How Fast Will Your Money Grow? — The Ultimate Growth Rules Chart

Understanding how fast your money can grow is one of the most powerful skills in personal finance. Whether you’re saving for retirement, investing in mutual funds, or building your emergency fund, knowing how quickly your money can double, triple, or even quadruple helps you make smarter financial decisions.

The good news?

You don’t need complex formulas or a finance degree.

Just a few simple “Growth Rules” can predict how long it takes for your investment to multiply.

This guide breaks down the most popular shortcuts — Rule of 72, 114, 144, 115, and more — and includes a Growth Rules Chart to make your planning easier.

✅ What Are Money Growth Rules?

Money growth rules are simple mental shortcuts used by investors, financial planners, and wealth coaches to estimate how long an investment will take to grow based on a fixed interest/return rate.

These rules are easy to remember, work with any long-term investment, and help you:

- Compare investment options

- Set realistic financial goals

- Predict long-term wealth

- Avoid overestimating returns

Let’s break them down one by one 👇

📈 1. Rule of 72 — The Double Rule

How long will it take to DOUBLE your money?

Formula:

72 ÷ Interest Rate = Years to Double

Example

If you earn 8% annual return:

72 ÷ 8 = 9 years to double

Why it matters

This rule is the most widely used because doubling your money is a key milestone in long-term investing.

📈 2. Rule of 114 — Triple Your Money

How long will it take to TRIPLE your money?

Formula:

114 ÷ Interest Rate = Years to Triple

Example

At 10% return:

114 ÷ 10 = 11.4 years

Use case

Perfect for estimating long-term wealth growth or retirement planning.

📈 3. Rule of 144 — Quadruple Your Money

How long will it take to 4X your money?

Formula:

144 ÷ Interest Rate = Years to Quadruple

Example

At 12% return:

144 ÷ 12 = 12 years

Why it’s useful

Great for evaluating aggressive, long-term investment strategies.

📈 4. Rule of 115 — Compounding Accuracy Rule

How long until your money grows through compound interest?

Formula:

115 ÷ Interest Rate = Years for 2.5× Growth (approx.)

This rule gives a more precise compounding estimate compared to Rule of 72.

Example

At 7% return:

115 ÷ 7 = 16.4 years

📉 5. Rule of 70 — Inflation Loss Rule

How long before inflation halves your purchasing power?

Formula:

70 ÷ Inflation Rate = Years to Lose Half Your Money’s Value

Example

If inflation is 5%:

70 ÷ 5 = 14 years

Why this matters

Even if your money grows, inflation can silently reduce your wealth. Always compare investment returns after adjusting for inflation.

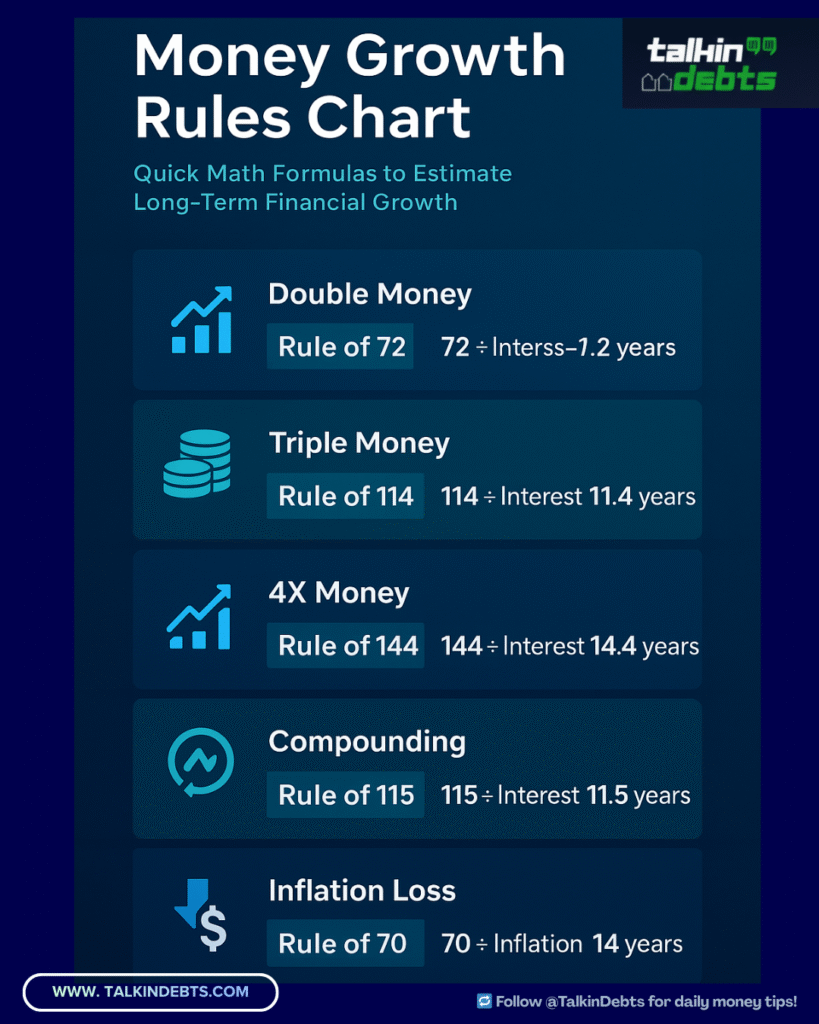

🧮 Ultimate Money Growth Rules Chart

| Growth Goal | Rule | Formula | Example (10% return) |

| Double Money | Rule of 72 | 72 ÷ Interest | 72 ÷ 10 = 7.2 years |

| Triple Money | Rule of 114 | 114 ÷ Interest | 114 ÷ 10 = 11.4 years |

| 4X Money | Rule of 144 | 144 ÷ Interest | 144 ÷ 10 = 14.4 years |

| Compounding | Rule of 115 | 115 ÷ Interest | 115 ÷ 10 = 11.5 years |

| Inflation Loss | Rule of 70 | 70 ÷ Inflation | 70 ÷ 5 = 14 years |

This chart makes it easy to compare and visualize how your money behaves over time.

⭐ Why These Rules Matter for Every Investor

✔ Helps you choose better investments

Instead of guessing, you can estimate real growth and choose faster-growing opportunities.

✔ Helps avoid low-return traps

If an investment offers just 3% return, Rule of 72 tells you it takes 24 years to double — not ideal.

✔ Helps track inflation impact

Even if your bank savings offer 4%, inflation at 6% means you’re losing value every year.

✔ Helps plan your financial future

Whether you’re saving for college, retirement, or a house, these rules simplify complex planning.

💡 Real-Life Scenarios Using Growth Rules

1️⃣ Saving for Retirement

If your mutual fund returns 10%, your money doubles every 7.2 years.

Invest at age 25 → you may double 4–5 times before retirement.

2️⃣ Building a Child Education Fund

If you invest $200/month at 12%, the money could quadruple in about 12 years.

3️⃣ Understanding Inflation Damage

At 7% inflation, your money loses half its value in just 10 years.

🧭 Final Thoughts: Simple Numbers, Powerful Results

Money grows when you understand how it grows.

These rules make complex financial planning incredibly simple — whether you’re a beginner or a seasoned investor.

Remember:

- Higher returns = faster growth

- Longer time = bigger compounding

- Inflation = silent wealth killer

Use these rules to make smarter investment decisions, plan better, and build the financial future you deserve.

✨ Want More Smart Money Tips?

Explore more at TalkinDebts.com — your trusted resource for personal finance, debt management, and smart investing.