Digital Debt Solutions: Can Fintech Really Save You from Debt?

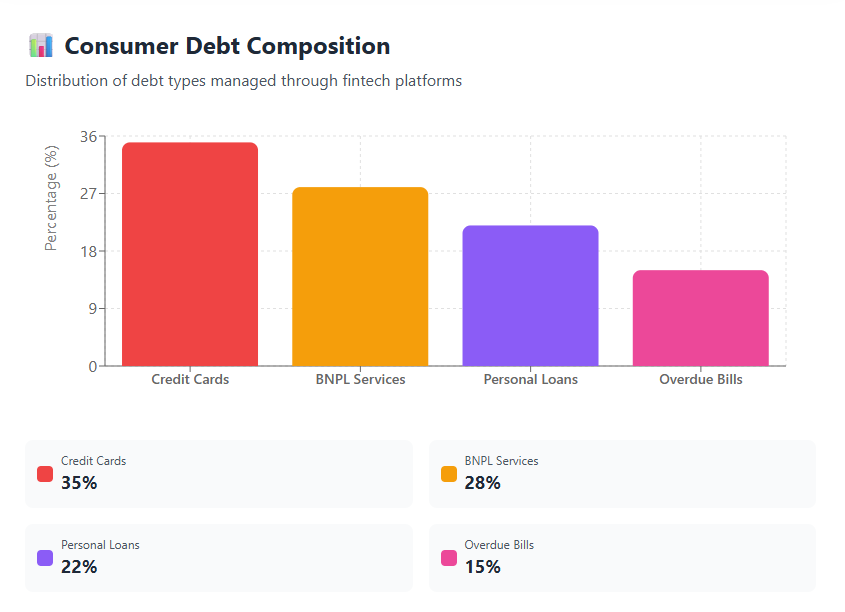

The global financial landscape has shifted dramatically in the last decade, and nowhere is the change more visible than in how consumers manage their debt. Fintech companies have transformed budgeting, borrowing, and repayment through digital tools that promise speed, transparency, and personalised insights. The result is a growing belief that technology can solve one of the most persistent problems in modern life: rising personal debt.

But can fintech truly save people from the growing burden of credit card balances, personal loans, buy-now-pay-later (BNPL) plans, and overdue bills? Or is this shift simply adding another layer of digital complexity? Understanding how these tools work—and their limitations—can help consumers make smarter decisions in an increasingly connected financial world.

The Rise of Digital Debt Solutions

Fintech innovation took off at a time when traditional banks were slow to change. Consumers wanted faster access to credit, easier budgeting tools, and simplified ways to track spending. Fintechs responded by building products that turned complicated financial tasks into streamlined digital experiences.

Today, millions rely on debt management apps, AI-driven budgeting tools, robo-advisors, and online consolidation platforms to keep their finances healthy. The appeal is obvious: everything happens on your phone, 24/7, with personalised alerts and recommendations that traditional institutions rarely offer.

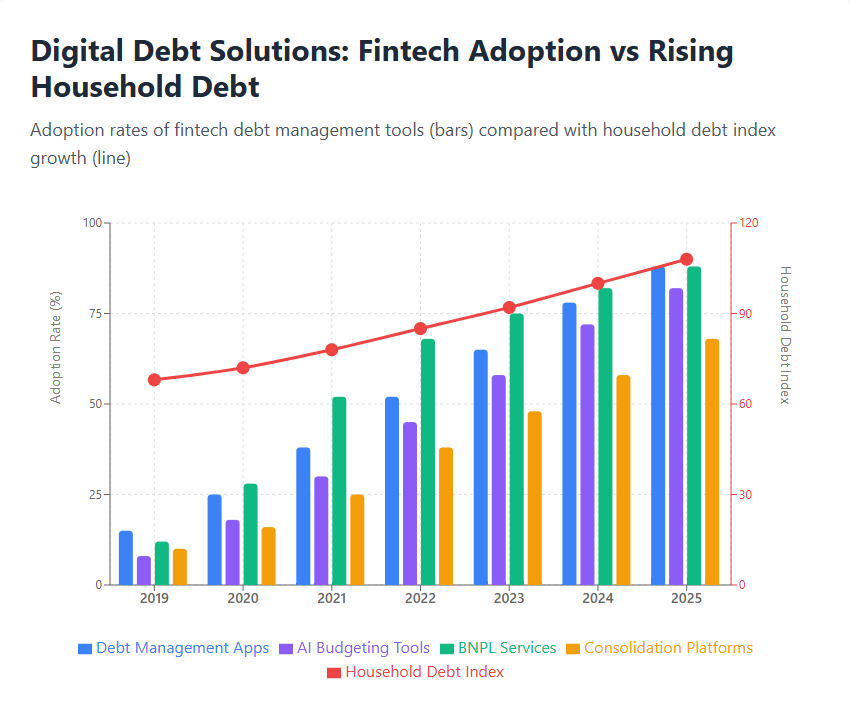

Growing Demand for Tech-Based Financial Help

The surge in global debt has contributed significantly to the adoption of these tools. As households struggle with inflation, stagnant wages, and rising borrowing costs, people are seeking solutions that give them greater control over their finances. Digital debt tools deliver real-time spending breakdowns, automatic repayment reminders, and predictive analytics showing how long it will take to clear balances.

In an age where financial stress is widespread, the promise of clarity and control resonates strongly.

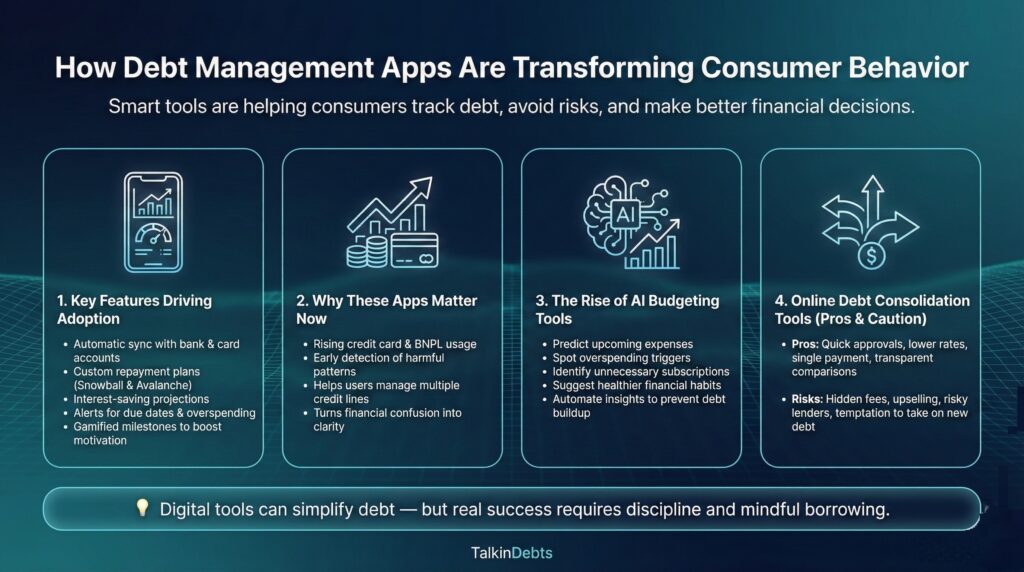

How Debt Management Apps Are Changing Consumer Behaviour

Debt management apps simplify the process of tracking multiple accounts, calculating interest, and creating payoff goals. Many offer automated strategies such as snowball and avalanche payoff methods, helping users see a clear path to becoming debt-free.

Key Features Driving Adoption

- Automatic sync with bank accounts and credit cards for real-time debt updates

- Custom repayment plans tailored to income and spending habits

- Interest-saving projections showing how small payment changes impact timelines

- Alerts for due dates, overspending, and risk behaviours

- Gamification, which motivates users by rewarding progress

These tools are especially helpful for people who rely on BNPL services, small short-term loans, or multiple credit lines. Instead of juggling statements manually, users can see their entire debt landscape in one clean dashboard.

Why These Apps Matter Now More Than Ever

Household borrowing continues to rise across the world. Credit card debt is increasing at the fastest pace in over a decade in several economies, and BNPL usage has become a default payment method for younger consumers. Debt management apps intervene early by helping users identify dangerous patterns before they turn into emergencies.

With proper use, they can turn financial confusion into actionable insight.

AI Budgeting Tools: From Prediction to Prevention

One of the most groundbreaking developments in fintech is the integration of artificial intelligence in budgeting and spending analysis. These tools go far beyond simple expense categorisation—they actively forecast future spending and alert users before they fall into debt traps.

How AI Budgeting Tools Work

AI analyzes your historical spending, income patterns, and habits to:

- Predict upcoming expenses

- Highlight overspending triggers

- Suggest personalised budget adjustments

- Identify unnecessary subscriptions

- Recommend healthier financial behaviours

The biggest advantage is automation. Instead of manually inputting data, users receive instant insights that help prevent debt, not just manage it.

Why AI Matters in Debt Prevention

Traditional budgeting often fails because it requires discipline and constant monitoring. AI-based tools take the pressure off by doing the heavy lifting. This reduces friction and increases the likelihood that users will stick to long-term financial plans.

By identifying risks early—such as upcoming loan instalments or recurring expenses—AI helps consumers avoid missed payments and penalty fees, which are major contributors to growing debt.

Online Debt Consolidation Services: Convenience with Caution

Digital consolidation platforms make it extremely easy to merge multiple debts into a single loan, often at a lower interest rate. This streamlined approach is appealing, especially for consumers overwhelmed by high-interest credit card bills.

Advantages of Online Consolidation

- Quick approvals compared to traditional banks

- Lower interest rates for qualified borrowers

- One single monthly payment instead of multiple bills

- Transparent comparisons between lenders

- Instant eligibility checks without affecting credit score

These platforms remove bureaucratic barriers, helping users take control of their financial lives faster.

Potential Risks and Limitations

Despite their benefits, not all consolidation offers are favourable. Some platforms advertise low rates but approve customers at much higher ones. Others charge hidden fees or connect borrowers with lenders who engage in aggressive upselling.

Consumers also risk becoming overconfident after consolidating their debt and may take on new credit, restarting the cycle. Consolidation is a tool, not a solution—its success depends on disciplined spending habits.

Can Fintech Really Save You from Debt? A Balanced View

Fintech debt solutions can be powerful, but they are not magic. The answer depends on how consumers use these tools and how disciplined they remain.

Where Fintech Excels

- Provides clarity through real-time tracking

- Improves accountability with alerts and insights

- Encourages proactive behaviour

- Democratises financial advice, making it accessible to everyone

- Reduces friction and complexity in managing multiple debts

Technology helps create structure, visibility, and motivation—three factors that significantly improve debt repayment outcomes.

Where Fintech Falls Short

- Apps cannot change spending habits on their own

- Debt solutions may oversimplify complex financial situations

- Some platforms focus more on user acquisition than genuine support

- People may rely too heavily on technology instead of building financial discipline

Fintech is a tool, not a replacement for financial responsibility.

Data Privacy Concerns: A Growing Issue with Digital Debt Tools

As helpful as fintech apps are, they collect sensitive financial data that must be handled responsibly. Many users do not realise how much information they share—including income, spending behaviour, bill payments, and credit card details.

Major Privacy Risks

- Data sharing with third-party advertisers

- Selling user behaviour insights for profit

- Risk of hacks or data breaches

- Lack of clear disclosure on storage and usage

Debt information is deeply personal. If misused, it can lead to discrimination, targeted manipulation, or financial exposure.

How Consumers Can Protect Themselves

- Choose apps that offer end-to-end encryption

- Read privacy policies before signing up

- Avoid apps that require unnecessary permissions

- Use strong authentication methods

- Periodically review connected accounts

Privacy should never be sacrificed for convenience.

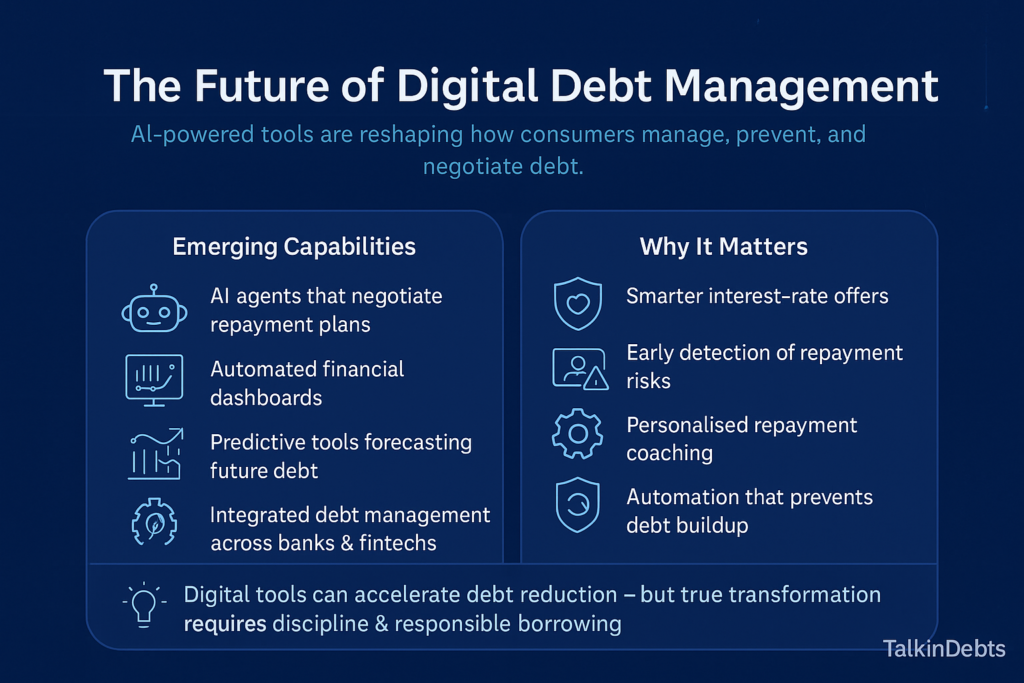

The Future of Digital Debt Management

Fintech is evolving rapidly. AI-driven risk scoring, predictive savings tools, personalised repayment coaching, and automated negotiation systems represent the next wave of innovation. These technologies may help consumers secure better interest rates, renegotiate overdue accounts, or prevent debt from accumulating in the first place.

The future will likely include:

- AI agents that negotiate repayment plans

- Fully automated financial dashboards

- Predictive tools that anticipate debt months in advance

- Integrated debt management across banks and fintechs

- Stronger regulations on data privacy

As adoption grows, fintech companies will refine their systems, governments will introduce stronger consumer protections, and users will gain more control over their financial futures.

Final Thoughts

Digital debt solutions offer real benefits, but they are not one-size-fits-all. Fintech can empower consumers with clarity, structure, and personalised insights—but true financial transformation depends on consistent behaviour, responsible borrowing, and long-term discipline.

If used wisely, digital tools can absolutely help people reduce debt faster and avoid common financial pitfalls. The key is understanding both the advantages and the limitations, and choosing platforms that prioritise transparency and privacy.

Fintech may not be able to “save” every consumer from debt, but it can make the journey far more manageable—and far more informed.