Debit Card vs Credit Card: The Smart Guide to Choosing the Right One Every Time

You’re probably using the wrong card for most purchases — here’s how to fix it.

Most people use their debit and credit cards without thinking twice about which one is actually the smartest choice in the moment. But the truth is, your choice of card can affect your budget, your credit score, your safety, and even how much free money (rewards) you earn.

This guide breaks everything down in plain English, so you always know which card to swipe and when.

Credit Card vs Debit Card: How to Decide What to Use and When

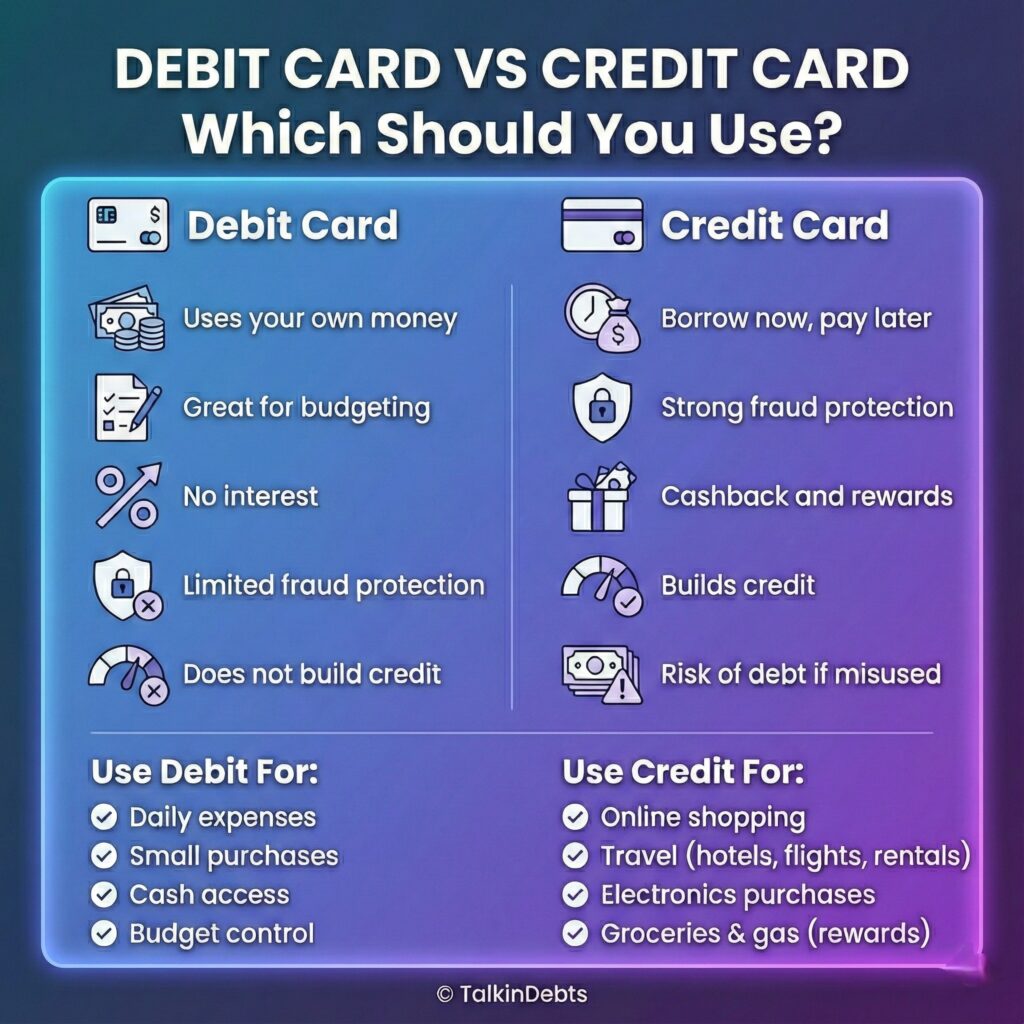

1. Debit Card: What It Really Does

A debit card pulls money directly from your bank account. If you make a $50 purchase, $50 instantly disappears from your checking account.

Pros of Debit Cards

- Great for budgeting

- No interest charges

- No risk of building debt

- Good for cash withdrawals

Cons of Debit Cards

- Weak fraud protection

- No rewards (or very few)

- Can cause overdraft fees

- Doesn’t build credit

Debit cards are best for people who prefer simple spending and want to avoid debt entirely.

2. Credit Card: How It Works

A credit card lets you borrow money up to a limit and pay it back later. If you pay your balance in full each month, you avoid interest and basically get a free short-term loan.

Pros of Credit Cards

- Excellent fraud protection

- Cashback, travel rewards, perks

- Builds credit

- Purchase protection & extended warranties

Cons of Credit Cards

- Easy to overspend

- High interest if mismanaged

- Late fees

- Temptation to carry a balance

Credit cards are powerful tools — but only if you use them responsibly.

3. Spending Control vs Rewards

Debit card = better control

When you pay with a debit card, you feel the money leave your account immediately. Psychologically, this makes you think twice before overspending.

Credit card = better rewards

Many credit cards offer:

- Cashback

- Airline miles

- Hotel points

- Category bonuses (groceries, gas, dining)

If you pay off the card every month, these rewards can add up to hundreds or even thousands of dollars per year.

Which is better?

If you struggle with overspending → Debit card

If you pay your card on time every month → Credit card (for the rewards)

4. Fraud Protection: Credit Cards Win Easily

If someone steals your debit card, the money is gone from your bank account until the bank investigates. This can take days — sometimes weeks.

If someone steals your credit card, the charge hits your credit line, not your bank account. It’s easier to dispute and is usually removed instantly.

If you’re buying something from a place you don’t fully trust (online shops, unfamiliar stores), use your credit card.

5. Overspending Risk

Credit cards make spending feel “invisible.” You don’t feel the pain of paying until the monthly bill arrives. That’s why credit card debt is so common.

Debit cards keep you grounded. You see your balance drop in real time.

A simple rule:

If the purchase is emotional — like impulse shopping — use debit.

If the purchase is planned — like groceries or gas — credit cards are safe.

6. Fees and Interest

Debit Card Fees

- Overdraft fees

- ATM withdrawals (out of network)

- Monthly maintenance fees from some banks

Credit Card Fees

- Interest (only if you carry a balance)

- Annual fees (for premium cards)

- Late payment fees

If you pay your credit card in full every month, interest doesn’t matter — you avoid it completely.

7. Credit Score: Why Credit Cards Matter More

Debit cards don’t affect your credit score. At all.

Credit cards help build (or hurt) your credit score by affecting:

- Payment history

- Amount of credit used

- Length of credit history

If you want to qualify for:

- A car loan

- A mortgage

- Lower insurance rates

- Better apartments

You need a solid credit score. A well-managed credit card is one of the easiest ways to build one.

8. Everyday Purchases: Which Card Should You Use?

Here’s a quick guide:

- Groceries

Use a credit card for rewards. Pay it off monthly.

- Gas & Transportation

Credit card — many offer extra cashback here.

- Online Shopping

Always use a credit card — better fraud protection.

- Subscriptions

Either works, but a credit card avoids accidental overdrafts.

- Dining Out

Credit cards often have restaurant rewards.

- Medical Payments

A credit card is safer if you need dispute protection.

9. Large Purchases

Buying electronics, furniture, or appliances?

Use a credit card because it often includes:

- Extended warranty

- Purchase insurance

- Price protection

- Easier dispute process

Debit cards rarely offer these protections.

10. Travel Purchases

Never use a debit card for:

- Hotels

- Flights

- Car rentals

- Foreign transactions

Hotels and rental companies place holds on your card. On a debit card, that hold blocks your actual money, which is frustrating and risky.

Credit cards handle travel much better and offer:

- Rental car insurance

- Trip cancellation coverage

- Lost luggage reimbursement

- No foreign transaction fees (depends on card)

11. Budgeting With Both Cards

A smart system that many people use:

1. Debit card for daily spending limits

Great for keeping your weekly budget under control.

2. Credit card for planned expenses

Groceries, gas, bills — pay it off monthly and earn rewards.

3. Another credit card for travel

If you travel often, a travel card saves a ton of money.

12. Pros & Cons Summary Table

| Feature | Debit Card | Credit Card |

| Spending control | Excellent | Weak |

| Fraud protection | Average | Strong |

| Rewards | Low/None | High |

| Builds credit | No | Yes |

| Overspending risk | Low | High |

| Interest | None | Possible |

| Purchase protection | Weak | Strong |

| Travel benefits | None | Excellent |

13. When You Should Use a Debit Card

- You struggle with overspending

- You want simple budgeting

- You prefer avoiding debt entirely

- You’re making small, everyday purchases

- You’re withdrawing cash

14. When You Should Use a Credit Card

- Online purchases

- Travel bookings

- Large purchases

- Groceries & gas (for rewards)

- You want to build credit

- You want fraud and purchase protection

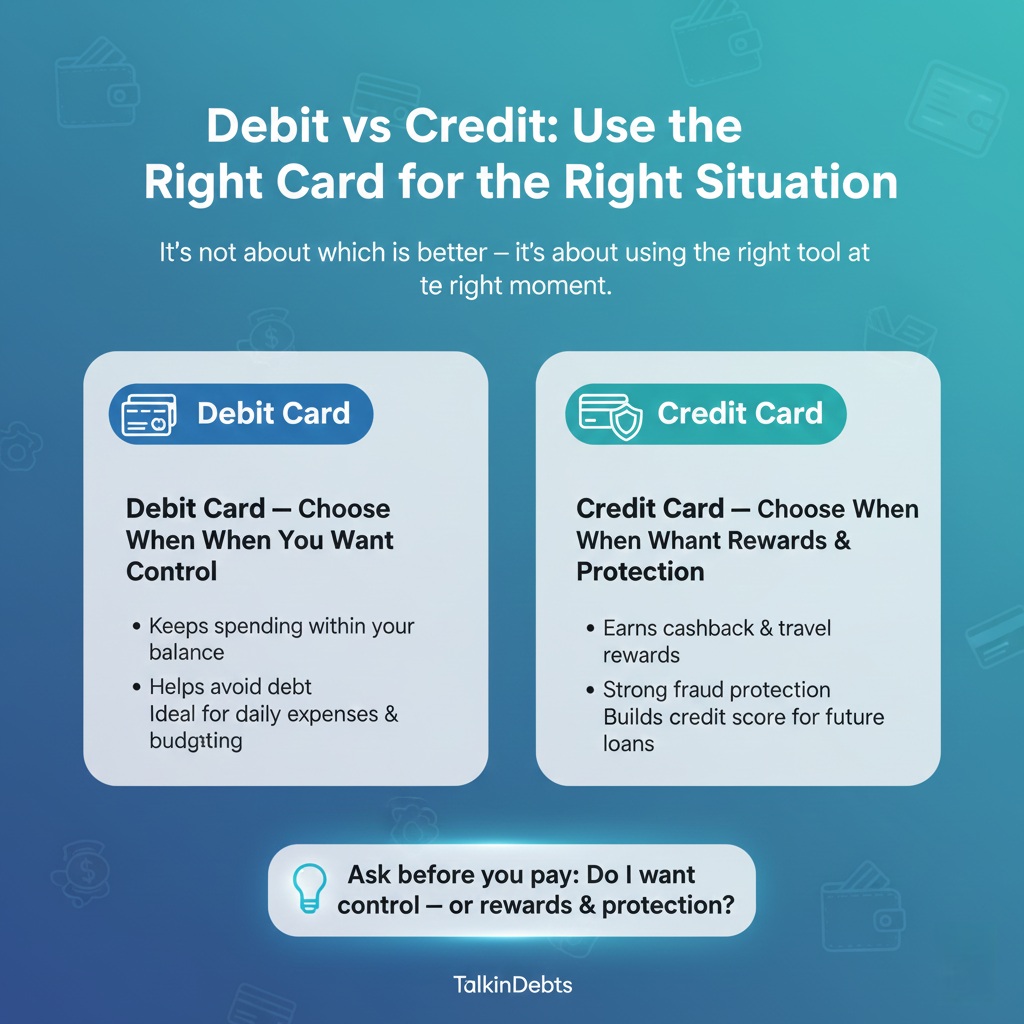

Conclusion

Choosing between a debit card and a credit card isn’t about which one is “better” — it’s about using the right card in the right situation. Think of them like two tools in a toolbox. A debit card keeps your spending under control and helps you avoid debt. A credit card protects you from fraud, earns rewards, and builds your credit score.

If you pay attention to where each card shines, you’ll earn more, stay safer, and avoid the financial traps that many people fall into. The next time you reach for your wallet, ask yourself: Do I want control, or do I want rewards and protection? The answer will tell you exactly which card to use.

FAQs

1. Can I use a credit card like a debit card?

Yes — if you pay your balance in full every month, you avoid interest and basically use it like a debit card with extra benefits.

2. Is it bad to only use a debit card?

Not bad, but you won’t build credit, and you miss out on rewards and stronger protections.

3. Will using a credit card hurt my credit score?

Not if you pay on time and keep your balance below 30% of your limit.

4. Should teenagers start with a debit or credit card?

Debit first for spending control. Credit card later to build credit responsibly.

5. How many credit cards should I have?

Most people do well with 1–3 cards, depending on their needs and discipline.