US & Canada See Early-2026 Spike in Credit Card and Auto Loan Delinquencies

January 2026 | North America

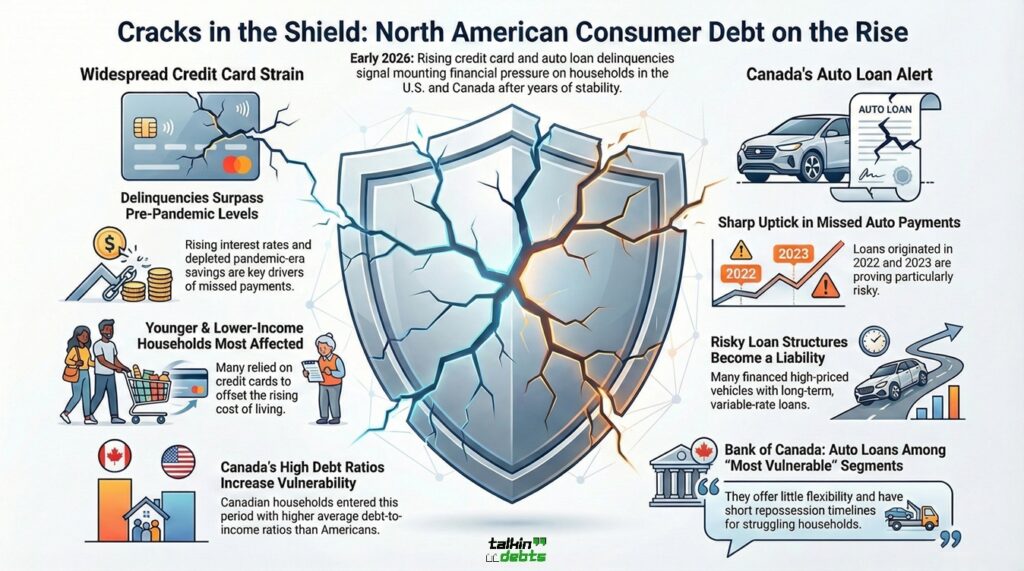

The first economic data sets of 2026 are flashing a warning sign across North America. Both the United States and Canada are recording a noticeable rise in credit card and auto loan delinquencies, pointing to mounting stress within household balance sheets after years of elevated inflation, higher interest rates, and slowing wage growth.

While policymakers had hoped for a “soft landing” following aggressive monetary tightening in 2023–2024, early-2026 numbers suggest that many households are struggling to keep pace with debt repayments—particularly in revolving credit and vehicle financing. Analysts say this trend is not yet a full-blown crisis, but it marks a clear shift in household debt trends that lenders, regulators, and consumers cannot ignore.

Credit Card Delinquencies Climb Across the US and Canada

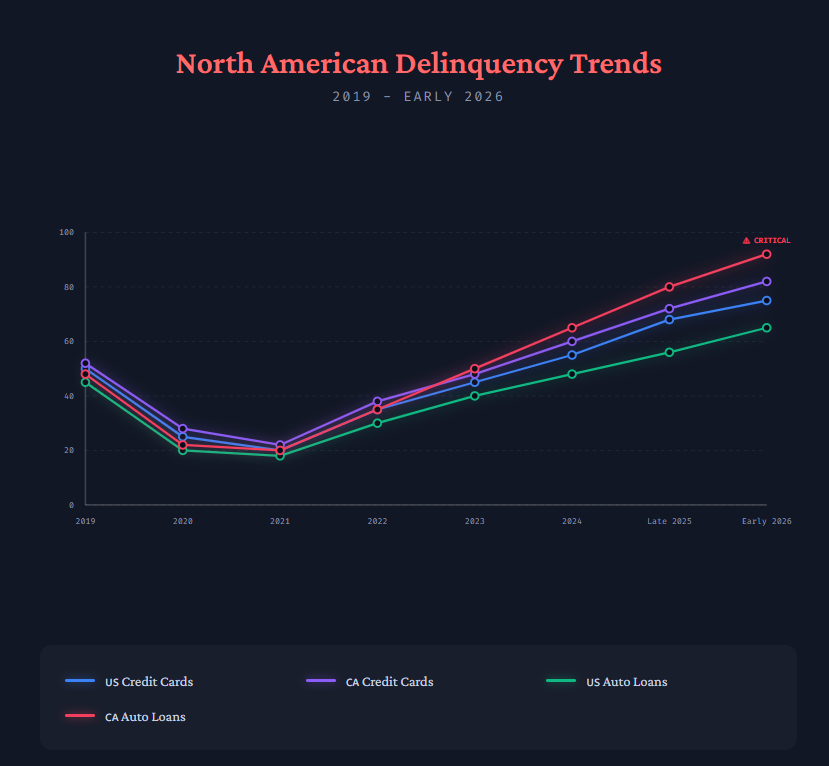

In the United States, data tracked by the Federal Reserve shows that 30-day-plus delinquencies on credit card balances have risen steadily since late 2025, crossing levels last seen before the pandemic stimulus era. Higher minimum payments, interest rates above 20% for many cardholders, and the exhaustion of pandemic-era savings buffers are driving the increase.

Canada is seeing a similar pattern. According to consumer credit reporting agencies, missed payments on credit cards rose sharply in Q4 2025 and continued into January 2026. Economists note that Canadian households entered this period with higher average debt-to-income ratios than their US counterparts, making them especially vulnerable as borrowing costs remain elevated.

The pressure is most acute among younger borrowers and lower-to-middle income households, many of whom relied on credit cards to offset rising living costs over the past two years. Food, rent, utilities, and insurance premiums have outpaced wage growth, pushing everyday expenses onto revolving credit.

Canada Auto Loan Delinquency Emerges as a Key Risk

One of the most closely watched developments is the sharp uptick in Canada’s auto loan delinquency rates. Vehicle financing expanded rapidly during the post-pandemic recovery, fueled by supply shortages, rising vehicle prices, and longer loan terms designed to keep monthly payments manageable.

By early 2026, those extended loan structures will become a liability.

Industry data indicates that delinquencies on auto loans in Canada—particularly loans originated in 2022 and 2023—are climbing faster than expected. Many borrowers financed vehicles at higher prices with variable or semi-variable interest rates, leaving them exposed as rates stayed higher for longer.

The Bank of Canada has acknowledged growing risks in household credit, noting that auto loans now represent one of the most vulnerable segments of consumer debt. Unlike mortgages, auto loans offer little flexibility when budgets tighten, and repossession timelines are relatively short.

For many Canadian households, the vehicle is not optional—it is essential for commuting and work. That reality increases financial stress and forces borrowers to juggle payments, often prioritizing housing costs over auto and credit card obligations.

Household Debt Trends Signal Structural Stress

Beyond short-term delinquencies, the broader household debt trends across North America tell a more concerning story. Total consumer debt continues to rise, even as real incomes struggle to keep pace with inflation-adjusted costs.

In the US, revolving credit balances are near record highs, while non-revolving debt—especially auto loans—remains elevated. In Canada, household debt as a percentage of disposable income remains among the highest in the G7, leaving little margin for error if economic conditions weaken further.

Credit reporting firms such as Equifax and TransUnion have both flagged early-stage delinquencies as a leading indicator of deeper financial strain. While 90-day defaults remain contained for now, the rise in 30- and 60-day late payments suggests that stress is spreading beyond a narrow group of borrowers.

Economists caution that once delinquencies broaden across income brackets, the risk of a feedback loop increases—higher defaults tighten credit standards, which in turn restricts access to refinancing and balance transfers.

Interest Rates Remain the Central Pressure Point

A key driver behind the early-2026 spike is the persistence of higher interest rates. Although inflation has moderated from its 2022 peak, central banks have been reluctant to cut rates aggressively, citing ongoing price pressures in services and housing-related costs.

For consumers, this has translated into:

- Higher credit card APRs

- Increased auto loan refinancing costs

- Reduced access to promotional balance transfers

- Tighter underwriting standards for new credit

In Canada, the prevalence of variable-rate borrowing amplifies the impact. Even modest changes in rates can significantly alter monthly payment obligations, especially for households already stretched thin.

Regional and Demographic Patterns Emerge

Early data suggest that delinquency growth is not evenly distributed. Urban centers with high living costs—such as Toronto, Vancouver, New York, and Los Angeles—are reporting faster increases in missed payments. These regions combine elevated housing expenses with higher transportation and insurance costs.

Younger borrowers are also disproportionately affected. Many entered the credit market during a low-rate environment and are now adjusting to higher payments without the income growth needed to absorb them. At the same time, older borrowers carrying auto loans later into life are facing fixed-income constraints.

Subprime and near-prime borrowers remain the most vulnerable, but analysts note a gradual spillover into prime credit tiers—often a sign that economic pressure is becoming systemic rather than isolated.

What This Means for Lenders and Credit Markets

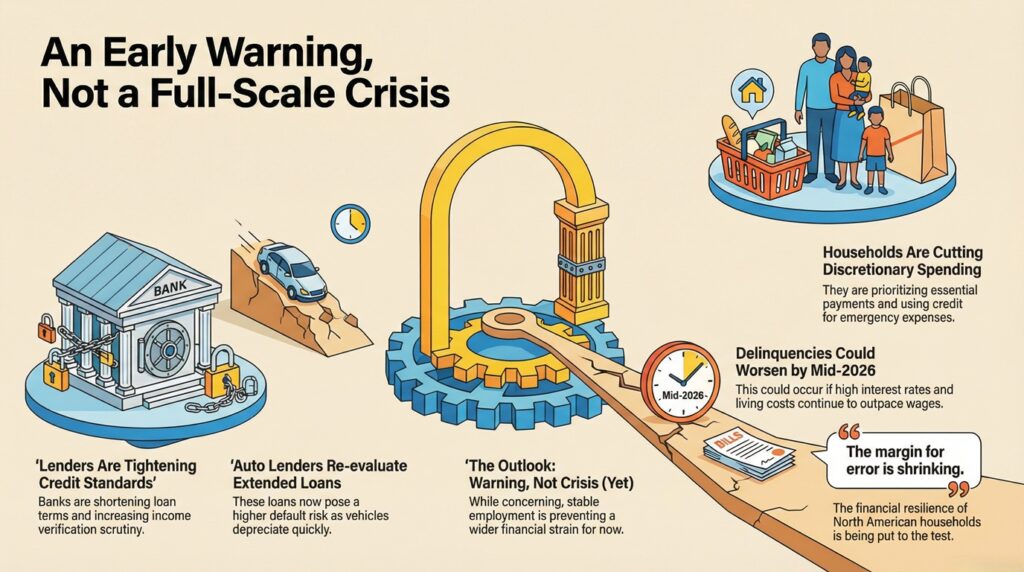

For lenders, the early-2026 delinquency spike is prompting a reassessment of risk models built during the post-pandemic recovery. Many banks and non-bank lenders are tightening credit standards, shortening loan terms, and increasing scrutiny on income verification.

Auto lenders, in particular, are reevaluating extended loan structures that push payments far into the future. While these loans helped sustain vehicle sales during supply-chain disruptions, they now pose higher default risk as vehicles depreciate faster than loan balances decline.

In the US and Canada alike, collection activity is increasing—but regulators are closely monitoring practices to ensure compliance with consumer protection laws amid rising financial stress.

Consumer Behavior Shifts Under Financial Pressure

Households themselves are responding to debt pressure in predictable ways. Discretionary spending is slowing, savings rates remain low, and reliance on credit for emergency expenses is rising. Some consumers are prioritizing mortgage or rent payments at the expense of unsecured debt, while others are juggling multiple accounts to stay current.

Debt consolidation and credit counseling inquiries are increasing, particularly in Canada, where auto loan stress is intersecting with high housing costs. Financial advisors warn that without meaningful income growth or rate relief, delinquency trends could worsen as 2026 progresses.

Outlook: Early Warning, Not Yet a Crisis

Despite the concerning data, economists stop short of calling the situation a full-scale consumer debt crisis. Employment levels remain relatively stable, and most borrowers are still meeting their obligations. However, the trajectory is unmistakable.

The rise in Canada auto loan delinquency and credit card delinquency across both countries serves as an early warning that household debt trends are becoming less sustainable under current economic conditions. If rates remain elevated and living costs continue to outpace wages, delinquencies could accelerate further by mid-2026.

For policymakers, lenders, and consumers alike, the message is clear: the margin for error is shrinking. What began as manageable post-pandemic borrowing is now testing the resilience of North American households—and the next few quarters will determine whether this spike remains contained or evolves into a broader financial strain.