceries, utilities, and transportation. Housing inflation, therefore, indirectly drives debt growth across multiple expense categories.

Food Inflation and the Rise of Consumption Debt

Food inflation has become one of the most visible and socially impactful elements of the cost-of-living crisis. Supply chain disruptions, climate-related events, energy costs, and geopolitical tensions have all contributed to higher food prices globally.

For households, food is a non-discretionary expense. Families cannot simply cut consumption beyond a certain point. As grocery bills rise, many households rely on credit cards, overdrafts, or short-term loans to manage weekly expenses. Over time, this leads to revolving balances that are difficult to clear, especially in high-interest environments.

This form of debt is particularly concerning because it reflects financial vulnerability rather than financial choice. Debt incurred to cover food expenses is a clear indicator of declining household resilience.

Energy and Utility Costs Intensifying Financial Stress

Energy and utility costs have surged across multiple regions, placing additional strain on household budgets. Electricity, gas, fuel, and water expenses have become more volatile and less predictable, making financial planning increasingly difficult.

In colder or hotter climates, energy usage is unavoidable. Households facing higher utility bills often prioritize keeping essential services active, even if it means delaying other payments or using credit to avoid disconnections. This behaviour increases short-term debt exposure while reducing long-term financial stability.

Utility-related debt also tends to compound quickly through late fees, penalties, and service reinstatement costs, deepening financial stress over time.

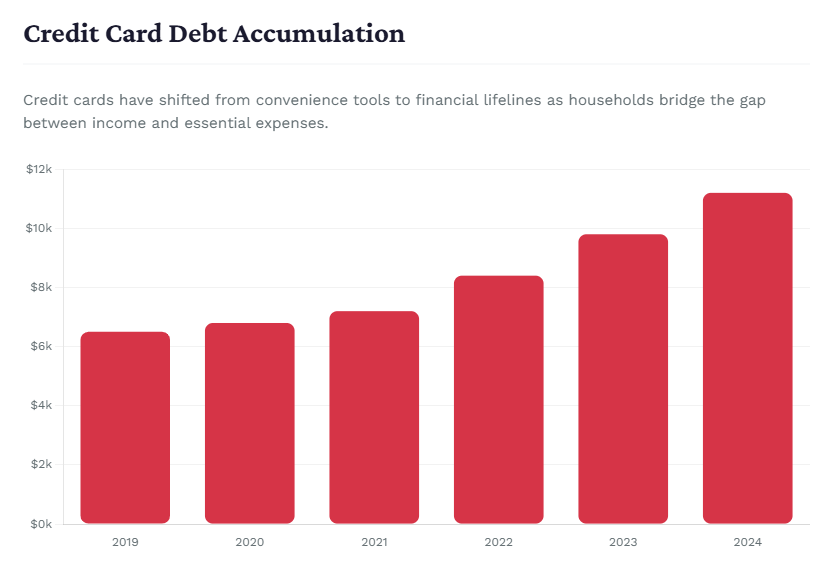

Credit Cards as a Financial Lifeline

Credit cards have shifted from convenience tools to financial lifelines for many households. Rising living costs have driven increased credit utilization, higher balances, and greater reliance on minimum payments.

High interest rates exacerbate the problem. Even modest balances can persist for years when households are unable to pay more than the minimum due. Over time, interest costs inflate total repayment amounts, locking consumers into long-term debt cycles.

This normalization of credit dependence is one of the most significant risks emerging from the cost-of-living crisis. When borrowing becomes routine rather than exceptional, financial vulnerability becomes widespread.

Regional Differences, Common Outcomes

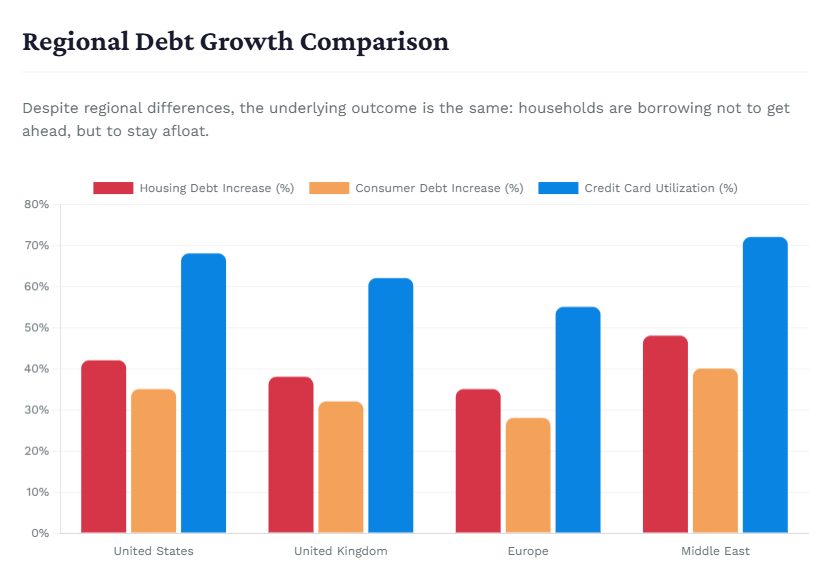

Although the cost-of-living crisis manifests differently across regions, the underlying outcomes are strikingly similar.

In the United States, rising interest rates, healthcare costs, and housing expenses have driven significant growth in consumer debt. Credit cards and personal loans are increasingly used to manage essential spending.

In the United Kingdom and Europe, energy prices, housing shortages, and food inflation have strained household finances despite stronger social protections. Delinquency risks are rising, particularly among lower-income households.

In the Middle East, especially in urban and expatriate-heavy markets, rising rents and living costs have increased dependence on installment plans and personal credit. Income disruption can quickly escalate into serious debt exposure due to limited safety nets for non-citizens.

Across all regions, households are borrowing not to get ahead, but to stay afloat.

The Psychological Burden of Debt-Fueled Living

Financial stress extends beyond numbers. Persistent debt pressure affects mental health, family relationships, workplace productivity, and long-term decision-making. When households operate under constant financial strain, stress becomes chronic rather than episodic.

This psychological burden often leads to avoidance behaviors, delayed engagement with lenders, and missed payments. Over time, credit scores deteriorate, access to affordable credit declines, and financial recovery becomes more difficult.

The cost-of-living crisis, therefore, is not just an economic issue—it is a social and mental health challenge with long-term consequences.

Why Traditional Budgeting Is No Longer Enough

Conventional financial advice emphasizes budgeting, expense reduction, and disciplined saving. While these principles remain relevant, they are increasingly insufficient in an environment where essential costs dominate household spending.

When rent, food, utilities, and transportation consume the majority of income, there is little room for optimization. The issue is not poor financial behavior, but structural affordability constraints. Households cannot budget their way out of systemic price pressures.

This reality calls for a more realistic approach to debt management, one that acknowledges the limits of individual control in a high-cost environment.

Long-Term Risks of Rising Household Debt

Sustained growth in household debt presents long-term risks for both consumers and the broader economy. High debt burdens reduce financial flexibility, making households more vulnerable to job loss, illness, or economic shocks.

For financial institutions, rising unsecured debt increases default risk, particularly as interest rates remain elevated. For economies, debt-driven consumption masks underlying weakness until repayment stress becomes unavoidable, potentially triggering broader slowdowns.

If left unaddressed, the cost-of-living crisis risks embedding debt dependency into everyday financial life.

Implications for Consumers, Lenders, and Policymakers

For consumers, early engagement, realistic repayment planning, and prioritization of essential obligations are critical. Ignoring debt problems only increases long-term costs and stress.

For lenders, the environment demands more sophisticated risk monitoring, proactive customer engagement, and responsible recovery strategies. Long-term portfolio health depends on sustainable repayment, not short-term pressure.

For policymakers, addressing household debt requires tackling root causes: housing supply, energy pricing, wage growth, and access to fair credit. Temporary relief measures may help, but structural reforms are essential for lasting impact.

A Structural Shift in Household Finance

The cost-of-living crisis has fundamentally changed how households interact with money. Debt is no longer a tool reserved for growth or emergencies—it has become a mechanism for survival. This shift has profound implications for financial systems, social stability, and economic resilience.

As inflation and high prices continue to shape daily life, the challenge is not merely managing debt, but preventing its normalization as a permanent condition. The decisions made by households, financial institutions, and governments today will determine whether this crisis leaves a lasting legacy of vulnerability—or becomes a catalyst for more sustainable economic structures.