Maple Crypto Collapse: How Bitcoin-Backed Loans Are Sinking Alberta Families Amid Regulatory Crackdown

Edmonton, Alberta – September 19, 2025 – The collapse of Maple Crypto, once a rising star in Canada’s digital lending sector, has left thousands of Alberta families facing devastating financial consequences. The company’s Bitcoin-backed loan scheme, once hailed as innovative, has now become a cautionary tale. As regulators move to contain the fallout, the Maple Crypto crisis is reshaping the conversation around cryptocurrency lending in Canada and beyond.

The Rise of Maple Crypto

Founded in 2021 during Bitcoin’s meteoric rise, Maple Crypto positioned itself as a safe bridge between digital assets and traditional finance. It offered Albertans the chance to borrow cash by pledging Bitcoin as collateral, allowing investors to access liquidity without selling their holdings.

Advertising campaigns emphasized stability and innovation, appealing to families, small businesses, and even farmers. “Your Bitcoin works for you,” one campaign declared, promising flexible loans with minimal paperwork. Maple Crypto quickly attracted thousands of clients across Alberta, many of whom already saw crypto as a long-term investment strategy.

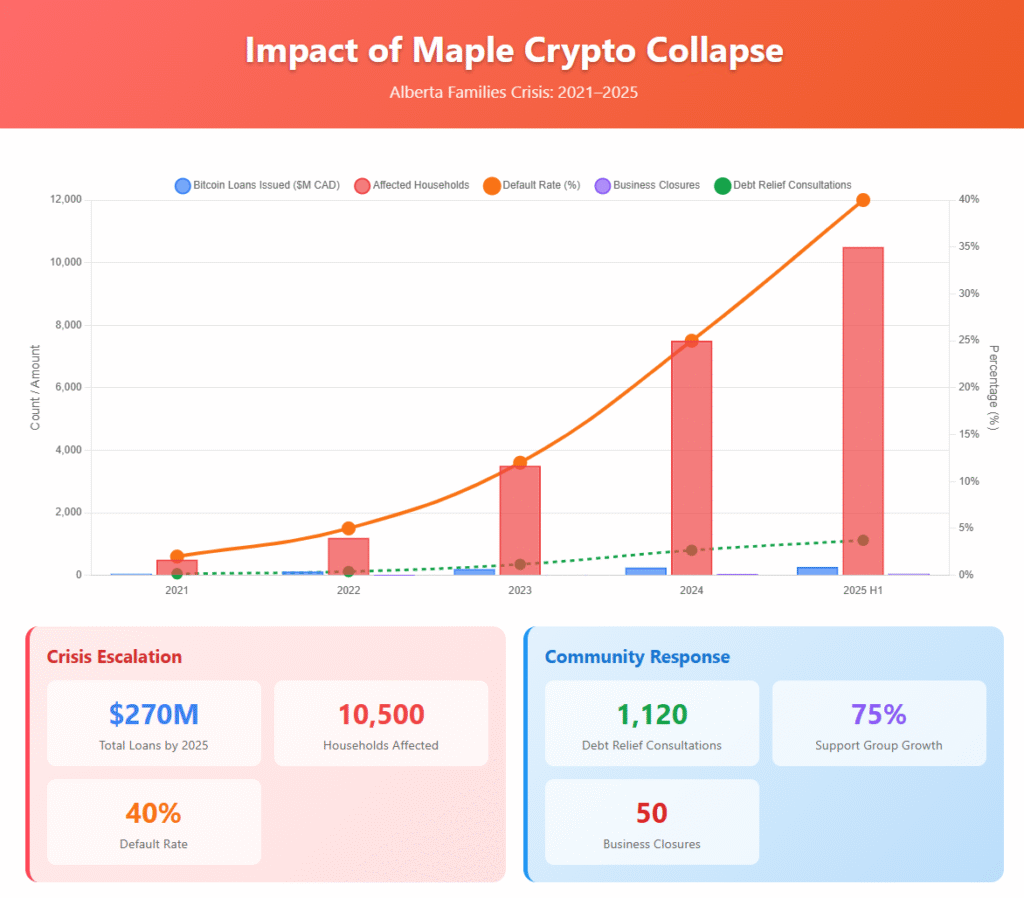

The business model thrived as long as Bitcoin maintained high valuations. At its peak in late 2021, Maple Crypto managed hundreds of millions in loan volume. To many, the company appeared untouchable.

The Collapse: When Prices Fell

The foundation cracked when Bitcoin prices plunged in late 2022, and again during the sharp market downturn of 2025. Maple Crypto’s collateralized loans triggered margin calls across the board. Borrowers unable to meet the demands saw their Bitcoin liquidated at depressed values, often leaving them with outstanding debts but no remaining assets.

A Calgary family who borrowed $50,000 CAD against $100,000 worth of Bitcoin in 2021 saw their collateral sold off when prices fell by more than half. Today, they still owe more than $20,000 CAD, with no crypto savings left.

“This wasn’t just about bad luck,” a financial consultant in Edmonton said. “The structure of these loans guaranteed that ordinary families would be the first to lose when prices dropped.”

Human Cost Across Alberta

The financial toll on households has been severe.

- Small Business Owners: An Edmonton couple who borrowed against their Bitcoin to finance a café saw their holdings liquidated, leaving them without working capital and unable to repay suppliers. Their café shut down this summer.

- Farmers: In rural Alberta, farmers who turned to Maple Crypto to cover seasonal costs say they are now overwhelmed with debt. One farmer near Red Deer explained: “We thought we were securing short-term cash without giving up our Bitcoin. Instead, we lost everything.”

- Young Investors: Many younger Albertans, drawn by the promise of financial independence, borrowed against their digital savings to fund education, vehicles, or housing down payments. Now, many are carrying unsecured debt as they enter an already difficult job market.

Debt relief agencies across the province report a surge in demand for consultations. In Calgary alone, requests for debt management services linked to crypto lending rose by nearly 40 percent in the first half of 2025.

A Regulatory Reckoning in Alberta

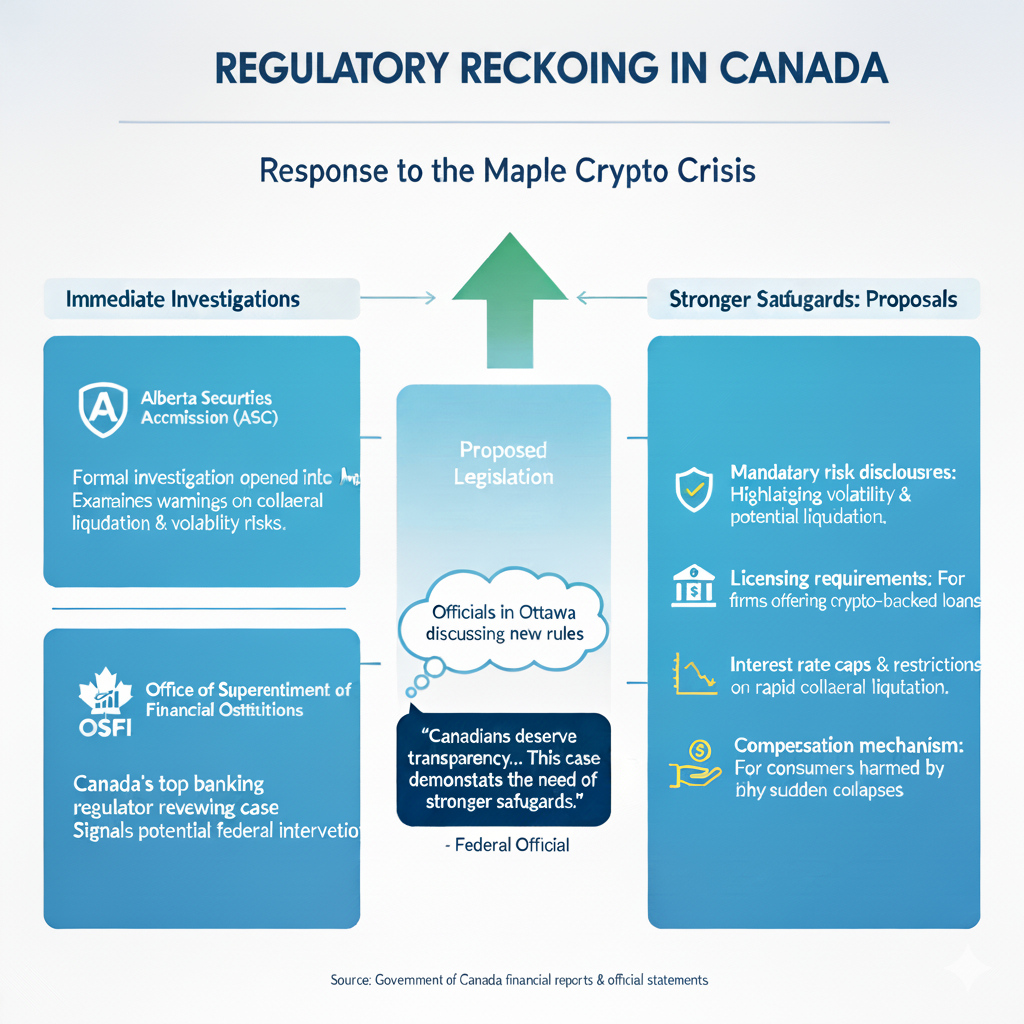

The crisis has triggered an aggressive response from regulators.

The Alberta Securities Commission (ASC) has opened a formal investigation into Maple Crypto, examining whether the company adequately warned clients about the risks of collateral liquidation and volatility.

The Office of the Superintendent of Financial Institutions (OSFI), Canada’s top banking regulator, is also reviewing the case, signaling potential federal intervention. Officials in Ottawa are discussing new legislation that would bring crypto-backed loans under the same rules as high-risk lending products.

“Canadians deserve transparency when engaging with financial services, whether traditional or digital,” one federal official said. “This case demonstrates the need for stronger safeguards.”

Proposals under discussion include:

- Mandatory risk disclosures highlighting volatility and potential liquidation.

- Licensing requirements for firms offering crypto-backed loans.

- Interest rate caps and restrictions on rapid collateral liquidation.

- A compensation mechanism for consumers harmed by sudden collapses.

Global Repercussions

The Maple Crypto collapse is reverberating far beyond Alberta.

In the United States, lawmakers have cited the case in Congressional hearings about digital asset lending. The Securities and Exchange Commission (SEC) is reportedly considering stricter oversight of similar platforms.

In Europe, regulators are using Maple Crypto’s failure as a case study while finalizing the Markets in Crypto-Assets (MiCA) framework. Authorities in Germany and France have flagged crypto lending as an area of “immediate concern.”

Asian markets, too, are reacting. Singapore’s Monetary Authority has announced a review of digital collateral lending practices, while South Korea is considering new consumer protection measures after a rise in crypto-linked bankruptcies.

Alberta’s crisis may become a global reference point for why crypto lending requires international regulation.

Analysts: A Flawed Model

Financial experts argue that Maple Crypto’s failure was inevitable.

“Unlike mortgages or car loans, where collateral retains relatively stable value, Bitcoin can lose half its price in days,” explained a Toronto-based analyst. “That volatility makes these loans inherently unstable.”

Others point to the psychological impact. Borrowers often believed their Bitcoin would eventually rise again, making liquidation especially painful. “It wasn’t just losing money—it was losing the future they thought they were securing,” one financial psychologist said.

Political Fallout in Alberta

Politicians in Alberta face growing pressure from constituents who say they were misled. Opposition lawmakers are calling for a provincial compensation fund, while some government officials argue responsibility lies with federal regulators.

The crisis has also raised broader questions about Alberta’s economic strategy. In recent years, the province promoted fintech innovation as part of its diversification beyond energy. Maple Crypto’s collapse has fueled skepticism about whether Alberta rushed too quickly into supporting an unregulated sector.

Community Impact

Local communities are feeling the aftershocks.

- Housing: Families who used crypto-backed loans for down payments are now struggling with both mortgage and unsecured debt, raising concerns about foreclosures.

- Employment: Small businesses financed through Maple Crypto have shuttered, leading to layoffs and reduced local spending.

- Mental Health: Counselors report rising anxiety and depression linked to financial loss. One Edmonton support group for debt-stressed households has tripled its membership since March.

Comparing Past Crises

Observers are comparing the Maple Crypto collapse to earlier financial disasters.

Some liken it to the 2008 subprime mortgage crisis, where families took on loans they did not fully understand, only to face foreclosure when markets turned. Others draw parallels to the dot-com bubble, where speculative innovation outpaced regulation.

“The difference is scale,” one University of Alberta economics professor noted. “This isn’t global banks collapsing. But for individual households, the pain is just as real.”

Industry Response

The crypto industry has responded with a mix of defensiveness and calls for reform. Some blockchain advocates insist Maple Crypto was poorly managed and does not represent the sector as a whole. Others argue that regulation could prevent future disasters and help rebuild trust.

Several Canadian crypto exchanges have already announced voluntary disclosure initiatives, promising clearer communication about risks. Industry groups are lobbying Ottawa to create “balanced regulation” that does not stifle innovation.

Looking Ahead

For affected families, the focus remains on survival. Debt restructuring, credit counseling, and, in some cases, bankruptcy are becoming common solutions. Lawyers are exploring whether Maple Crypto could face class-action lawsuits.

For policymakers, the challenge is to balance innovation with protection. “Crypto is not going away,” one federal lawmaker acknowledged. “But we cannot allow families to be destroyed by financial products they don’t fully understand.”

A Costly New Era in Alberta

The Maple Crypto collapse has transformed Alberta’s relationship with digital finance. Once seen as a frontier of opportunity, the sector is now viewed with caution and distrust.

For thousands of households, the promise of Bitcoin-backed loans has turned into a cycle of debt and despair. For regulators, the crisis marks the start of a costly new era—one where consumer protection must keep pace with innovation.

As Alberta reckons with the aftermath, its story may stand as both a warning and a lesson for the world: without proper safeguards, the dream of crypto-driven prosperity can quickly become a nightmare of financial ruin.