Credit Card Debt in 2025: Why Minimum Payments Aren’t Enough Anymore

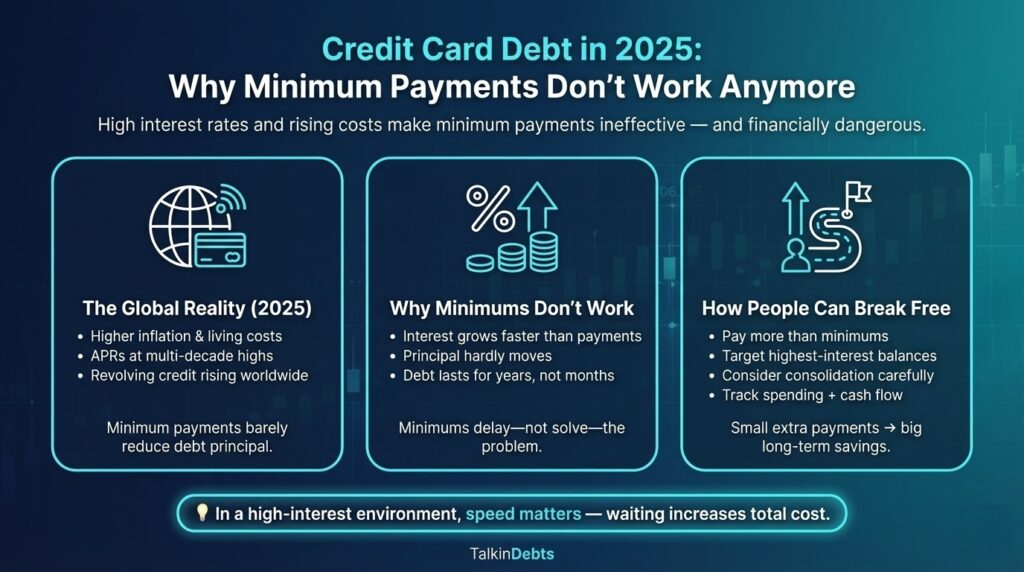

Credit card debt has reached a critical tipping point in 2025. What was once considered a manageable form of short-term borrowing has evolved into one of the most expensive and persistent financial burdens for everyday consumers. Across the United States, Canada, and the European Union, millions of households are discovering that making minimum payments is no longer a path to repayment — it is a slow descent into long-term debt dependency.

Rising interest rates, elevated living costs, and tighter credit conditions have fundamentally altered how revolving debt behaves. Consumers who believe they are “staying on top” of their finances by paying the minimum each month are often moving backwards financially without realizing it. In today’s environment, minimum payments rarely reduce debt in any meaningful way — they simply delay the problem while interest compounds relentlessly.

Understanding why this shift has occurred, and how to escape it, has become one of the most important personal finance challenges of this decade.

The Credit Card Landscape Has Changed — Permanently

The global fight against inflation reshaped consumer credit markets. Central banks in the US, Canada, and the EU raised interest rates aggressively through 2023 and 2024, and by 2025 those increases are fully embedded in credit card pricing.

Average credit card interest rates now sit at levels unseen in decades. Many cards carry APRs exceeding 20 percent, with some far higher for consumers with average or damaged credit. Unlike fixed-rate loans, credit cards adjust quickly to policy changes, meaning borrowers feel the impact almost immediately.

At the same time, household budgets are under strain. Essentials such as housing, groceries, insurance, transportation, and utilities consume a growing share of income. As disposable income shrinks, consumers increasingly rely on credit cards not for convenience, but for survival. This structural shift has turned revolving credit into a long-term liability rather than a short-term bridge.

The old assumptions about “manageable” credit card debt no longer apply.

Why Minimum Payments Fail in 2025

Minimum payments were never designed to eliminate debt. Their purpose is to keep accounts current and lenders protected. In a low-interest environment, they could still allow gradual progress. In today’s high-rate environment, they actively work against borrowers.

Most minimum payments are calculated as a small percentage of the outstanding balance plus interest. When interest rates are elevated, the math becomes punishing:

- A large share of the payment goes toward interest

- Very little reduces the principal balance

- The repayment timeline stretches dramatically

In many cases, borrowers can make payments for years while seeing little to no reduction in what they owe. Any new charges, fees, or interest rate adjustments can completely erase progress.

What feels like responsible behavior — paying on time every month — often masks the reality that debt is barely shrinking, if at all.

The Compounding Effect of High Interest Rates

High interest rates don’t just increase costs; they change outcomes.

Compounding accelerates when APRs rise, meaning interest is charged on previously accumulated interest at a faster pace. Even modest balances can balloon over time, especially when only minimum payments are made.

For consumers carrying multiple cards, the effect is amplified. Interest compounds separately on each balance, creating overlapping repayment timelines that drain cash flow and extend indebtedness.

In the US and Canada, variable-rate cards pass rate hikes directly to consumers. In the EU, stricter consumer credit frameworks offer some protection, but higher borrowing costs and fewer restructuring options make mistakes harder to recover from.

In all regions, time now works in favor of the lender — not the borrower.

The Illusion of Control Created by Minimum Payments

Minimum payments create a dangerous psychological trap.

Seeing a low required payment provides reassurance. It signals compliance, stability, and normalcy — even when the underlying debt is growing. Over time, carrying balances becomes psychologically normalized, shifting from a temporary situation to a permanent condition.

Modern digital banking reinforces this illusion by highlighting “amount due” rather than “interest paid.” Many borrowers are unaware that their payments are servicing interest almost exclusively.

By the time frustration sets in, thousands may already have been lost to interest charges alone.

Breaking this mental cycle is as important as changing the numbers.

Credit Scores, Utilization, and the Hidden Cost of Revolving Debt

The impact of long-term credit card debt extends beyond monthly payments.

High balances increase credit utilization ratios, which are a major factor in credit scoring models. Even consumers who never miss a payment may see their credit scores stagnate or decline.

Lower scores translate into:

- Higher interest rates on future borrowing

- Reduced refinancing options

- Limited access to mortgages, auto loans, or business credit

In 2025’s cautious lending environment, revolving debt is scrutinized more heavily than ever. Consumers trapped in minimum-payment cycles often find themselves locked out of opportunities that could improve their financial position.

Debt becomes both a cost and a barrier.

A Global Problem with Shared Consequences

Although financial systems differ, the struggle is remarkably consistent across regions.

In the United States, strong consumer spending masks rising reliance on debt. In Canada, already-high household debt magnifies the impact of rate increases. Across the European Union, stricter lending rules limit flexibility once balances accumulate.

The common threads are clear:

- Elevated interest rates

- Persistent inflation

- Growing dependence on revolving credit

Together, these forces have rendered minimum payments ineffective as a long-term debt strategy.

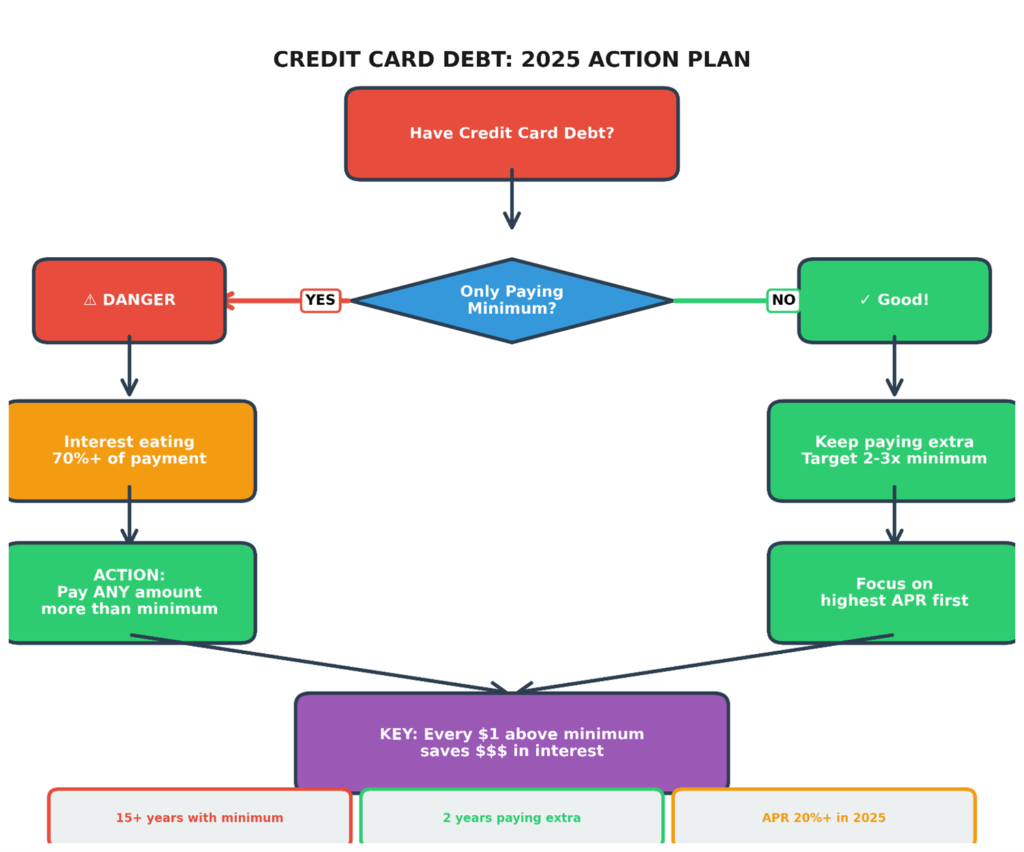

Escaping the Minimum-Payment Trap

In 2025, escaping credit card debt requires intentional action. Passive repayment is no longer sufficient.

The most effective approaches share three principles: reducing interest exposure, accelerating principal repayment, and changing spending behavior.

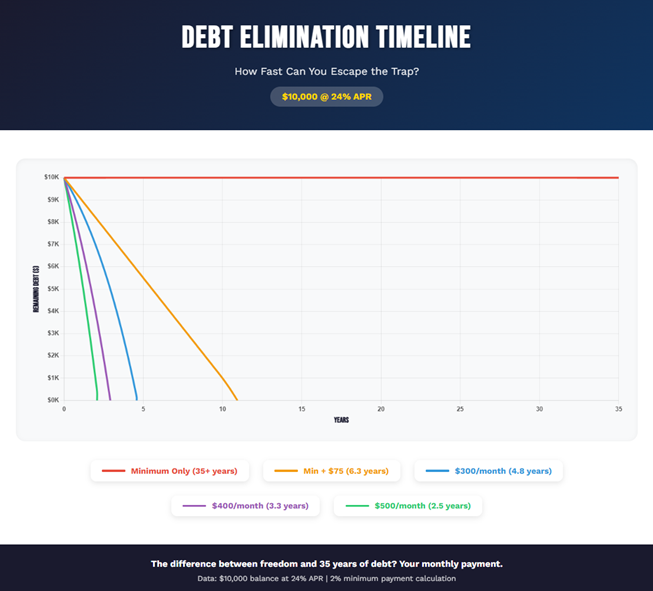

Paying more than the minimum — even slightly — can dramatically shorten repayment timelines by cutting into principal earlier. Prioritizing the highest-interest balances first reduces overall costs and limits compounding damage.

Debt consolidation can help when it genuinely lowers interest rates and simplifies payments, but it must be paired with disciplined spending to avoid repeating the cycle.

For many households, professional guidance provides structure and accountability. Credit counseling and debt advisory services can help renegotiate terms, create sustainable repayment plans, and prevent further deterioration.

The critical factor is commitment. Without a clear plan, debt inertia takes over.

Cash Flow Awareness Is Non-Negotiable

Debt reduction is impossible without understanding cash flow.

In 2025, financial strain often comes not from large expenses but from cumulative small leaks — subscriptions, variable bills, impulse purchases, and lifestyle creep. These erode repayment capacity quietly and consistently.

Tracking actual spending, rather than estimated budgets, often reveals room to redirect funds toward debt repayment. Even modest reallocations can significantly reduce interest costs over time.

Control, not deprivation, is the goal.

The Cost of Waiting

Many consumers delay action, hoping interest rates will fall or income will rise. This assumption is costly.

Even if rates stabilize, balances accumulated at today’s levels continue compounding. Every month without meaningful principal reduction increases total repayment costs.

Waiting is no longer neutral — it actively benefits creditors.

In a high-interest environment, speed matters.

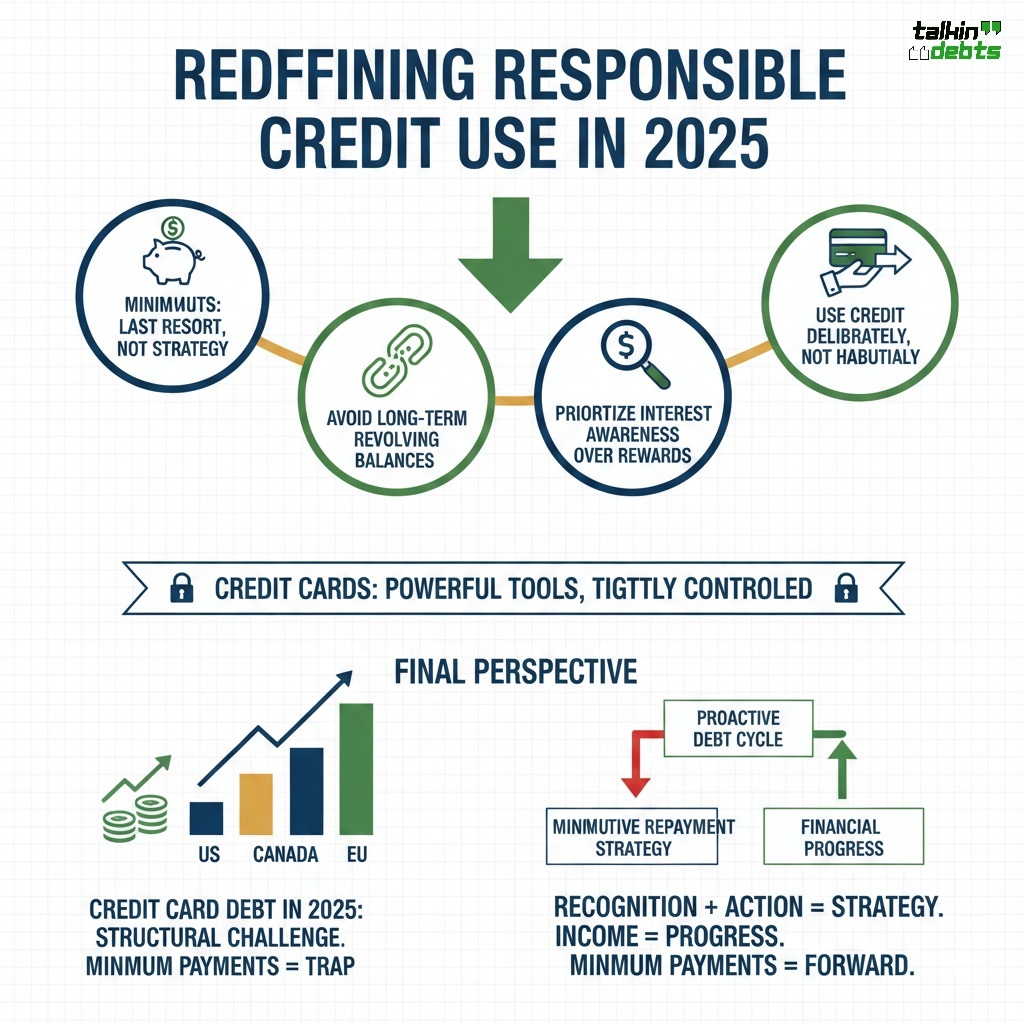

Redefining Responsible Credit Use in 2025

Responsible credit use has evolved.

It now means:

- Treating minimum payments as a last resort, not a strategy

- Avoiding long-term revolving balances

- Prioritizing interest awareness over rewards and perks

- Using credit deliberately, not habitually

Credit cards remain powerful tools — but only when tightly controlled.

Final Perspective

Credit card debt in 2025 represents a structural financial challenge, not a personal failure. Rising interest rates and economic pressure have transformed minimum payments from a safety net into a trap that quietly drains wealth and limits opportunity.

Across the US, Canada, and the EU, consumers face the same truth: paying the minimum is no longer enough. Without proactive repayment strategies, balances will linger longer and cost more than ever before.

Financial recovery begins with recognition and action. In today’s environment, the difference between progress and stagnation is not income — it is strategy.

Minimum payments may keep accounts current, but they no longer move consumers forward.